Answered step by step

Verified Expert Solution

Question

1 Approved Answer

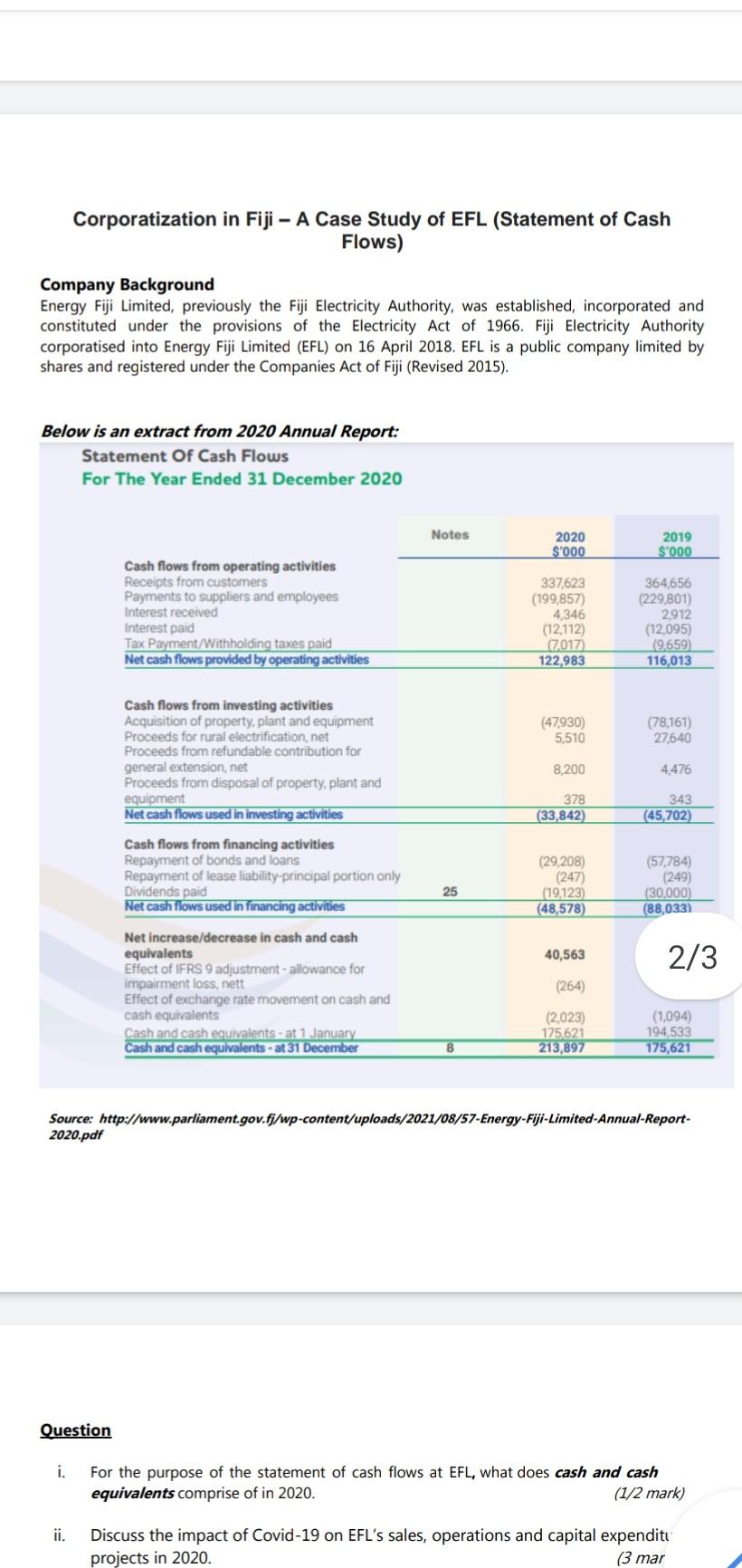

Corporatization in Fiji A Case Study of EFL (Statement of Cash Flows) Company Background Energy Fiji Limited, previously the Fiji Electricity Authority, was established, incorporated

