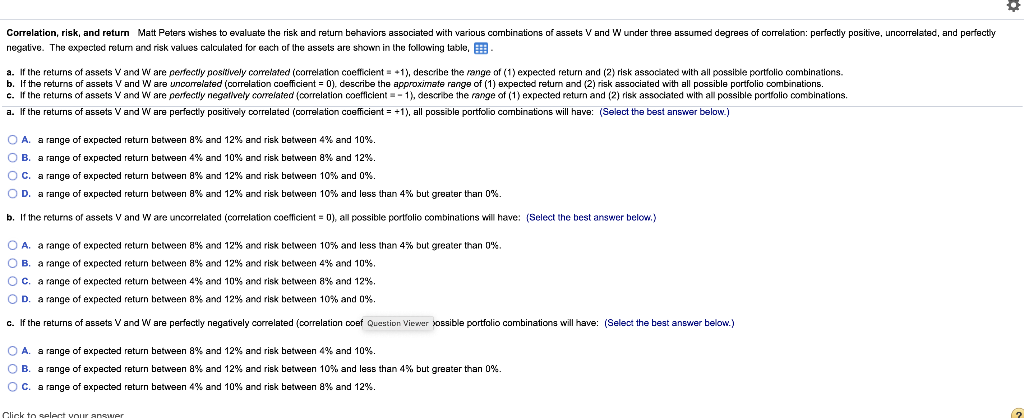

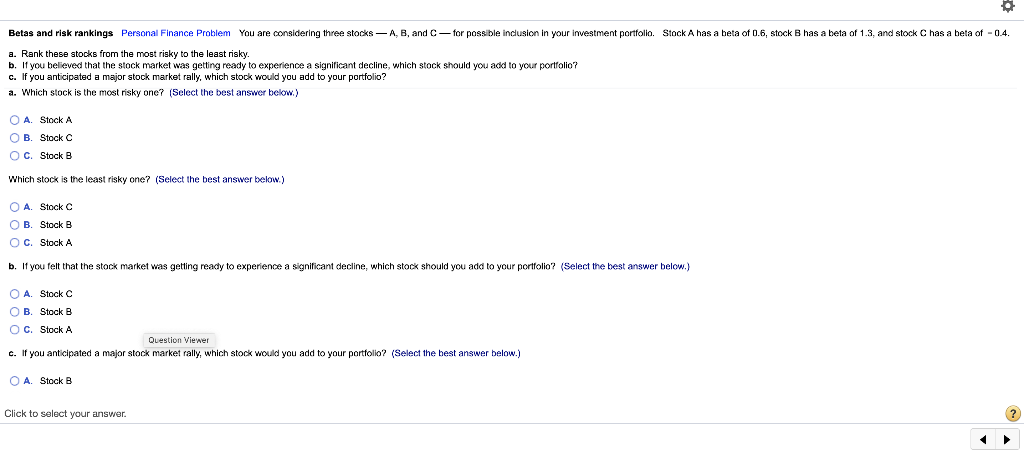

Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative. The expected return and risk values calculated for each of the assets are shown in the following table, B a. If the returns of assets V and W are perfectly positively correlated correlation coefficient = +1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. b. If the returns of assets V and W are uncorrelated (correlation coefficient = 0), describe the approximate range of (1) expected return and (2) risk associated with all possible portfolio combinations. c. If the returns of assets V and W are perfectly negatively correlated (correlation coefficient = -1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations, a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient = +1), all possible portfolio combinations will have: (Select the best answer below.) O A. a range of expected return between 8% and 12% and risk between 4% and 10% OB. a range of expected return between 4% and 10% and risk between 8% and 12%. O c. a range of expected return between 8% and 12% and risk between 10% and 0%. OD. a range of expected return between 8% and 12% and risk between 10% and less than 4% but greater than 0%. b. If the returns of assets V and W are uncorrelated (correlation coefficient = 0), all possible portfolio combinations will have: (Select the best answer below.) O A. a range of expected return between 8% and 12% and risk between 10% and less than 4% but greater than 0% O B. a range of expected return between 8% and 12% and risk between 4% and 10%. O c. a range of expected return between 4% and 10% and risk between 8% and 12%. OD. a range of expected return between 8% and 12% and risk between 10% and 0% c. If the returns of assets V and W are perfectly negatively correlated (correlation coef Question Viewer Yossible portfolio combinations will have: (Select the best answer below.) O A. a range of expected return between 8% and 12% and risk between 4% and 10%. O B. a range of expected return between 8% and 12% and risk between 10% and less than 4% but greater than 0%. OC. a range of expected return between 4% and 10% and risk between 8% and 12%. Click to select your answer Betas and risk rankings Personal Finance Problem You are considering three stocks A, B, and C- for possible inclusion in your investment portfolio. Stock A has a beta of 0.6, stock Bhas a beta of 1.3, and stock C has a beta of -0.4. a. Rank these stocks from the most risky to the least risky. b. If you believed that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? c. If you anticipated a major stock market rally, which stock would you add to your portfolio? a. Which stock is the most risky one? (Select the best answer below.) O A Stock A OB. Stock C OC Stock B Which stock is the least risky one? (Select the best answer below.) O A Stock OB. Stock B OC. Stock A b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) O A. Stock C OB Stock B OC Stock A Question Viewer e. If you anticipated a major stock market rally, which stock would you add to your portfolio? (Select the best answer below.) O A. Stock B Click to select your