Answered step by step

Verified Expert Solution

Question

1 Approved Answer

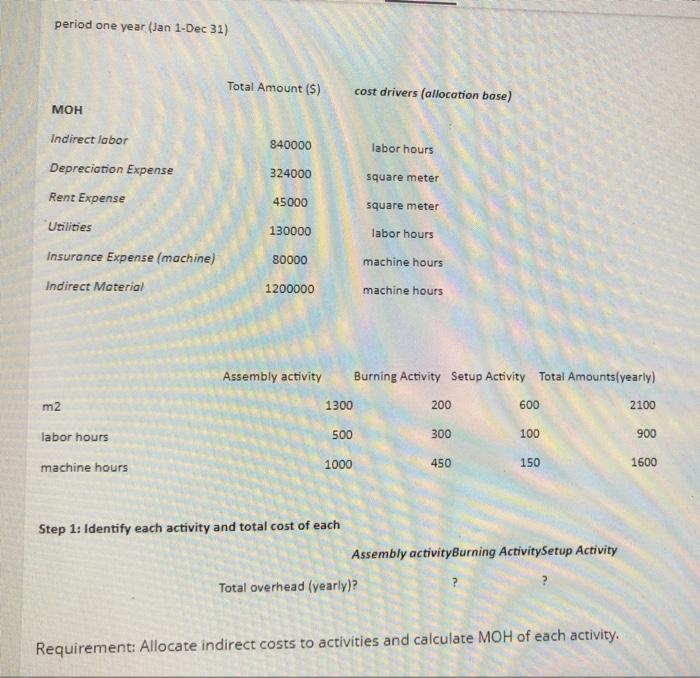

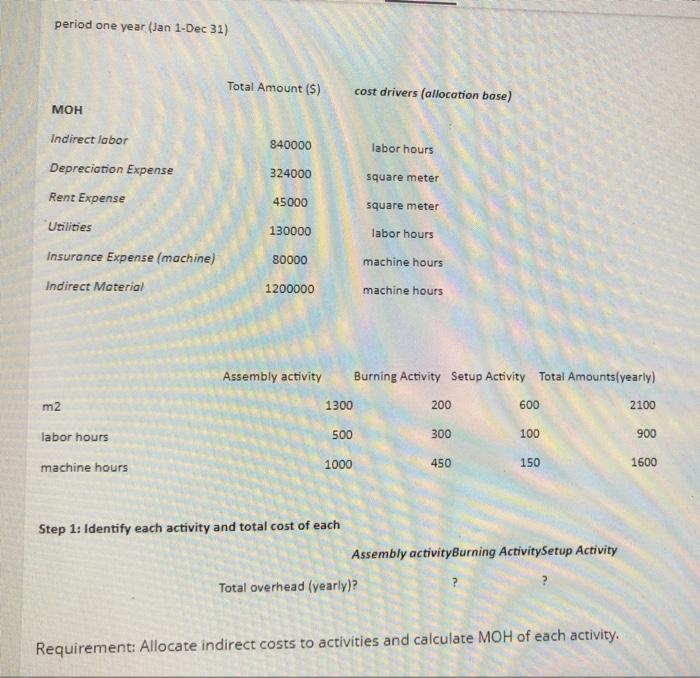

COST ACCOUNTING period one year (Jan 1-Dec 31) Total Amount (5) cost drivers (allocation base) MOH Indirect labor 840000 labor hours Depreciation Expense 324000 square

COST ACCOUNTING

period one year (Jan 1-Dec 31) Total Amount (5) cost drivers (allocation base) MOH Indirect labor 840000 labor hours Depreciation Expense 324000 square meter Rent Expense 45000 square meter Utilities 130000 labor hours 80000 Insurance Expense (machine) Indirect Material machine hours machine hours 1200000 Assembly activity Burning Activity Setup Activity Total Amounts(yearly) 1300 2100 m2 200 600 labor hours 500 300 100 900 1000 450 150 1600 machine hours Step 1: Identify each activity and total cost of each Assembly activityBurning ActivitySetup Activity Total overhead (yearly)? Requirement: Allocate indirect costs to activities and calculate MOH of each activity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started