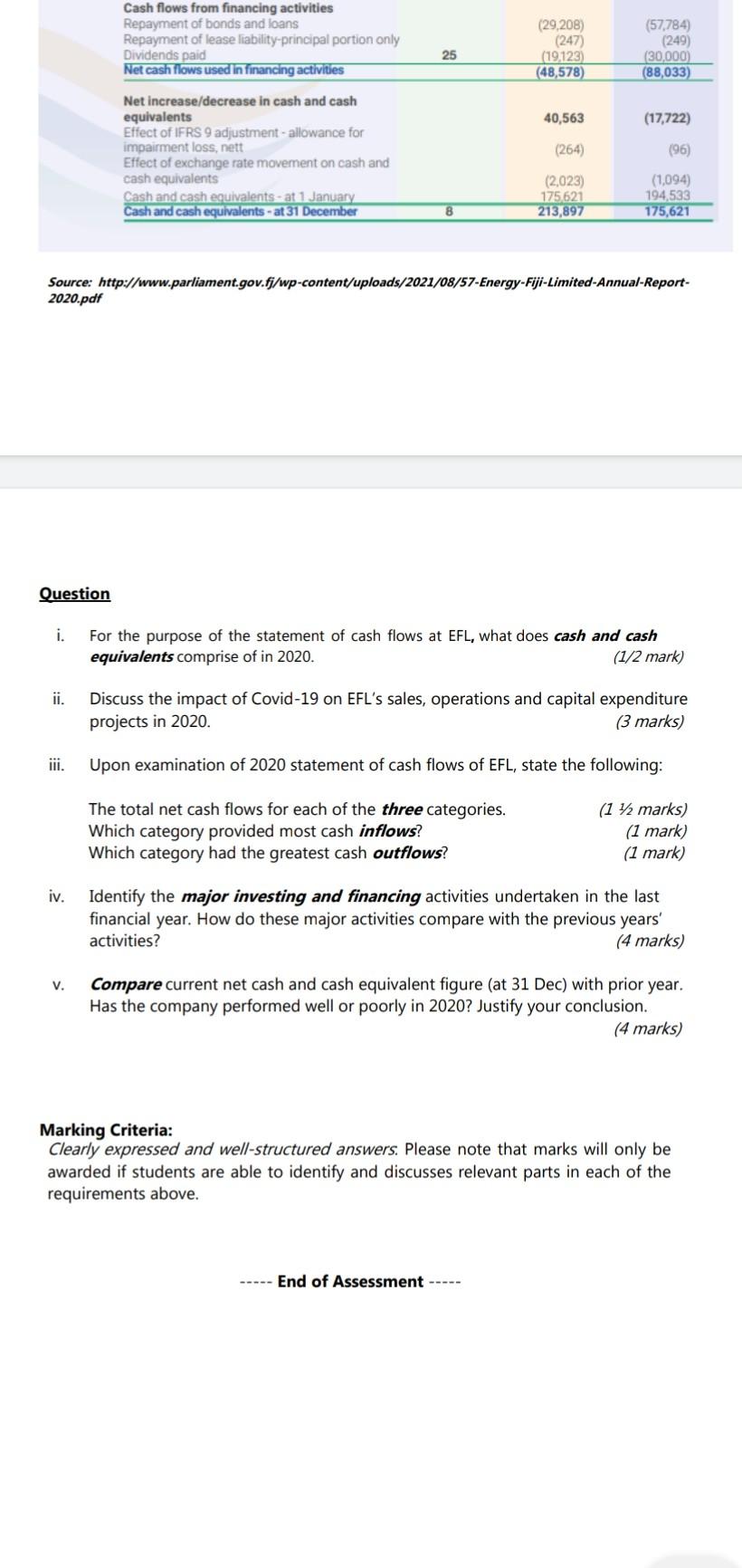

Corporatization in Fiji A Case Study of EFL (Statement of Cash Flows) Company Background Energy Fiji Limited, previously the Fiji Electricity Authority, was established, incorporated and constituted under the provisions of the Electricity Act of 1966. Fiji Electricity Authority corporatised into Energy Fiji Limited (EFL) on 16 April 2018. EFL is a public company limited by shares and registered under the Companies Act of Fiji (Revised 2015). Below is an extract from 2020 Annual Report: Statement of Cash Flows For The Year Ended 31 December 2020 Notes 2020 S'000 2019 S'000 Cash flows from operating activities Receipts from customers Payments to suppliers and employees Interest received Interest paid Tax Payment/Withholding taxes paid Net cash flows provided by operating activities 337,623 (199,857) 4,346 (12,112) 2017) 122,983 364,656 (229,801) 2912 (12,095) 19,659) 116,013 (47,930) 5,510 (78,161) 27,640 Cash flows from investing activities Acquisition of property, plant and equipment Proceeds for rural electrification, net Proceeds from refundable contribution for general extension, net Proceeds from disposal of property, plant and equipment Net cash flows used in investing activities 8,200 4,476 378 (33,842) 343 (45,702) (29,208) Cash flows from financing activities Repayment of bonds and loans Repayment of lease liability-principal portion only Dividends paid Net cash flows used in financing activities (57,784) (249) (30,000) (88,033) (247 (19,123) (48,578) 25 40,563 2/3 Net increase/decrease in cash and cash equivalents Effect of IFRS 9 adjustment - allowance for impairment loss, nett Effect of exchange rate movement on cash and cash equivalents Cash and cash equivalents at 1 January Cash and cash equivalents - at 31 December (264) (2,023) 175621 213,897 (1,094 194,533 175,621 8 Source: http://www.parliament.gov.fi/wp-content/uploads/2021/08/57-Energy-Fiji-Limited-Annual-Report- 2020.pdf Question i. For the purpose of the statement of cash flows