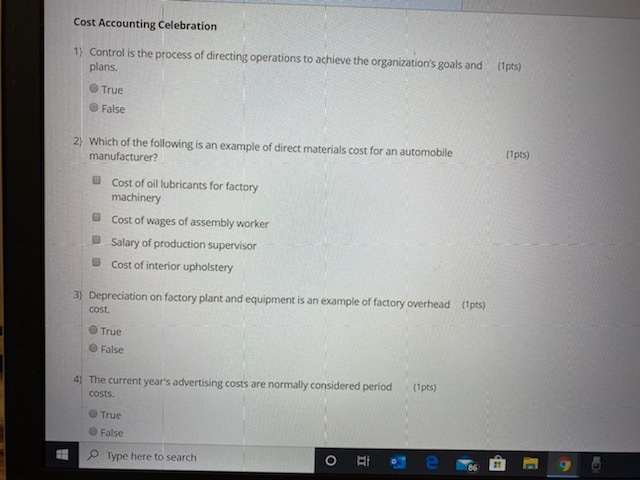

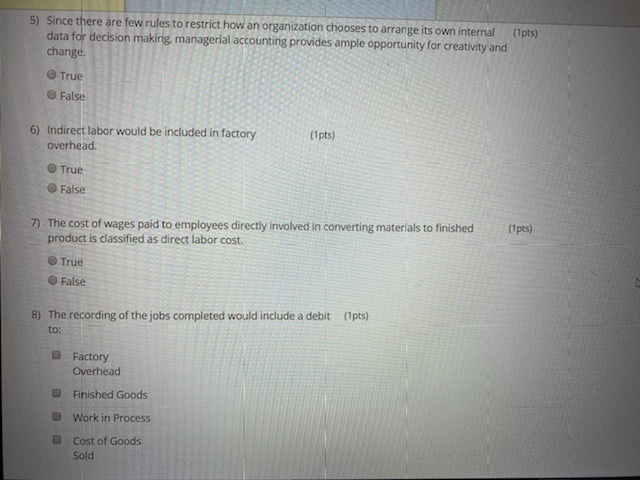

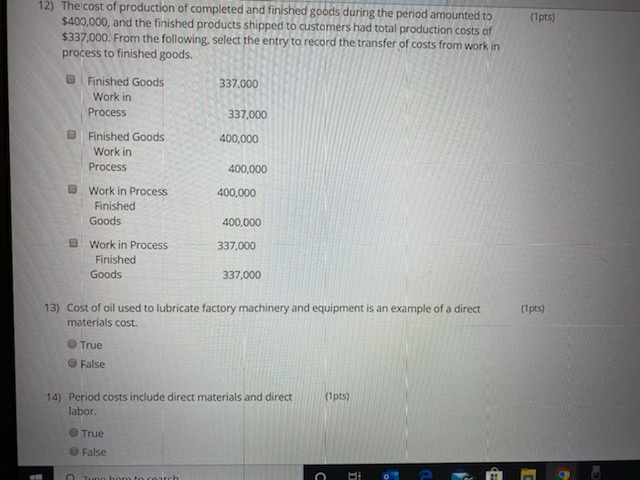

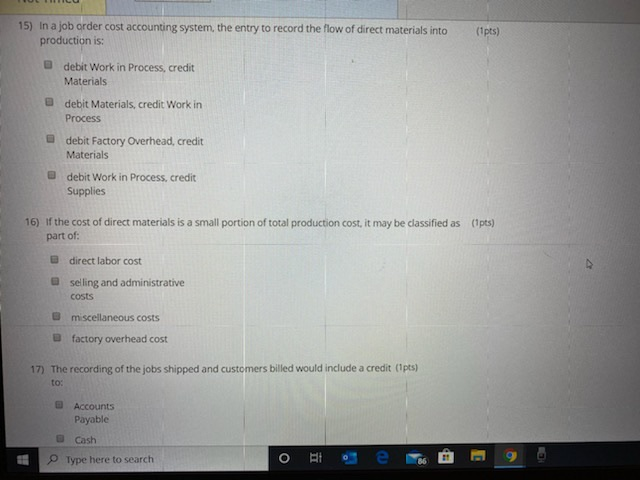

Cost Accounting Celebration 1) Control is the process of directing operations to achieve the organization's goals and plans. (Ipts) True False 2) Which of the following is an example of direct materials cost for an automobile manufacturer? (1pts) Cost of oil lubricants for factory machinery Cost of wages of assembly worker Salary of production supervisor Cost of interior upholstery (Ipts) 3) Depreciation on factory plant and equipment is an example of factory overhead cost. True False 41 The current year's advertising costs are normally considered period costs. (1pts) True False Type here to search Cost Accounting Celebration 1) Control is the process of directing operations to achieve the organization's goals and plans. (Ipts) True False 2) Which of the following is an example of direct materials cost for an automobile manufacturer? (1pts) Cost of oil lubricants for factory machinery Cost of wages of assembly worker Salary of production supervisor Cost of interior upholstery (Ipts) 3) Depreciation on factory plant and equipment is an example of factory overhead cost. True False 41 The current year's advertising costs are normally considered period costs. (1pts) True False Type here to search 5) Since there are few rules to restrict how an organization chooses to arrange its own internal data for decision making, managerial accounting provides ample opportunity for creativity and change. (Ipts) True False 6) Indirect labor would be included in factory overhead. (1 pts) True False 7) The cost of wages paid to employees directly involved in converting materials to finished product is classified as direct labor cost. pts) True False 8) The recording of the jobs completed would include a debit to: (Ipts) Factory Overhead @ Finished Goods @ Work in Process Cost of Goods Sold (1pts) 12) The cost of production of completed and finished goods during the period amounted to $400,000, and the finished products shipped to customers had total production costs of $337.000. From the following select the entry to record the transfer of costs from work in process to finished goods. B Finished Goods 337.000 Work in Process 337,000 Finished Goods 400,000 Work in Process 400,000 Work in Process 400,000 Finished Goods 400,000 B Work in Process 337,000 Finished Goods 337,000 13) Cost of oil used to lubricate factory machinery and equipment is an example of a direct materials cost. (1pts) True False pts) 14) Period costs include direct materials and direct labor. True False Tahtach I e - 9 15) In a job order cost accounting system, the entry to record the flow of direct materials into production is: (Ipts) debit Work in Process, credit Materials B debit Materials, credit Work in Process debit Factory Overhead, credit Materials @ debit Work in Process, credit Supplies 16) If the cost of direct materials is a small portion of total production cost, it may be classified as (1 pts) part of: B direct labor cost selling and administrative costs miscellaneous costs factory overhead cost 17) The recording of the jobs shipped and customers billed would include a credit (pt) Accounts Payable Cash Type here to search