correct Answers

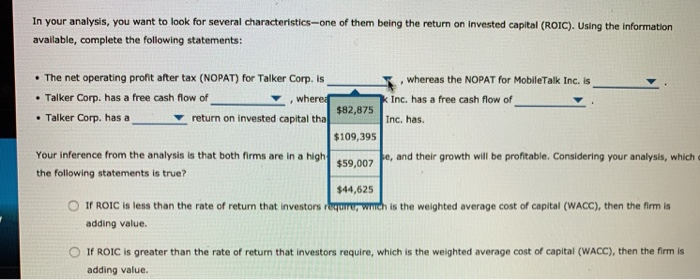

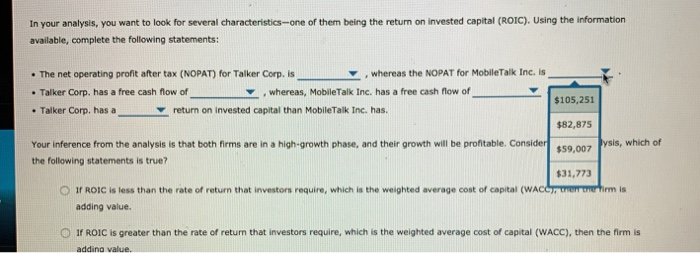

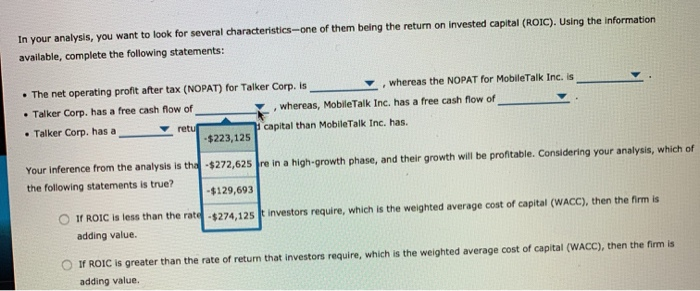

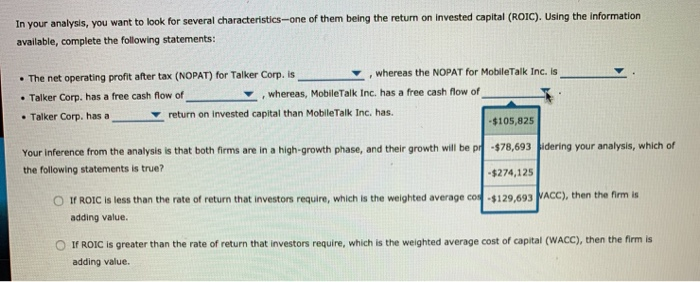

here is the drop down option

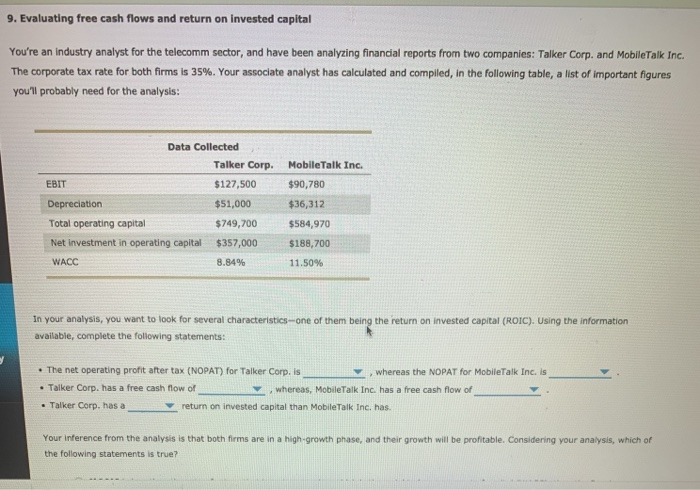

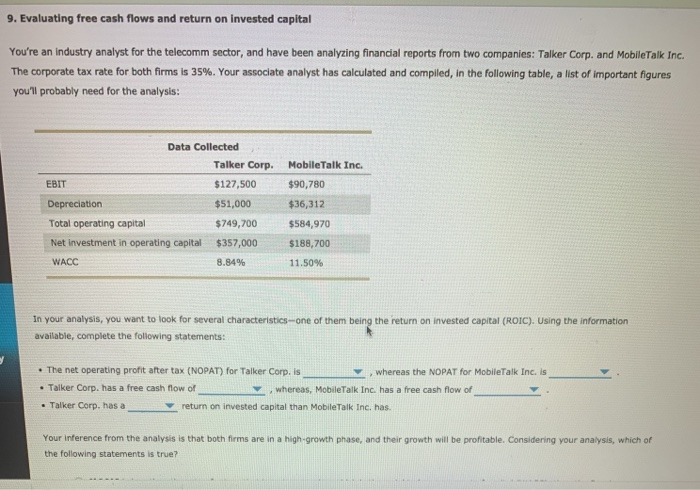

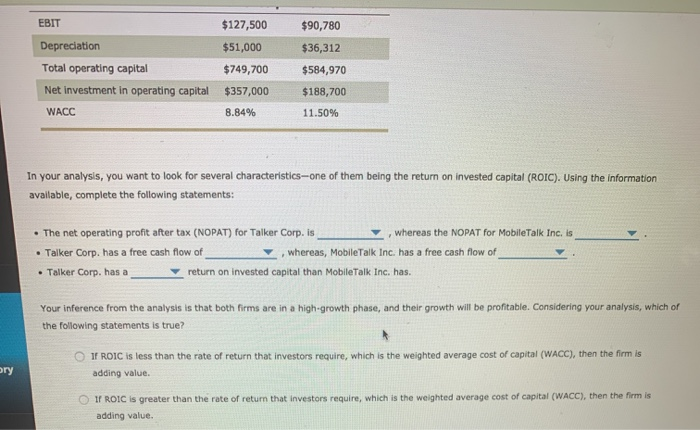

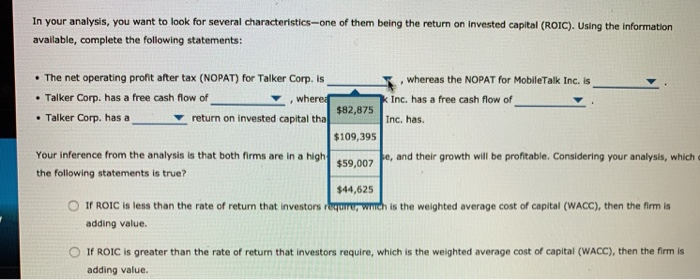

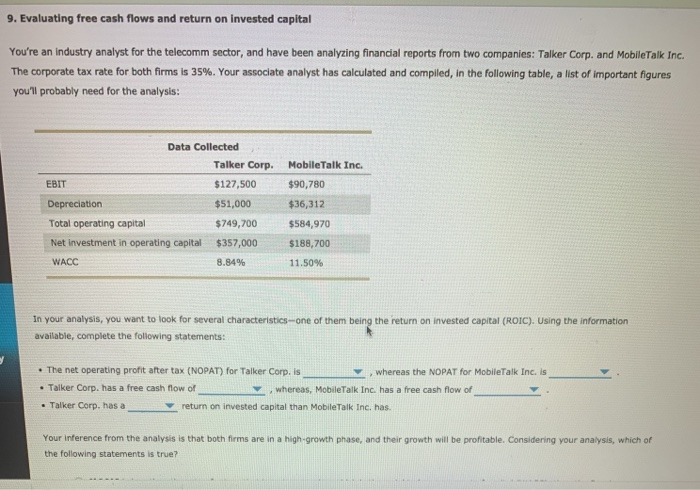

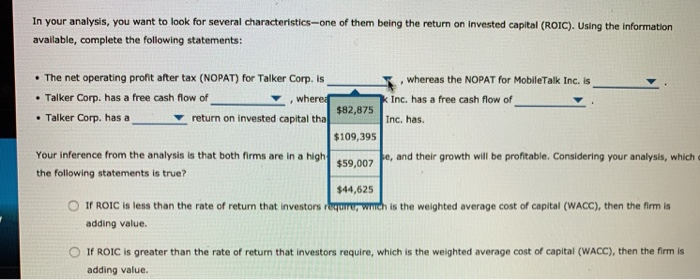

9. Evaluating free cash flows and return on invested capital You're an industry analyst for the telecomm sector, and have been analyzing financial reports from two companies: Talker Corp. and MobileTalk Inc. The corporate tax rate for both firms is 35%. Your associate analyst has calculated and compiled, in the following table, a list of important figures you'll probably need for the analysis: Data Collected Talker Corp. EBIT $127,500 Depreciation $51,000 Total operating capital $749,700 Net investment in operating capital $357,000 WACC 8.84% Mobile Talk Inc. $90,780 $36,312 $584,970 $188,700 11.50% in your analysis, you want to look for several characteristics one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for MobileTalk Inc. is Talker Corp. has a free cash flow of , whereas, MobileTalk Inc. has a free cash flow of Talker Corp. has a return on invested capital than Mobile Talk Inc. