Montgomery Enterprises, Inc., had operating earnings of $280,000 for the year just ended. During the year, the firm sold stock that it held in another

Montgomery Enterprises, Inc., had operating earnings of $280,000 for the year just ended. During the year, the firm sold stock that it held in another company for $180,000, which was $30,000 above its original purchase price of $150,000, paid 1 year earlier.

a. What is the amount, if any, of capital gains realized during the year?

b. How much total taxable income did the firm earn during the year?

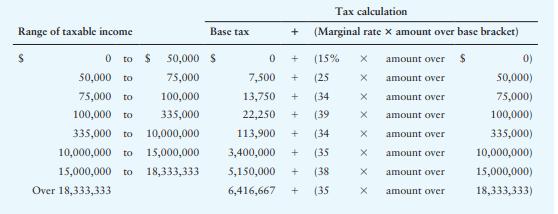

c. Use the corporate tax rate schedule given in Table 1.4 to calculate the firm’s total taxes due.

d. Calculate both the average tax rate and the marginal tax rate on the basis of your findings.

Tax calculation Range of taxable income Base tax (Marginal rate x amount over base bracket) O to $ 50,000 S (15% amount over $ 0) 50,000 to 75,000 7,500 (25 50,000) amount over 75,000 to 100,000 13,750 + (34 75,000) amount over 100,000 to 335,000 22,250 (39 amount over 100,000) 335,000 to 10,000,000 113,900 (34 amount over 335,000) 10,000,000 to 15,000,000 3,400,000 + (35 10,000,000) amount over 15,000,000 to 18,333,333 5,150,000 (38 amount over 15,000,000) Over 18,333,333 6,416,667 (35 18,333,333) amunt over

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Capital gains sale price purchase price 1...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started