Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost allocation 1. What is the difference between the minimum and maximum cost of manufacturing individual products and how do we interpret it? 2. What

Cost allocation

1. What is the difference between the minimum and maximum cost of manufacturing individual products and how do we interpret it?

2. What cost level would be the best for salespeople?

3. What level of costs would be the best for owners/managers?

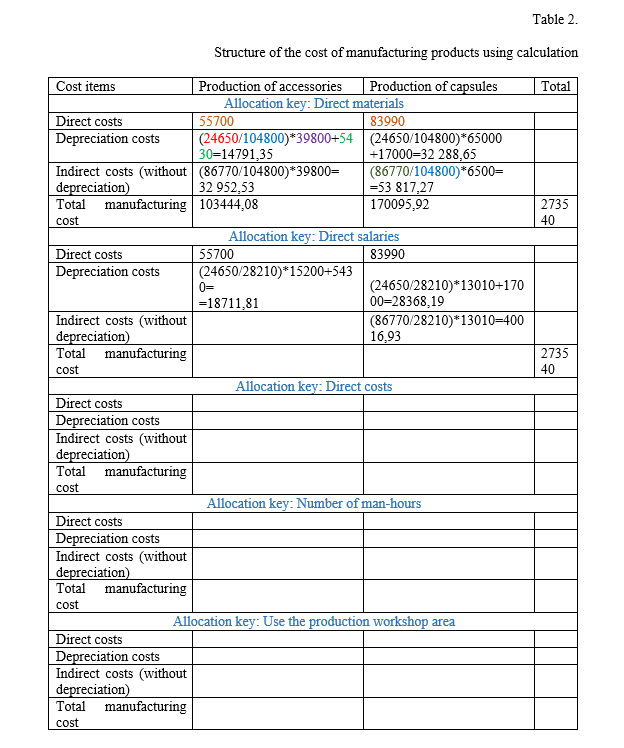

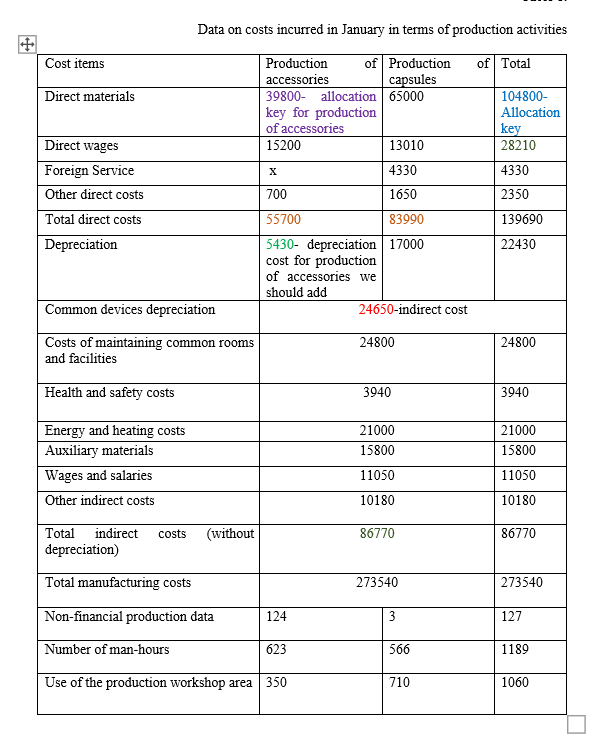

Management Accounting Case study Cost allocation For many years, OP Group has been based on the provision of hotel and home swimming pool design services. The company's competitive advantage was built mainly through the provision of applications, i.e. including the delivery of the necessary equipment, starting the system, training the staff as well as warranty and post-warranty service. At the same time, the company produces small accessories for swimming pools, such as pool edges, filters for swimming pool pumps or chlorine dispensers. In connection with the search for the possibility of extending the range of services provided, the company last year started trial production of larger elements, i.e. floating capsules. Since last year the production of capsules took place mainly during downtime of production workers and the management did not decide to start permanent production and no customers were obtained for the capsules produced, the cost of capsule production was determined at the level of direct costs, which included direct materials, semi-finished products and direct labor . From the new year, in connection with the acquisition of customers, regular production of capsules was started and the revenues from the sale of capsules were taken into account in the planned sales for the current year with a share of 15%. the value of direct materials used. The applied allocation keys are variable, ie. the total sum of key units changes each month, as well as the number of units for each key carrier. The indirect costs of small accessories produced mainly include the maintenance of machinery and equipment, the costs of energy used in production and for the lighting of rooms, the costs of remuneration of employees for vacation and sickness, costs of auxiliary materials, heating of production premises and depreciation. On the other hand, the characteristic indirect costs of the provision of design services are the costs of office materials, heating of office rooms, depreciation of the software used and engineers' wages for holidays and sickness. Indication of indirect costs related to the services provided and those incurred in connection with the manufactured products, was strictly determined due to the various buildings for the provision of services and production activities, as well as other employees dealing with the above-mentioned activities. Due to the commencement of the production of capsules, the indirect costs, so far assigned to the production of small accessories, will also apply to capsules, because their production will be carried out in the same building as the production of small accessories. Table 1 presents information available to the newly hired controlling specialist for January in the scope of the described production activities of the company. The analysis of indirect costs incurred in January compared to the previous periods shows a slight increase in depreciation costs (in the part conceming new machines purchased for the purpose of starting capsule production), energy and auxiliary materials costs. There was no increase in employee costs, as at the same time organizational measures were taken aimed at more effective use of working time of production workers. The production of small accessories and capsules takes place in one shift, intended for sale to wholesalers and or pool contractors and at the same time for the needs of specific projects carried out by the company. Each manufactured element of swimming pool accessories is taken to the finished goods warehouse, where the principle of detailed price identification applies. The decision was made on an identical capsule solution, although a small part of the series production is assumed due to the predominance of production for individual customer orders. The production process of capsules is different than that of small accessories produced so far, and therefore several devices dedicated to this production were purchased. However, starting production did not require hiring new employees, but only on-the-job training of the already employed people. It is assumed that