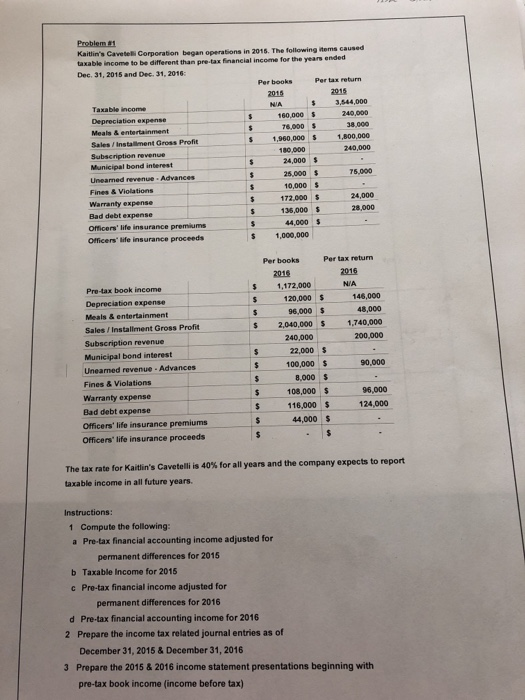

Corporation began operations in 2018. The following items caused taxable income to be different than pre-tax financial Dec. 31, 2015 and Dec. 31, 2016: income for the years ended Per books Per tax return 2015 NA 3,544,000 160,000 .. $ 240,000 38,000 S 1,960,000 1,800,000 240,000 Taxable income Depreciation expense 76,000 Sales / Installment Gross Profit 180,000 24,000 10,000 136,000 s Municipal bond interest Uneamed revenue Advances ,-25,000$ 75,000 . Fines & Violations Warranty expense Bad debt expense Officers' life insurance premiums Officers" life insurance proceeds 172000 24,000 28,000 44,000 s $ 1,000,000 Per tax return 2016 Per books 2016 Pretax book income Depreciation expense Meals&entertainment Sales Installment Gross Profit Subscription revenue Municipal bond interest Unearned revenue - Advances Fines & Violations $ 1,172,000 S 120,000 S 146,000 $ 96,000 S 2,040,000 1,740,000 48,000 240,000 22,000 S 5 100,000 S 90,000 8,000 108,000 96,000 Warranty expense Bad debt expense $ 116,000 124,000 Officers' life insurance premiums Officers' life insurance proceeds 44,000 S The tax rate for Kaitlin's Cavetelli is 40% for all years and the company expects to report taxable income in all future years. Instructions 1 Compute the following a Pre-tax financial accounting income adjusted for permanent differences for 2015 b Taxable Income for 2015 c Pre-tax financial income adjusted for permanent differences for 2016 Pre-tax financial accounting income for 2016 Prepare the income tax related journal entries as of December 31, 2015 & December 31, 2016 Prepare the 2015 &2016 income statement presentations beginning with pre-tax book income (income before tax) d 2 3 Corporation began operations in 2018. The following items caused taxable income to be different than pre-tax financial Dec. 31, 2015 and Dec. 31, 2016: income for the years ended Per books Per tax return 2015 NA 3,544,000 160,000 .. $ 240,000 38,000 S 1,960,000 1,800,000 240,000 Taxable income Depreciation expense 76,000 Sales / Installment Gross Profit 180,000 24,000 10,000 136,000 s Municipal bond interest Uneamed revenue Advances ,-25,000$ 75,000 . Fines & Violations Warranty expense Bad debt expense Officers' life insurance premiums Officers" life insurance proceeds 172000 24,000 28,000 44,000 s $ 1,000,000 Per tax return 2016 Per books 2016 Pretax book income Depreciation expense Meals&entertainment Sales Installment Gross Profit Subscription revenue Municipal bond interest Unearned revenue - Advances Fines & Violations $ 1,172,000 S 120,000 S 146,000 $ 96,000 S 2,040,000 1,740,000 48,000 240,000 22,000 S 5 100,000 S 90,000 8,000 108,000 96,000 Warranty expense Bad debt expense $ 116,000 124,000 Officers' life insurance premiums Officers' life insurance proceeds 44,000 S The tax rate for Kaitlin's Cavetelli is 40% for all years and the company expects to report taxable income in all future years. Instructions 1 Compute the following a Pre-tax financial accounting income adjusted for permanent differences for 2015 b Taxable Income for 2015 c Pre-tax financial income adjusted for permanent differences for 2016 Pre-tax financial accounting income for 2016 Prepare the income tax related journal entries as of December 31, 2015 & December 31, 2016 Prepare the 2015 &2016 income statement presentations beginning with pre-tax book income (income before tax) d 2 3