Answered step by step

Verified Expert Solution

Question

1 Approved Answer

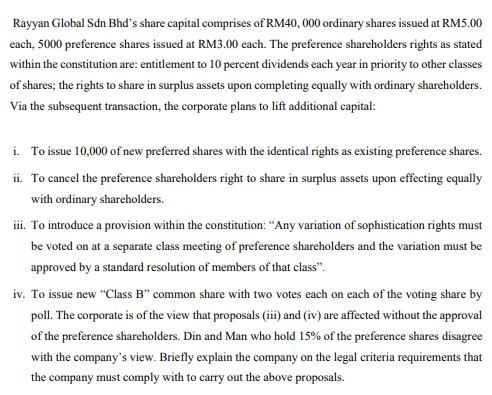

Corporate law Topic :shares https://www.slideshare.net/syafawanimahadi/capital-shares-companies-act-2016 Rayyan Global Sdn Bhd's share capital comprises of RM40, 000 ordinary shares issued at RM5.00 each, 5000 preference shares issued

Corporate law

Topic :shares

https://www.slideshare.net/syafawanimahadi/capital-shares-companies-act-2016

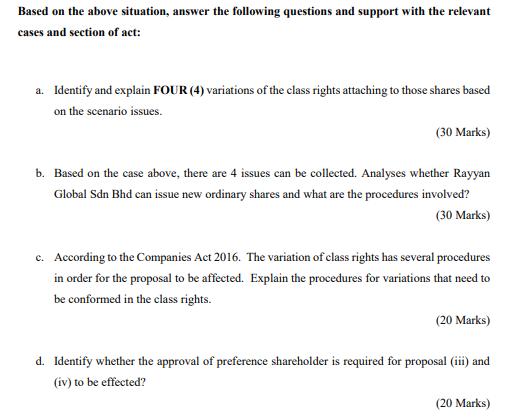

Rayyan Global Sdn Bhd's share capital comprises of RM40, 000 ordinary shares issued at RM5.00 each, 5000 preference shares issued at RM3.00 each. The preference shareholders rights as stated within the constitution are: entitlement to 10 percent dividends each year in priority to other classes of shares; the rights to share in surplus assets upon completing equally with ordinary shareholders. Via the subsequent transaction, the corporate plans to lift additional capital: i. To issue 10,000 of new preferred shares with the identical rights as existing preference shares. ii. To cancel the preference shareholders right to share in surplus assets upon effecting equally with ordinary shareholders. iii. To introduce a provision within the constitution: "Any variation of sophistication rights must be voted on at a separate class meeting of preference shareholders and the variation must be approved by a standard resolution of members of that class". iv. To issue new "Class B" common share with two votes each on each of the voting share by poll. The corporate is of the view that proposals (iii) and (iv) are affected without the approval of the preference shareholders. Din and Man who hold 15% of the preference shares disagree with the company's view. Briefly explain the company on the legal criteria requirements that the company must comply with to carry out the above proposals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started