the capsules will be made during the so far ineffective working time of employees working in the production of small accessories. On the other hand, the start of production required the separation of a significant part of the room due to the large dimensions of the capsules produced. The beginning of capsule production coincided with the employment of a controlling specialist, whose task is, among others, developing the principles of assessing the effectiveness of individual swimming pool design services (including comprehensive implementation) and the production of products (small devices already produced and the commenced activity in the field of floating capsules). The allocation of indirect costs (separated for design services and for the production of small accessories) was based on the allocation key defined as the number of man-hours allocated in a given month for a specific project, and in relation to the production of accessories - based on | In the situation described above, the task of the newly hired employee is to define the principles of production valuation (for management purposes) of small accessories and floating capsules that are manufactured by the same employees, in the same building, only with the use of largely separate fixed assets. The controlling specialist is currently unable to implement modern cost management systems, such as activity costing, due to the lack of preparation of the company to provide the necessary data. He plans to use selected modern techniques, but only in the next financial years. While preparing the data for the cost of manufacturing calculations, the controlling specialist pointed out that the determined cost of manufacturing products is one of the most important determinants of the commission paid to sellers. The sellers' motivation system is based in the company, among others on the margin generated on a given transaction. In connection with the above, assuming that the company has no influence on the sales prices of products (sales at market prices the controlling specialist determined, based on financial data from January, that the cost of producing small accessories below PLN 105,000 guarantees the payment of commission to sellers dealing with these products. In turn, the cost of producing capsules below PLN 160.000 ensures the fulfillment of the goals set for the second group of sellers, i.e. the sales department employees responsible for the implementation of the plan for the sale of floating capsules, and guarantees the payment of commission to sellers who have acquired customers. In-house regulations regarding the commission remuneration of sellers result from the adopted regulations and do not fall within the scope of duties and competences of a controlling specialist. Work with the described case should begin with the analysis of costs incurred in the production process, paying attention to direct and indirect costs. Subsequently, it is necessary to determine the methods of calculating the production cost, which can be used by a newly hired controlling specialist. Due to the short period of work in the company and the resulting incomplete information on all processes taking place during the production of products, attention should be paid to the difficulties that the employee will encounter. In addition, it is worth mentioning the short period for which the employee has financial data about the production process and the organization that has just started in the company. The above circumstances lead to the use of traditional cost calculation methods with available allocation keys. Table 2. Structure of the cost of manufacturing products using calculation Total 2735 40 2735 40 Cost items Production of accessories Production of capsules Allocation key: Direct materials Direct costs 55700 83990 Depreciation costs (24650/104800)*39800+54 (24650/104800)*65000 30=14791,35 +17000=32 288,65 Indirect costs (without (86770/104800)*39800= (86770/104800)*6500= depreciation) 32 952,53 =53 817,27 Total manufacturing 103444,08 170095,92 cost Allocation key: Direct salaries Direct costs 55700 83990 Depreciation costs (24650/28210)*15200+543 0= (24650/28210)*13010+170 =18711,81 00=28368,19 Indirect costs (without (86770/28210)*13010-400 depreciation) 16,93 Total manufacturing cost Allocation key: Direct costs Direct costs Depreciation costs Indirect costs (without depreciation) Total manufacturing cost Allocation key: Number of man-hours Direct costs Depreciation costs Indirect costs (without depreciation) Total manufacturing cost Allocation key: Use the production workshop area Direct costs Depreciation costs Indirect costs (without