Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corrigan Corporation is a small firm in textile industry of Fruitania. You are given the following financial stements of Corrigan Corporation for two years,

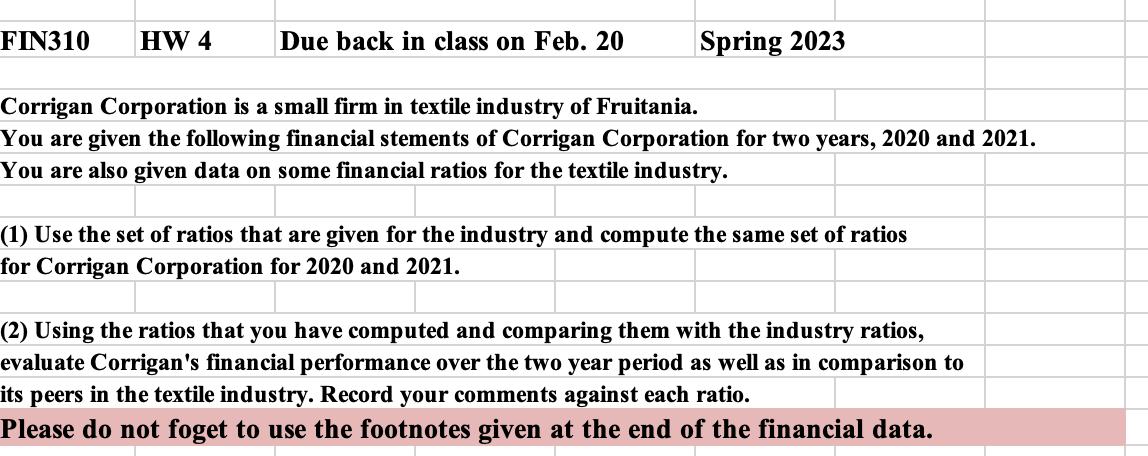

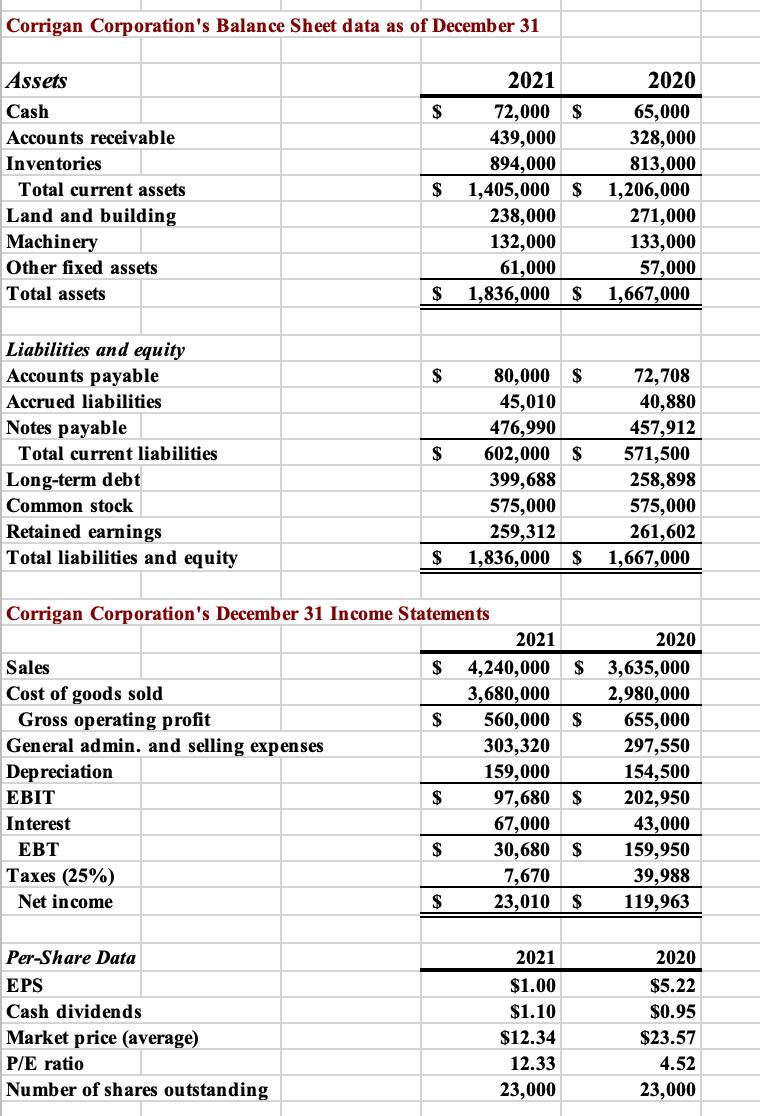

Corrigan Corporation is a small firm in textile industry of Fruitania. You are given the following financial stements of Corrigan Corporation for two years, 2020 and 2021. You are also given data on some financial ratios for the textile industry. FIN310 HW 4 Due back in class on Feb. 20 Spring 2023 Corrigan Corporation is a small firm in textile industry of Fruitania. You are given the following financial stements of Corrigan Corporation for two years, 2020 and 2021. You are also given data on some financial ratios for the textile industry. (1) Use the set of ratios that are given for the industry and compute the same set of ratios for Corrigan Corporation for 2020 and 2021. (2) Using the ratios that you have computed and comparing them with the industry ratios, evaluate Corrigan's financial performance over the two year period as well as in comparison to its peers in the textile industry. Record your comments against each ratio. Please do not foget to use the footnotes given at the end of the financial data. Corrigan Corporation's Balance Sheet data as of December 31 Assets Cash Accounts receivable Inventories Total current assets Land and building Machinery Other fixed assets Total assets Liabilities and equity Accounts payable Accrued liabilities Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Sales Cost of goods sold Gross operating profit General admin. and