Question

Corporations not only issue securities; they may also invest corporate funds in securities-and other investment vehicles. Suppose you are the chief financial officer of Twenty-Four

Corporations not only issue securities; they may also invest corporate funds in securities-and other investment vehicles. Suppose you are the chief financial officer of Twenty-Four Security. Although Twenty-Four will need a large amount of funds in a couple of years to finance an expansion of its security services into the Asian market, for now it just needs to find a good place to "park" its money. Suppose that Twenty-Four has $10 million cash on hand today. Calculate the present discount value of the following options. Equation in the picture.

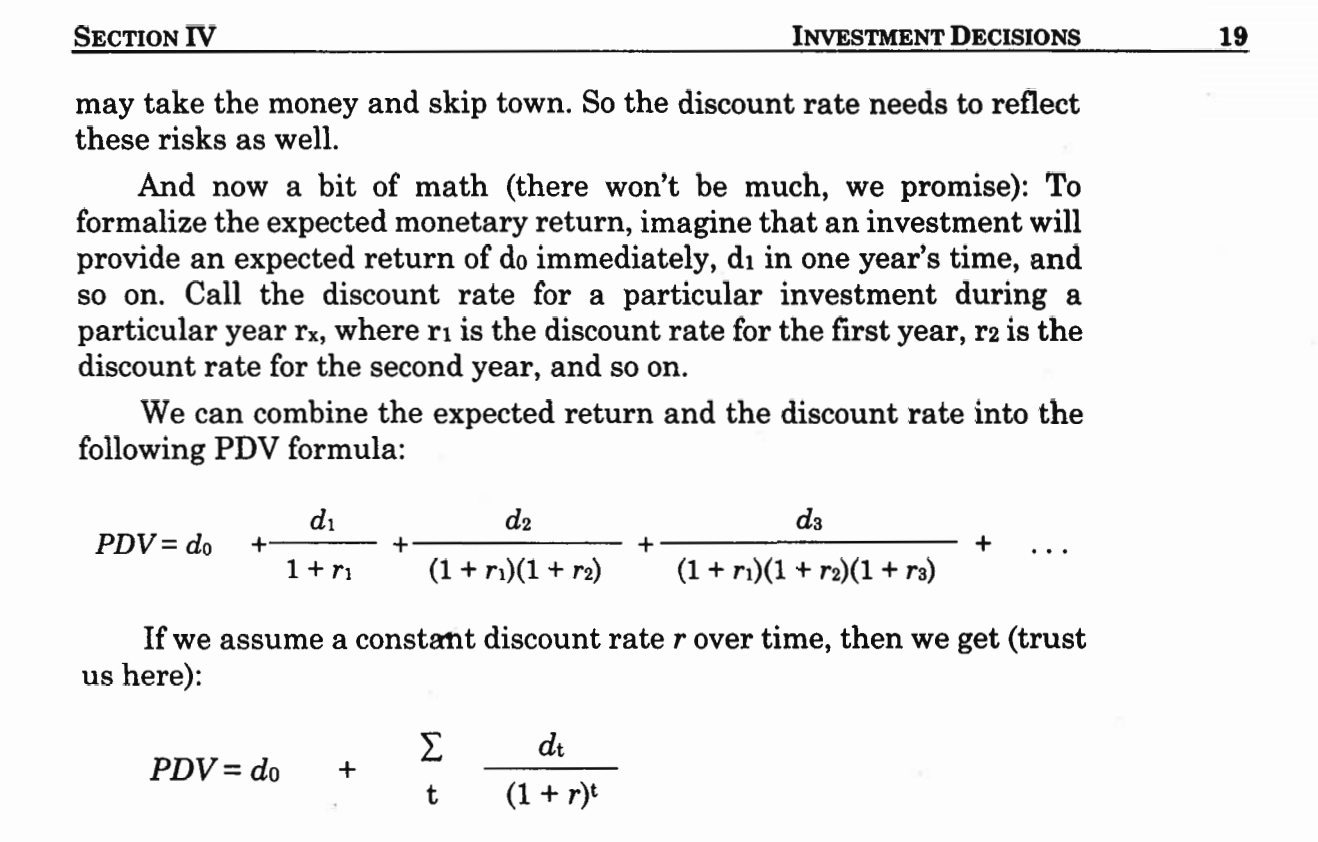

SECTION IV INVESTMENT DECISIONS 19 may take the money and skip town. So the discount rate needs to reflect these risks as well. And now a bit of math (there won't be much, we promise): To formalize the expected monetary return, imagine that an investment will provide an expected return of do immediately, d in one year's time, and so on. Call the discount rate for a particular investment during a particular year rx, where ri is the discount rate for the first year, r2 is the discount rate for the second year, and so on. We can combine the expected return and the discount rate into the following PDV formula: d PDV = do + 1+11 d2 d3 (1 + r)(1 + r2) (1 + r)(1 + r2)(1 + r) + ... If we assume a constant discount rate r over time, then we get (trust us here): PDV = do + t dt (1 + r)t

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started