depreciation) Total manufacturing cost Data on costs incurred in January in terms of production activities + Cost items of Total Direct materials Production of Production accessories capsules 39800- allocation 65000 key for production of accessories 15200 13010 104800- Allocation key 28210 X 4330 4330 Direct wages Foreign Service Other direct costs Total direct costs Depreciation 700 1650 2350 55700 83990 139690 22430 5430- depreciation 17000 cost for production of accessories we should add 24650-indirect cost Common devices depreciation Costs of maintaining common rooms and facilities 24800 24800 Health and safety costs 3940 3940 21000 15800 21000 15800 Energy and heating costs Auxiliary materials Wages and salaries Other indirect costs 11050 11050 10180 10180 costs (without 86770 86770 Total indirect depreciation) Total manufacturing costs 273540 273540 124 3 127 Non-financial production data Number of man-hours 623 566 1189 Use of the production workshop area 350 710 1060 Management Accounting Case study Cost allocation For many years, OP Group has been based on the provision of hotel and home swimming pool design services. The company's competitive advantage was built mainly through the provision of applications, i.e. including the delivery of the necessary equipment, starting the system, training the staff as well as warranty and post-warranty service. At the same time, the company produces small accessories for swimming pools, such as pool edges, filters for swimming pool pumps or chlorine dispensers. In connection with the search for the possibility of extending the range of services provided, the company last year started trial production of larger elements, i.e. floating capsules. Since last year the production of capsules took place mainly during downtime of production workers and the management did not decide to start permanent production and no customers were obtained for the capsules produced, the cost of capsule production was determined at the level of direct costs, which included direct materials, semi-finished products and direct labor . From the new year, in connection with the acquisition of customers, regular production of capsules was started and the revenues from the sale of capsules were taken into account in the planned sales for the current year with a share of 15%. the value of direct materials used. The applied allocation keys are variable, ie. the total sum of key units changes each month, as well as the number of units for each key carrier. The indirect costs of small accessories produced mainly include the maintenance of machinery and equipment, the costs of energy used in production and for the lighting of rooms, the costs of remuneration of employees for vacation and sickness, costs of auxiliary materials, heating of production premises and depreciation. On the other hand, the characteristic indirect costs of the provision of design services are the costs of office materials, heating of office rooms, depreciation of the software used and engineers' wages for holidays and sickness. Indication of indirect costs related to the services provided and those incurred in connection with the manufactured products, was strictly determined due to the various buildings for the provision of services and production activities, as well as other employees dealing with the above-mentioned activities. Due to the commencement of the production of capsules, the indirect costs, so far assigned to the production of small accessories, will also apply to capsules, because their production will be carried out in the same building as the production of small accessories. Table 1 presents information available to the newly hired controlling specialist for January in the scope of the described production activities of the company. The analysis of indirect costs incurred in January compared to the previous periods shows a slight increase in depreciation costs (in the part conceming new machines purchased for the purpose of starting capsule production), energy and auxiliary materials costs. There was no increase in employee costs, as at the same time organizational measures were taken aimed at more effective use of working time of production workers. The production of small accessories and capsules takes place in one shift, intended for sale to wholesalers and or pool contractors and at the same time for the needs of specific projects carried out by the company. Each manufactured element of swimming pool accessories is taken to the finished goods warehouse, where the principle of detailed price identification applies. The decision was made on an identical capsule solution, although a small