Corporation On April 1, 2020, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only

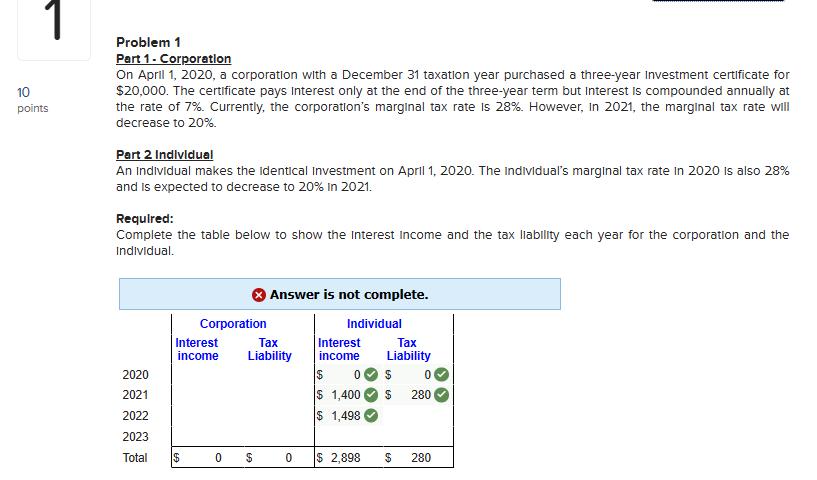

Corporation On April 1, 2020, a corporation with a December 31 taxation year purchased a three-year investment certificate for $20,000. The certificate pays interest only at the end of the three-year term but interest is compounded annually at the rate of 7%. Currently, the corporation’s marginal tax rate is 28%. However, in 2021, the marginal tax rate will decrease to 20%.

Part 2 Individual An individual makes the identical investment on April 1, 2020. The individual’s marginal tax rate in 2020 is also 28% and is expected to decrease to 20% in 2021.

Required: Complete the table below to show the interest income and the tax liability each year for the corporation and the individual

1 10 points Problem 1 Part 1 - Corporation On April 1, 2020, a corporation with a December 31 taxation year purchased a three-year Investment certificate for $20,000. The certificate pays Interest only at the end of the three-year term but Interest is compounded annually at the rate of 7%. Currently, the corporation's marginal tax rate is 28%. However, in 2021, the marginal tax rate will decrease to 20%. Part 2 Individual An Individual makes the identical Investment on April 1, 2020. The Individual's marginal tax rate in 2020 is also 28% and is expected to decrease to 20% in 2021. Required: Complete the table below to show the Interest Income and the tax liability each year for the corporation and the Individual. 2020 2021 2022 2023 Total Corporation Interest income $ 0 Answer is not complete. $ Tax Tax Interest Liability income Liability 0 $ 0 $ $ 1,400 $ 280 $ 1,498 Individual 0 $ 2,898 $ 280

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the interest income and tax liability for both the corporation and the individual ove...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started