Corporate Valuation and Risk Management

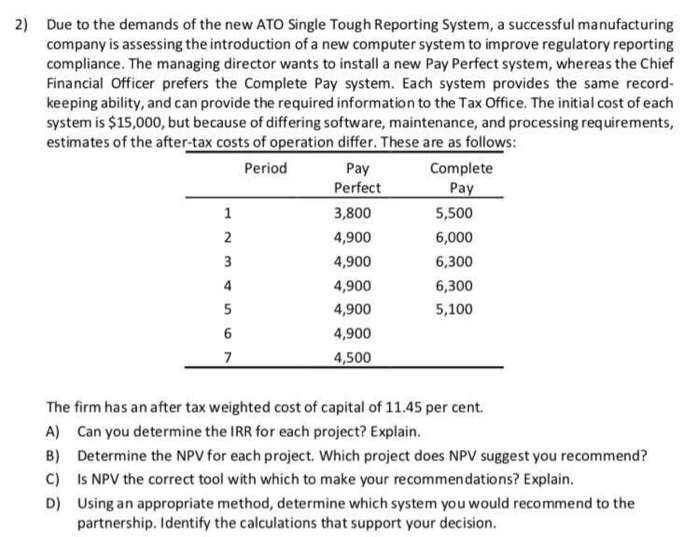

2) Due to the demands of the new ATO Single Tough Reporting System, a successful manufacturing company is assessing the introduction of a new computer system to improve regulatory reporting compliance. The managing director wants to install a new Pay Perfect system, whereas the Chief Financial Officer prefers the Complete Pay system. Each system provides the same record- keeping ability, and can provide the required information to the Tax Office. The initial cost of each system is $15,000, but because of differing software, maintenance, and processing requirements, estimates of the after-tax costs of operation differ. These are as follows: Complete Pay Period Pay Perfect 1 3,800 5,500 4,900 2 6,000 3 4,900 6,300 4 4,900 6,300 5,100 5 4,900 6 4,900 7 4,500 The firm has an after tax weighted cost of capital of 11.45 per cent. Can you determine the IRR for each project? Explain A) B) Determine the NPV for each project. Which project does NPV suggest you recommend? C) Is NPV the correct tool with which to make your recommendations? Explain. D) Using an appropriate method, determine which system you would recommend to the partnership. Identify the calculations that support your decision. 2) Due to the demands of the new ATO Single Tough Reporting System, a successful manufacturing company is assessing the introduction of a new computer system to improve regulatory reporting compliance. The managing director wants to install a new Pay Perfect system, whereas the Chief Financial Officer prefers the Complete Pay system. Each system provides the same record- keeping ability, and can provide the required information to the Tax Office. The initial cost of each system is $15,000, but because of differing software, maintenance, and processing requirements, estimates of the after-tax costs of operation differ. These are as follows: Complete Pay Period Pay Perfect 1 3,800 5,500 4,900 2 6,000 3 4,900 6,300 4 4,900 6,300 5,100 5 4,900 6 4,900 7 4,500 The firm has an after tax weighted cost of capital of 11.45 per cent. Can you determine the IRR for each project? Explain A) B) Determine the NPV for each project. Which project does NPV suggest you recommend? C) Is NPV the correct tool with which to make your recommendations? Explain. D) Using an appropriate method, determine which system you would recommend to the partnership. Identify the calculations that support your decision