Question

(Corporate income tax) Barrington Enterprises earned $4.4 million in taxable income (earnings before taxes) during its most recent year of operations. Use the corporate

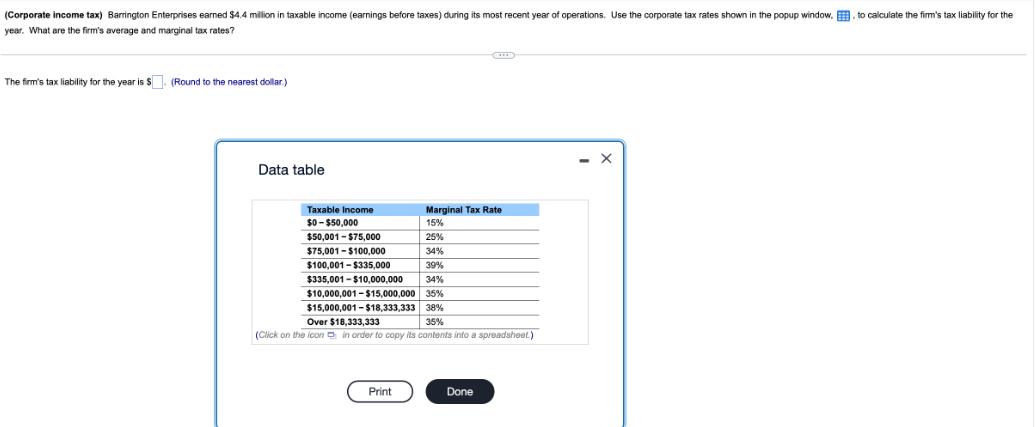

(Corporate income tax) Barrington Enterprises earned $4.4 million in taxable income (earnings before taxes) during its most recent year of operations. Use the corporate tax rates shown in the popup window. to calculate the firm's tax liability for the year. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar.) Data table Taxable Income Marginal Tax Rate $0-$50,000 15% $50,001-$75,000 25% $75,001-$100,000 34% $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur Keown, John Martin

12th edition

133423824, 978-0133423822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App