at EFL, what does cash and cash equivalents comprise of in 2020. (1/2 mark) ii. Discuss the impact of Covid-19 on EFL's sales, operations and capital expenditu projects in 2020. (3 mar Cash flows from financing activities Repayment of bonds and loans Repayment of lease liability-principal portion only Dividends paid Net cash flows used in financing activities (29,208) (247 (19,123) (48,578) (57,784) (249) (30,000) (88,033) 25 40,563 (17,722) Net increase/decrease in cash and cash equivalents Effect of IFRS 9 adjustment-allowance for impairment loss, nett Effect of exchange rate movement on cash and cash equivalents Cash and cash equivalents - at 1 January Cash and cash equivalents - at 31 December (264) (96) (2,023) 175621 213,897 (1,094) 194,533 175,621 Source: http://www.parliament.gov.fi/wp-content/uploads/2021/08/57-Energy-Fiji-Limited-Annual-Report- 2020.pdf Question i. For the purpose of the statement of cash flows at EFL, what does cash and cash equivalents comprise of in 2020. (1/2 mark) ii. Discuss the impact of Covid-19 on EFL's sales, operations and capital expenditure projects in 2020. (3 marks) iii. Upon examination of 2020 statement of cash flows of EFL, state the following: The total net cash flows for each of the three categories. Which category provided most cash inflows? Which category had the greatest cash outflows? (1 42 marks) (1 mark) (1 mark) iv. Identify the major investing and financing activities undertaken in the last financial year. How do these major activities compare with the previous years' activities? (4 marks) v. Compare current net cash and cash equivalent figure (at 31 Dec) with prior year. Has the company performed well or poorly in 2020? Justify your conclusion. (4 marks) Marking Criteria: Clearly expressed and well-structured answers. Please note that marks will only be awarded if students are able to identify and discusses relevant parts in each of the requirements above. End of Assessment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started