Answered step by step

Verified Expert Solution

Question

1 Approved Answer

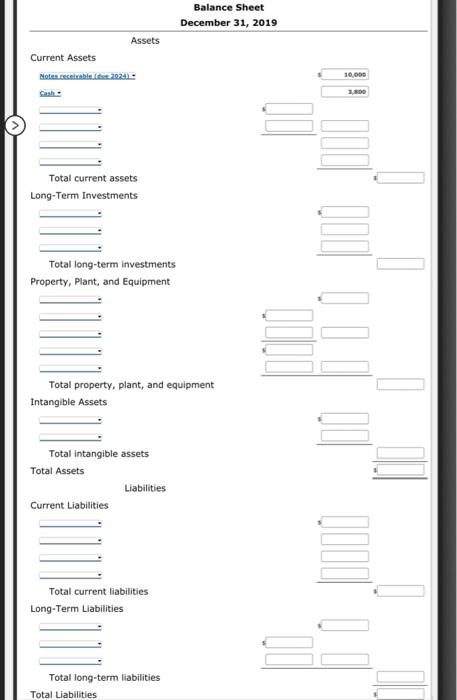

Corrections to Balance Sheet Brandt Company presents the following December 31, 2019, balance sheet: Brandt Company Sheet of Balances for Year Ended December 31, 2019

Corrections to Balance Sheet

Brandt Company presents the following December 31, 2019, balance sheet:

| Brandt Company Sheet of Balances for Year Ended December 31, 2019 | ||||

| Current assets | $ 43,900 | Current liabilities | $ 66,600 | |

| Long-term investments | 13,500 | Long-term liabilities | 24,100 | |

| Property, plant, and equipment | 123,500 | Contributed capital | 17,000 | |

| Intangible assets | 8,000 | Unrealized capital | 22,800 | |

| Other assets | 13,600 | Retained earnings | 72,000 | |

| Total assets | $202,500 | Total equities | $202,500 |

The following information is also available:

- Current assets include cash, $3,800; accounts receivable, $18,100; notes receivable (maturity date July 1, 2024), $10,000; and land, $12,000.

- Long-term investments include a $4,500 investment in available-for-sale securities that are expected to be sold in 2020 and a $9,000 investment in Dray Company bonds that are expected to be held until their December 31, 2022, maturity date.

- Property, plant, and equipment include buildings costing $63,400, inventory costing $30,500, and equipment costing $29,600.

- Intangible assets include patents that cost $8,500 (and on which $2,300 amortization has accumulated) and treasury stock that cost $1,800.

- Other assets include prepaid insurance (which expires on November 30, 2020), $2,900; sinking fund for bond retirement, $7,000; and trademarks that cost $3,700 and are not impaired.

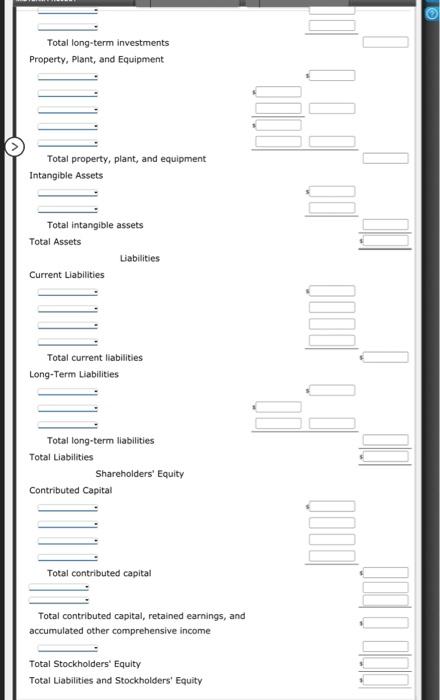

- Current liabilities include accounts payable, $19,400; bonds payable (maturity date December 31, 2024), $40,000; and accrued income taxes payable, $7,200.

- Long-term liabilities include accrued wages, $4,100; and mortgage payable (which is due in five equal annual payments starting December 31, 2020), $20,000.

- Contributed capital includes common stock ($5 par), $11,000; and preferred stock ($100 par), $6,000.

- Unrealized capital includes premium on bonds payable, $4,300; additional paid-in capital on preferred stock, $2,400; additional paid-in capital on common stock, $14,700; and accumulated other comprehensive income, $1,400.

- Retained earnings includes unrestricted retained earnings, $37,300; allowance for doubtful accounts, $700; and accumulated depreciation on buildings and equipment of $21,000 and $13,000, respectively.

Required:

Based on the preceding information, prepare a properly classified December 31, 2019, balance sheet for Brandt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started