Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corvallis Corporation owns 80% of the stock of Little Harrisburg, Inc. At December 31, 2012, Little Harrisburg had the following summarized balance sheet: LITTLE

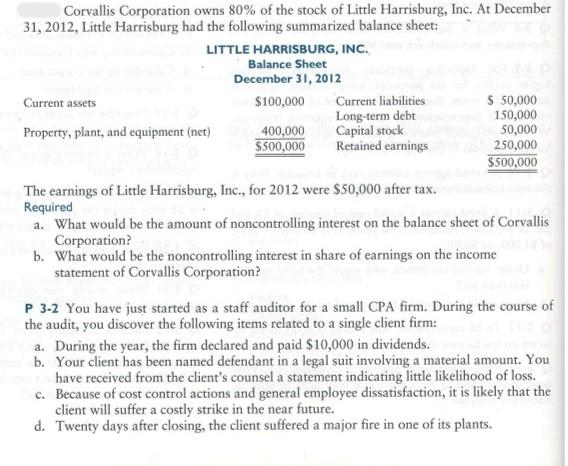

Corvallis Corporation owns 80% of the stock of Little Harrisburg, Inc. At December 31, 2012, Little Harrisburg had the following summarized balance sheet: LITTLE HARRISBURG, INC. Balance Sheet December 31, 2012 Current assets $100,000 Current liabilities $ 50,000 Long-term debt 150,000 Property, plant, and equipment (net) 400,000 Capital stock 50,000 $500,000 Retained earnings 250,000 $500,000 The earnings of Little Harrisburg, Inc., for 2012 were $50,000 after tax. Required a. What would be the amount of noncontrolling interest on the balance sheet of Corvallis Corporation? b. What would be the noncontrolling interest in share of earnings on the income statement of Corvallis Corporation? P 3-2 You have just started as a staff auditor for a small CPA firm. During the course of the audit, you discover the following items related to a single client firm: a. During the year, the firm declared and paid $10,000 in dividends. b. Your client has been named defendant in a legal suit involving a material amount. You have received from the client's counsel a statement indicating little likelihood of loss. c. Because of cost control actions and general employee dissatisfaction, it is likely that the client will suffer a costly strike in the near future. d. Twenty days after closing, the client suffered a major fire in one of its plants.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the amount of noncontrolling interest on the balance sheet of Corvallis Corporation w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started