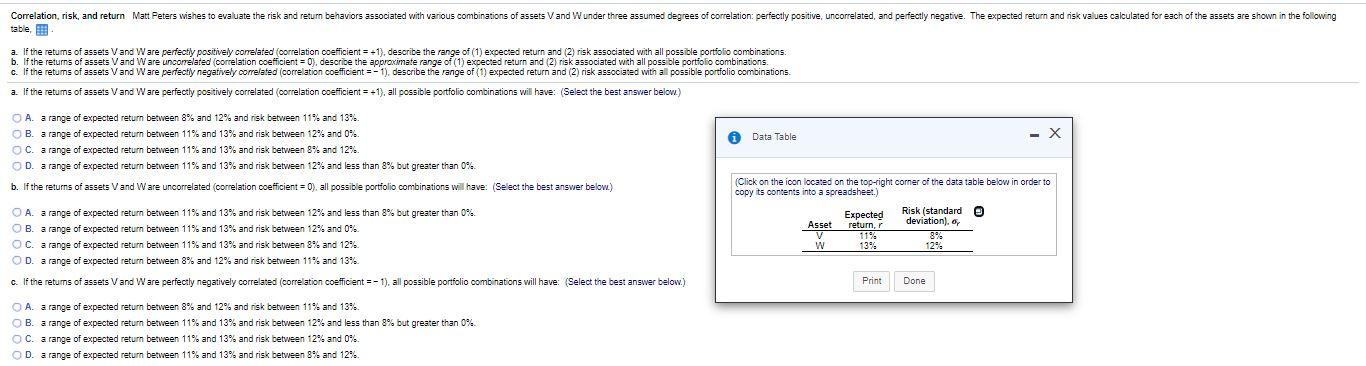

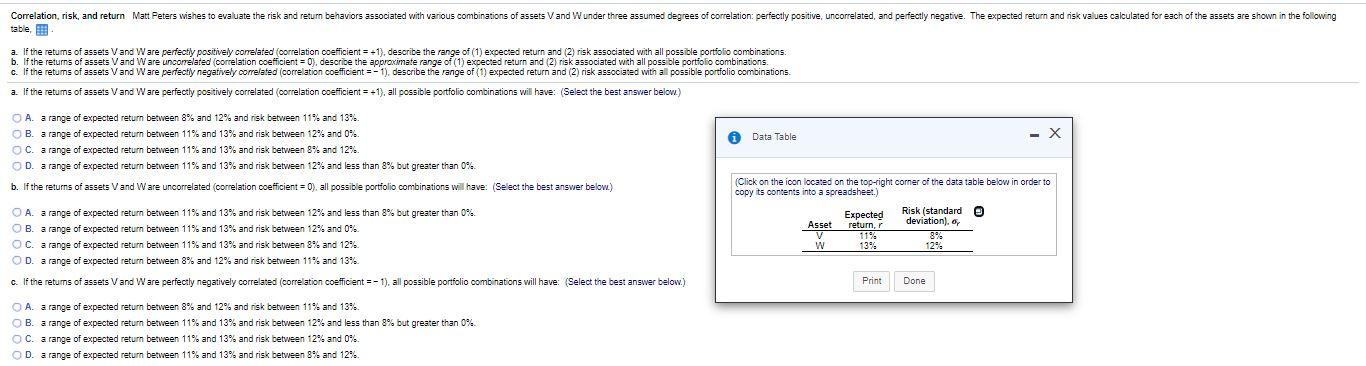

Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and Wunder three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative. The expected return and risk values calculated for each of the assets are shown in the following table, a. If the retums of assets V and Ware perfectly positively correlated correlation coefficient = -1), describe the range of (1) expected return and (2) risk associated with all possible portiollo combinations. b. If the returns of assets V and Ware uncorrelated correlation coefficient = 0), describe the approximate range of (1) expected return and (2) risk associated with all possible portiolio combinations. C. If the retums of assets V and Ware perfectly negatively correlated (correlation coefficient = -1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. a. If the retums of assets V and Ware perfectly positively correlated (correlation coefficient = -1), all possible portfolio combinations will have: (Select the best answer below) A. a range of expected return between 3% and 12% and risk between 11% and 13% OB. a range of expected return between 11% and 13% and risk between 12% and 0% * Data Table OC. a range of expected return between 11% and 13% and risk between 8% and 12% OD. a range of expected return between 11% and 13% and risk between 12% and less than 8% but greater than 0% b. If the returns of assets V and Ware uncorrelated correlation coefficient = 0). all possible portiolio combinations will have: (Select the best answer below.) (Click on the ioon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) O A. a range of expected return between 11% and 13% and risk between 12% and less than 8% but greater than 0% Expected Risk (standard OB. a range of expected return between 11% and 13% and risk between 12% and 0% deviation), return, V 11% 8% OC. a range of expected return between 11% and 13% and risk between 8% and 12 W 13% OD. a range of expected return between 8% and 12% and risk between 11% and 13% c. If the retums of assets V and Ware perfectly negatively correlated (correlation coefficient =-1), all possible portfolio combinations will have: (Select the best answer below.) Print Done Asser 12% A. a range of expected return between 8% and 12% and risk between 119 and 13% B. a range of expected return between 11% and 13% and risk between 12% and less than 3% but greater than 0% OC. a range of expected return between 11% and 13% and risk between 12% and 0% OD. a range of expected return between 11% and 13% and risk between 8% and 12%