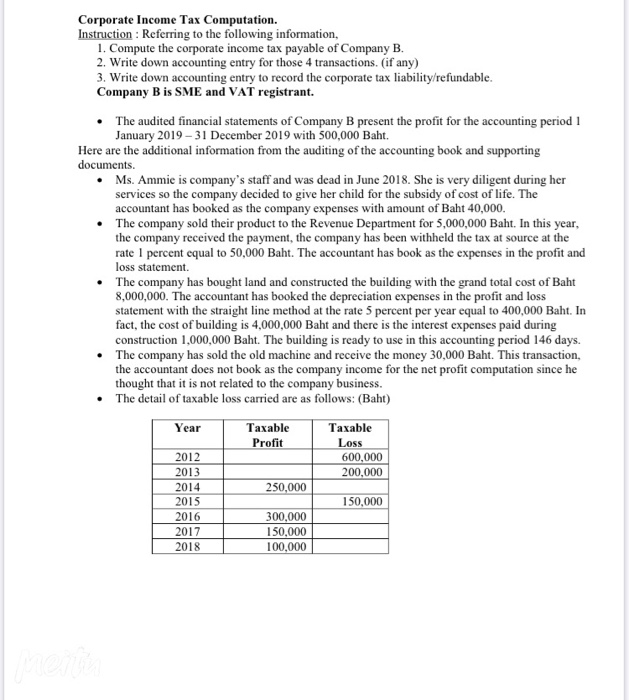

Corporate Income Tax Computation. Instruction : Referring to the following information, 1. Compute the corporate income tax payable of Company B. 2. Write down accounting entry for those 4 transactions. (if any) 3. Write down accounting entry to record the corporate tax liability/refundable. Company B is SME and VAT registrant. The audited financial statements of Company B present the profit for the accounting period 1 January 2019-31 December 2019 with 500,000 Baht. Here are the additional information from the auditing of the accounting book and supporting documents. mpany's staff and was dead in June 2018. She is very diligent during her services so the company decided to give her child for the subsidy of cost of life. The accountant has booked as the company expenses with amount of Baht 40,000. The company sold their product to the Revenue Department for 5,000,000 Baht. In this year, the company received the payment, the company has been withheld the tax at source at the rate 1 percent equal to 50,000 Baht. The accountant has book as the expenses in the profit and loss statement. The company has bought land and constructed the building with the grand total cost of Baht 8,000,000. The accountant has booked the depreciation expenses in the profit and loss statement with the straight line method at the rate 5 percent per year equal to 400,000 Baht. In fact, the cost of building is 4,000,000 Baht and there is the interest expenses paid during construction 1,000,000 Baht. The building is ready to use in this accounting period 146 days e company has sold the old machine and receive the money 30,000 Baht. This transaction the accountant does not book as the company income for the net profit computation since he thought that it is not related to the company business. The detail of taxable loss carried are as follows: (Baht) Year Taxable Profit Taxable Loss 600,000 200,000 250,000 2012 2013 2014 2015 2016 2017 2018 150,000 300,000 150,000 100,000 Corporate Income Tax Computation. Instruction : Referring to the following information, 1. Compute the corporate income tax payable of Company B. 2. Write down accounting entry for those 4 transactions. (if any) 3. Write down accounting entry to record the corporate tax liability/refundable. Company B is SME and VAT registrant. The audited financial statements of Company B present the profit for the accounting period 1 January 2019-31 December 2019 with 500,000 Baht. Here are the additional information from the auditing of the accounting book and supporting documents. mpany's staff and was dead in June 2018. She is very diligent during her services so the company decided to give her child for the subsidy of cost of life. The accountant has booked as the company expenses with amount of Baht 40,000. The company sold their product to the Revenue Department for 5,000,000 Baht. In this year, the company received the payment, the company has been withheld the tax at source at the rate 1 percent equal to 50,000 Baht. The accountant has book as the expenses in the profit and loss statement. The company has bought land and constructed the building with the grand total cost of Baht 8,000,000. The accountant has booked the depreciation expenses in the profit and loss statement with the straight line method at the rate 5 percent per year equal to 400,000 Baht. In fact, the cost of building is 4,000,000 Baht and there is the interest expenses paid during construction 1,000,000 Baht. The building is ready to use in this accounting period 146 days e company has sold the old machine and receive the money 30,000 Baht. This transaction the accountant does not book as the company income for the net profit computation since he thought that it is not related to the company business. The detail of taxable loss carried are as follows: (Baht) Year Taxable Profit Taxable Loss 600,000 200,000 250,000 2012 2013 2014 2015 2016 2017 2018 150,000 300,000 150,000 100,000