Answered step by step

Verified Expert Solution

Question

1 Approved Answer

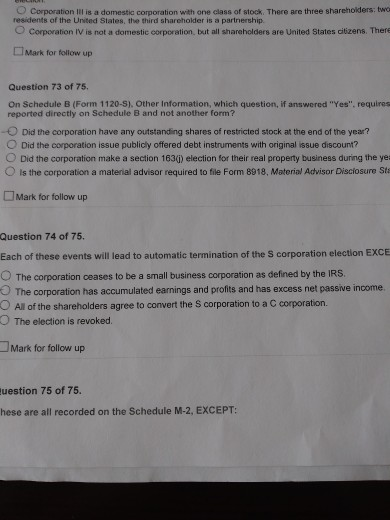

Corporation Ill is a domestic corporation with one class of stock. There are three shareholders: two residents of the United States, the third shareholder is

Corporation Ill is a domestic corporation with one class of stock. There are three shareholders: two residents of the United States, the third shareholder is a partnership Corporation IV is not a domestie corporation, but all shareholders are United States citizens. There Mark for follow up Question 73 of 75. On Schedule B (Form 1120-S). Other Information, which question, if answered "Yes". requires reported directly on Schedule B and not another form? Did the corporation have any outstanding shares of restricted stock at the end of the year? Did the corporation issue publicly offered debt instruments with original issue discount? Did the corporation make a section 163(1) election for their real property business during the ye Is the corporation a material advisor required to file Form 1918, Material Advisor Disclosure Ste Mark for follow up Question 74 of 75. Each of these events will lead to automatic termination of the Scorporation election EXCE The corporation ceases to be a small business corporation as defined by the IRS The corporation has accumulated earnings and profits and has excess net passive income O All of the shareholders agree to convert the corporation to a C corporation The election is revoked Mark for follow up Question 75 of 75. hese are all recorded on the Schedule M-2, EXCEPT: Corporation Ill is a domestic corporation with one class of stock. There are three shareholders: two residents of the United States, the third shareholder is a partnership Corporation IV is not a domestie corporation, but all shareholders are United States citizens. There Mark for follow up Question 73 of 75. On Schedule B (Form 1120-S). Other Information, which question, if answered "Yes". requires reported directly on Schedule B and not another form? Did the corporation have any outstanding shares of restricted stock at the end of the year? Did the corporation issue publicly offered debt instruments with original issue discount? Did the corporation make a section 163(1) election for their real property business during the ye Is the corporation a material advisor required to file Form 1918, Material Advisor Disclosure Ste Mark for follow up Question 74 of 75. Each of these events will lead to automatic termination of the Scorporation election EXCE The corporation ceases to be a small business corporation as defined by the IRS The corporation has accumulated earnings and profits and has excess net passive income O All of the shareholders agree to convert the corporation to a C corporation The election is revoked Mark for follow up Question 75 of 75. hese are all recorded on the Schedule M-2, EXCEPT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started