Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Raymond Corporation reports the following resuits for the current year: E (Click on the icon to view the results for the current year )

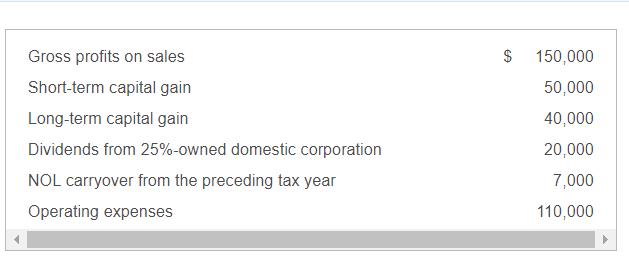

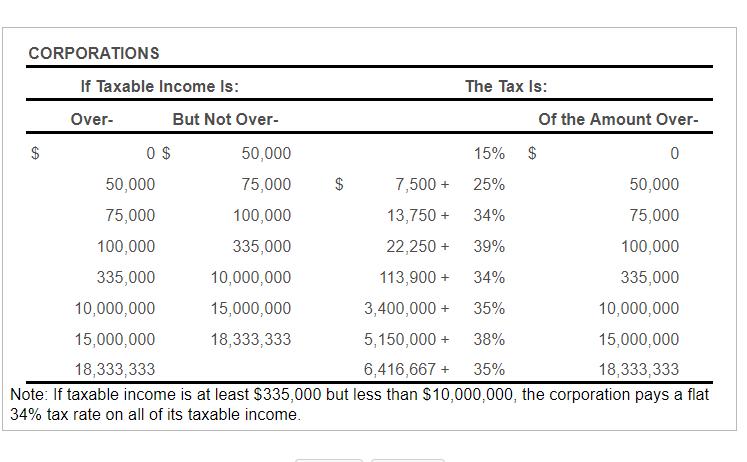

Raymond Corporation reports the following resuits for the current year: E (Click on the icon to view the results for the current year ) (Click on the icon to view the tax rate schedule.) Requirement What are Raymond's taxable income and income tax liability, assuming qualified production activities income is $40,000? Begin by computing Raymond's taxable income before special deductions, then calculate the taxable income. (Enter the special deductions in the specific sequence dictated by the tax rules.) Gross income Minus: Taxable income before special deductions Gross profits on sales $ 150,000 Short-term capital gain 50,000 Long-term capital gain 40,000 Dividends from 25%-owned domestic corporation 20,000 NOL carryover from the preceding tax year 7,000 Operating expenses 110,000 CORPORATIONS If Taxable Income Is: The Tax Is: Over- But Not Over- Of the Amount Over- 2$ O $ 50,000 15% $ 50,000 75,000 $ 7,500 + 25% 50,000 75,000 100,000 13,750 + 34% 75,000 100,000 335,000 22,250 + 39% 100,000 335,000 10,000,000 113,900 + 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 5,150,000 + 38% 15,000,000 18,333,333 6,416,667 + 35% 18,333,333 Note: If taxable income is at least $335,000 but less than $10,000,000, the corporation pays a flat 34% tax rate on all of its taxable income.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Raymonds t o l Qualified production activities income 40000 Gross Profit on sales S50 000 Sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started