Question

Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the corporation's records provide the following information: Ordinary operating income

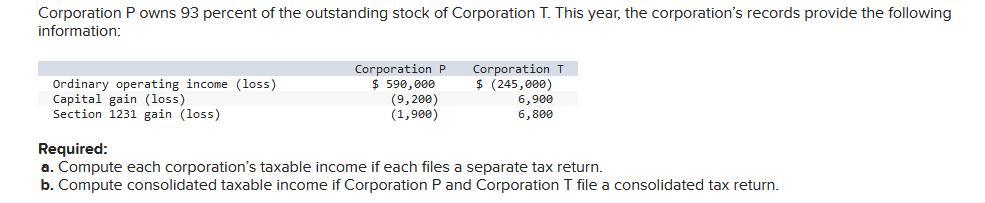

Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the corporation's records provide the following information: Ordinary operating income (loss) Capital gain (loss) Section 1231 gain (loss) Corporation P $ 590,000 (9,200) (1,900) Corporation T $ (245,000) 6,900 6,800 Required: a. Compute each corporation's taxable income if each files a separate tax return. b. Compute consolidated taxable income if Corporation P and Corporation T file a consolidated tax return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute each corporations taxable income if they file separate tax returns we need to consider th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2016 Edition

Authors: Sally Jones, Shelley Rhoades Catanach

19th Edition

1259549259, 978-1259618536, 1259618536, 978-1259549250

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App