Answered step by step

Verified Expert Solution

Question

1 Approved Answer

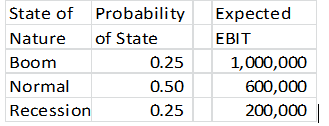

Corporate tax rate 40% Debt Outstanding $700,000 with a 12.0 percent coupon Expected EBIT expected forever. Companys Beta 1.75958 Your research has provided the following

Corporate tax rate 40%

Debt Outstanding $700,000 with a 12.0 percent coupon

Expected EBIT expected forever.

Companys Beta 1.75958

Your research has provided the following information:

T-bill rate 4% Return on the TSX 10%

- The company currently has 34,300 shares issued and outstanding. What is the market value of each share? (2 marks)

- You have decided to recommend a change in the capital for the firm. Assuming the markets are efficient and that you have recommended a change in the capital structure that will maximize the value of the firm and maximize the value of the shareholders wealth. What is the issue price or offer price for the shares? (2 marks)

c. Provide proof that the issue price or offer price is a fair price for all shareholders.

State of Probability Nature of State Boom 0.25 Normal 0.50 Recession 0.25 Expected EBIT 1,000,000 600,000 200,000 State of Probability Nature of State Boom 0.25 Normal 0.50 Recession 0.25 Expected EBIT 1,000,000 600,000 200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started