Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Correct Answers: The filing status of the taxpayer is Answer: Married Filing Jointly The number of dependents on the tax return is Answer: 2 Form

Correct Answers:

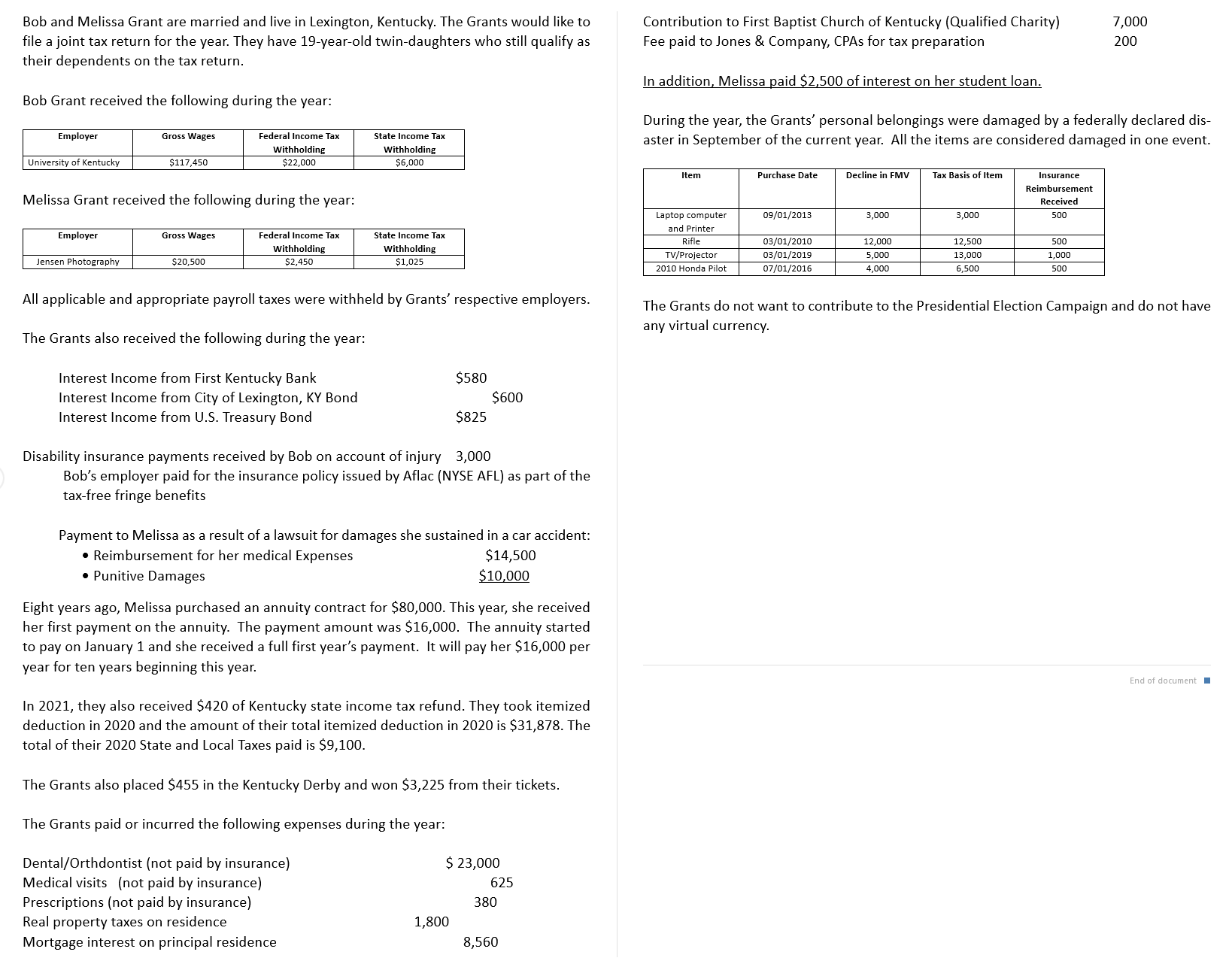

The filing status of the taxpayer is Answer: Married Filing Jointly

The number of dependents on the tax return is Answer:

Form Line W Wages, enter without comma or $ Answer:

Taxexempt interest on Line a Answer:

Taxable interest on Line b Answer:

Pensions and annuities gross amount, Line a Answer:

Pensions and annuities Taxable amount, Line b Answer:

Schedule Line Taxable refunds Answer:

How much of the AFLAC income is taxable as part of "Other income" on Schedule Line z Answer:

ScheduleLine Total other income Answer:

The phaseout percentage for the student loan interest deduction is Answer:

Schedule Line Student loan interest deduction. This number also applies to Form Line Answer:

Schedule A Line Interest You Paid Answer:

Schedule A Line Gifts to Charity Answer:

ScheduleA Line Other Itemized Deductions Answer:

NEED ANSWERS TO:

Adjusted Gross Income before Student Loan Interest Deduction Form Line #

Form Line Adjusted Gross Income

ScheduleA Itemized Deductions Line Medical and Dental Expenses

Schedule A Line Taxes You Paid

Schedule A Line Casualty and Theft Losses All items are considered one event

Form Line a total Standard deduction or itemized deductions

Form Line Taxable income

Form Line Income tax liability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started