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following statements is true? EBIT $127,500 $90,780 Depreciation $36,312 $584,970 Total operating capital Net investment in operating capital $51,000 $749,700 $357,000 8.84% $188,700 WACC 11.50% In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for MobileTalk Inc. is Talker Corp. has a free cash flow of , whereas, Mobile Talk Inc. has a free cash flow of Talker Corp. has a return on invested capital than Mobile Talk Inc. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following statements is true? If ROIC is less than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. IT ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for Mobile Talk Inc. is Talker Corp. has a free cash flow of , where * Inc. has a free cash flow of $82,875 Talker Corp. has a return on invested capital tha Inc. has. $109,395 Your inference from the analysis is that both firms are in a high He, and their growth will be profitable. Considering your analysis, which $59,007 the following statements is true? $44,625 O I ROIC is less than the rate of return that investors requiru, wrich is the weighted average cost of capital (WACC), then the firm is adding value. IF ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for Mobile Talk Inc. is Talker Corp. has a free cash flow of .. whereas, Mobile Talk Inc. has a free cash flow of $105,251 . Talker Corp. has a return on invested capital than MobileTalk Inc. has. $82,875 Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Consider the following statements is true? $31,773 O I ROIC is less than the rate of return that investors require, which is the weighted average cost of capital (WACC), reretirmis adding value. $59,007 fysis, which of I ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for Mobile Talk Inc. is Talker Corp. has a free cash flow of , whereas, Mobile Talk Inc. has a free cash flow of Talker Corp. has a retur capital than Mobile Talk Inc. has. - $223,125 Your inference from the analysis is the $272,625 re in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following statements is true? -$129,693 O I ROIC is less than the rate - $274,125 t investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. O I ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for MobileTalk Inc. is Talker Corp. has a free cash flow of , whereas, MobileTalk Inc. has a free cash flow of Talker Corp. has a return on invested capital than Mobile Talk Inc. has. - $105,825 Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be pl -$78,693 sidering your analysis, which of the following statements is true? -$274,125 O I ROIC is less than the rate of return that investors require, which is the weighted average co-$129,693 VACC), then the firm is adding value. O I ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is , whereas the NOPAT for Mobile Talk Inc. is . Talker Corp. has a free cash flow of , whereas, Mobile Talk Inc. has a free cash flow of Talker Corp. has a return on invested capital than MobileTalk Inc. has. higher Your inference from is is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following stateme lower le? O I ROIC is less than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. I ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value