selling expenses Depreciation EBIT Interest EBT Taxes (25%) Net income 2021 72,000 $ 439,000 894,000 $ 1,405,000 238,000 132,000 61,000 $ 1,836,000 Per-Share Data EPS Cash dividends Market price (average) P/E ratio Number of shares outstanding $ $ Corrigan Corporation's December 31 Income Statements $ $ $ $ $ $ $ 2020 65,000 328,000 813,000 1,206,000 271,000 133,000 57,000 S 1,667,000 80,000 $ 45,010 476,990 602,000 $ 399,688 575,000 259,312 1,836,000 $ $ 2021 4,240,000 $ 3,680,000 560,000 $ 303,320 159,000 2021 $1.00 $1.10 $12.34 12.33 23,000 97,680 $ 67,000 30,680 $ 7,670 23,010 $ 72,708 40,880 457,912 571,500 258,898 575,000 261,602 1,667,000 2020 3,635,000 2,980,000 655,000 297,550 154,500 202,950 43,000 159,950 39,988 119,963 2020 $5.22 $0.95 $23.57 4.52 23,000 Once we have this information set, we can calculate the necessary ratios for this analysis. Ratio Analysis Liquidity Current ratio a Asset Management Inventory turnoverb Days sales outstanding Fixed assets turnoverb Total assets turnover Profitability Return on assets Return on equity Return on invested capital Profit margin Debt Management d Debt-to-capital ratio Market Value P/E ratio M/B ratio EV/EBITDA ratio ? ? ? ? ? ? ? ? ? ? ? ? ? 2021 ? Industry average ratios have been constant for the past 4 years. b Based on year-end balance sheet figures. ? ? ? ? ? ? ? ? ? ? ? ? 2020 Industry Avg YOUR COMMENTS 2.7 7.0 32 13.0 2.6 11.4% 18.2% 14.5% 4.4% 50.0% 6.0 1.5 6.0 c Calculation is based on a 365-day year. Measured as (Short-term debt + Long-term debt)/(Short-term debt + Long-term debt + Common equity). ? ~~~ ? ? ? ? ? ? ? ? ? ? ? ?

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started