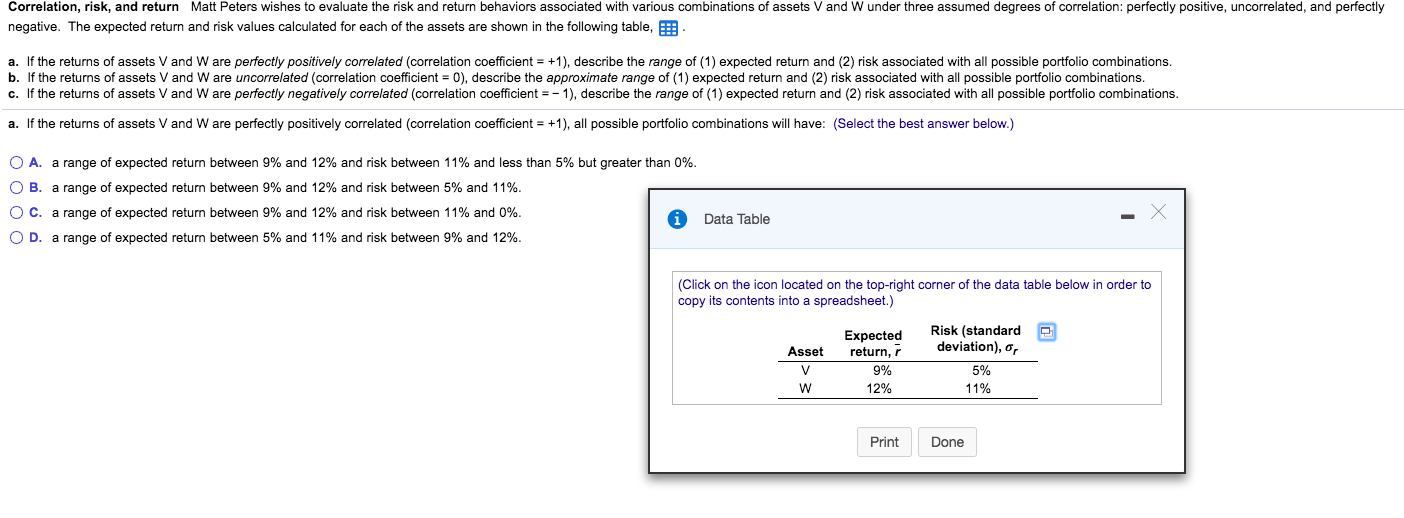

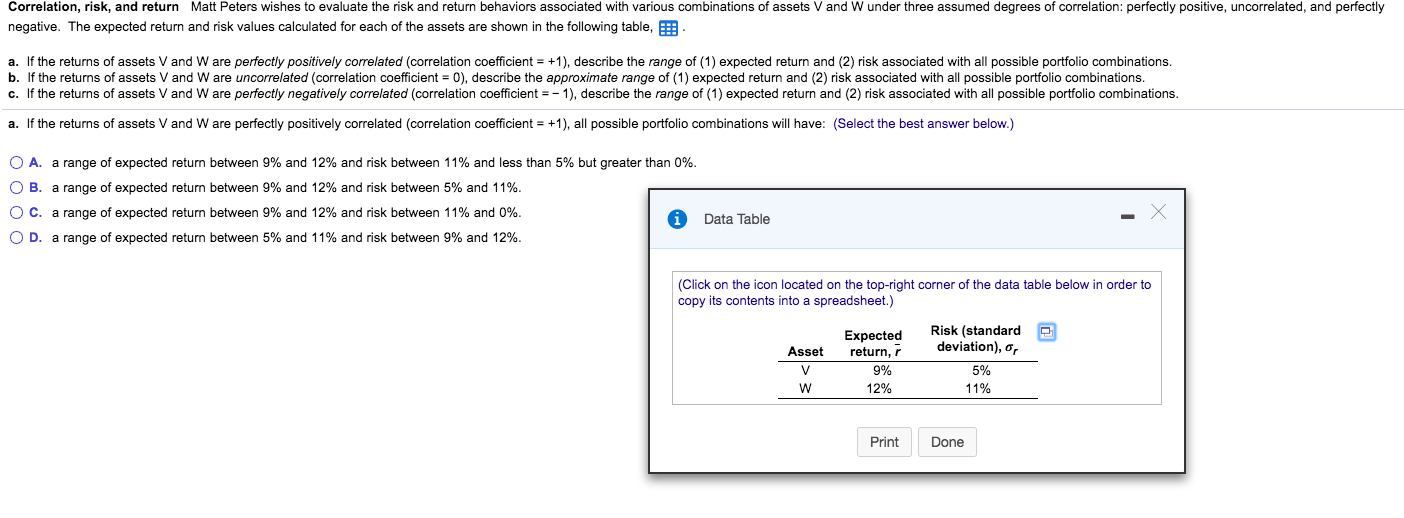

Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative. The expected return and risk values calculated for each of the assets are shown in the following table, PE a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient = +1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. b. If the returns of assets V and Ware uncorrelated (correlation coefficient = 0), describe the approximate range of (1) expected return and (2) risk associated with all possible portfolio combinations. c. If the returns of assets V and W are perfectly negatively correlated (correlation coefficient = -1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient = +1), all possible portfolio combinations will have: (Select the best answer below.) O A. a range of expected return between 9% and 12% and risk between 11% and less than 5% but greater than 0%. OB. a range of expected return between 9% and 12% and risk between 5% and 11% O c. a range of expected return between 9% and 12% and risk between 11% and 0% A Data Table OD. a range of expected return between 5% and 11% and risk between 9% and 12% (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Risk (standard deviation), o, Asset Expected return, 9% 12% 5% 11% Print Done Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative. The expected return and risk values calculated for each of the assets are shown in the following table, PE a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient = +1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. b. If the returns of assets V and Ware uncorrelated (correlation coefficient = 0), describe the approximate range of (1) expected return and (2) risk associated with all possible portfolio combinations. c. If the returns of assets V and W are perfectly negatively correlated (correlation coefficient = -1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient = +1), all possible portfolio combinations will have: (Select the best answer below.) O A. a range of expected return between 9% and 12% and risk between 11% and less than 5% but greater than 0%. OB. a range of expected return between 9% and 12% and risk between 5% and 11% O c. a range of expected return between 9% and 12% and risk between 11% and 0% A Data Table OD. a range of expected return between 5% and 11% and risk between 9% and 12% (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Risk (standard deviation), o, Asset Expected return, 9% 12% 5% 11% Print Done