correct answers only pls!!

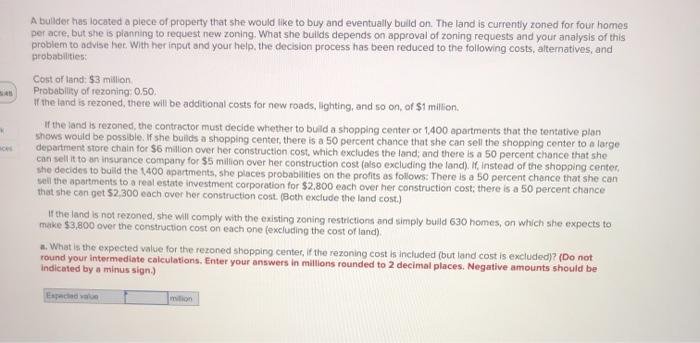

A builder has located a plece of property that she would like to buy and eventually build on. The land is currently zoned for four homes per acre, but she is planning to request new zoning. What she builds depends on approval of zoning requests and your analysis of this problem to advise her. With her input and your help, the decision process has been reduced to the following costs, alternatives, and probabilities: Cost of tand: $3 million Probability of rezoning: 0.50, If the land is rezoned, there will be additional costs for new roads, lighting, and so on, of $1 million of the land is rezoned, the contractor must decide whether to build a shopping center or 1400 apartments that the tentative plon shows would be possible. If she builds a shopping center, there is a 50 percent chance that she can sell the shopping center to a large department store chain for $6 million over her construction cost, which excludes the land, and there is a 50 percent chance that she can sell it to an insurance company for $5 million over her construction cost (also excluding the land). If, instead of the shopping center she decides to build the 1400 apartments, she places probabilities on the profits as follows: There is a 50 percent chance that she can sell the apartments to a real estate Investment Corporation for $2,800 each over her construction cost there is a 50 percent chance that she can get $2,300 each over her construction cost. (Both exclude the land cost.) If the land is not rezoned, she will comply with the existing zoning restrictions and simply bulld 630 homes, on which she expects to make $3,800 over the construction cost on each one (excluding the cost of tand), What is the expected value for the rezoned shopping center, if the rezoning cost is included (but land cost is excluded)? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign) Escada b. What is the expected value for the rezoned apartments, if the rezoning cost is included (but land cost is excluded)? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected value million c. If the land is rezoned, what should the contractor decide? O Bulld shopping center Bulld apartments d. What is the expected revenue. If the land is not rezoned (excluding the land costy (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected revenue mbon e. What is the expected net profit of entire project, including all applicable costs? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected repro milion A builder has located a plece of property that she would like to buy and eventually build on. The land is currently zoned for four homes per acre, but she is planning to request new zoning. What she builds depends on approval of zoning requests and your analysis of this problem to advise her. With her input and your help, the decision process has been reduced to the following costs, alternatives, and probabilities: Cost of tand: $3 million Probability of rezoning: 0.50, If the land is rezoned, there will be additional costs for new roads, lighting, and so on, of $1 million of the land is rezoned, the contractor must decide whether to build a shopping center or 1400 apartments that the tentative plon shows would be possible. If she builds a shopping center, there is a 50 percent chance that she can sell the shopping center to a large department store chain for $6 million over her construction cost, which excludes the land, and there is a 50 percent chance that she can sell it to an insurance company for $5 million over her construction cost (also excluding the land). If, instead of the shopping center she decides to build the 1400 apartments, she places probabilities on the profits as follows: There is a 50 percent chance that she can sell the apartments to a real estate Investment Corporation for $2,800 each over her construction cost there is a 50 percent chance that she can get $2,300 each over her construction cost. (Both exclude the land cost.) If the land is not rezoned, she will comply with the existing zoning restrictions and simply bulld 630 homes, on which she expects to make $3,800 over the construction cost on each one (excluding the cost of tand), What is the expected value for the rezoned shopping center, if the rezoning cost is included (but land cost is excluded)? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign) Escada b. What is the expected value for the rezoned apartments, if the rezoning cost is included (but land cost is excluded)? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected value million c. If the land is rezoned, what should the contractor decide? O Bulld shopping center Bulld apartments d. What is the expected revenue. If the land is not rezoned (excluding the land costy (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected revenue mbon e. What is the expected net profit of entire project, including all applicable costs? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.) Expected repro milion

correct answers only pls!!

correct answers only pls!!