part of the series production is assumed due to the predominance of production for individual customer orders. The production process of capsules is different than that of small accessories produced so far, and therefore several devices dedicated to this production were purchased. However, starting production did not require hiring new employees, but only on-the-job training of the already employed people. It is assumed that the capsules will be made during the so far ineffective working time of employees working in the production of small accessories. On the other hand, the start of production required the separation of a significant part of the room due to the large dimensions of the capsules produced. The beginning of capsule production coincided with the employment of a controlling specialist, whose task is, among others, developing the principles of assessing the effectiveness of individual swimming pool design services (including comprehensive implementation) and the production of products (small devices already produced and the commenced activity in the field of floating capsules). The allocation of indirect costs (separated for design services and for the production of small accessories) was based on the allocation key defined as the number of man-hours allocated in a given month for a specific project, and in relation to the production of accessories - based on | In the situation described above, the task of the newly hired employee is to define the principles of production valuation (for management purposes) of small accessories and floating capsules that are manufactured by the same employees, in the same building, only with the use of largely separate fixed assets. The controlling specialist is currently unable to implement modern cost management systems, such as activity costing, due to the lack of preparation of the company to provide the necessary data. He plans to use selected modern techniques, but only in the next financial years. While preparing the data for the cost of manufacturing calculations, the controlling specialist pointed out that the determined cost of manufacturing products is one of the most important determinants of the commission paid to sellers. The sellers' motivation system is based in the company, among others on the margin generated on a given transaction. In connection with the above, assuming that the company has no influence on the sales prices of products (sales at market prices the controlling specialist determined, based on financial data from January, that the cost of producing small accessories below PLN 105,000 guarantees the payment of commission to sellers dealing with these products. In turn, the cost of producing capsules below PLN 160.000 ensures the fulfillment of the goals set for the second group of sellers, i.e. the sales department employees responsible for the implementation of the plan for the sale of floating capsules, and guarantees the payment of commission to sellers who have acquired customers. In-house regulations regarding the commission remuneration of sellers result from the adopted regulations and do not fall within the scope of duties and competences of a controlling specialist. Work with the described case should begin with the analysis of costs incurred in the production process, paying attention to direct and indirect costs. Subsequently, it is necessary to determine the methods of calculating the production cost, which can be used by a newly hired controlling specialist. Due to the short period of work in the company and the resulting incomplete information on all processes taking place during the production of products, attention should be paid to the difficulties that the employee will encounter. In addition, it is worth mentioning the short period for which the employee has financial data about the production process and the organization that has just started in the company. The above circumstances lead to the use of traditional cost calculation methods with available allocation keys. Table 2. Structure of the cost of manufacturing products using calculation Total 2735 40 2735 40 Cost items Production of accessories Production of capsules Allocation key: Direct materials Direct costs 55700 83990 Depreciation costs (24650/104800)*39800+54 (24650/104800)*65000 30=14791,35 +17000=32 288,65 Indirect costs (without (86770/104800)*39800= (86770/104800)*6500= depreciation) 32 952,53 =53 817,27 Total manufacturing 103444,08 170095,92 cost Allocation key: Direct salaries Direct costs 55700 83990 Depreciation costs (24650/28210)*15200+543 0= (24650/28210)*13010+170 =18711,81 00=28368,19 Indirect costs (without (86770/28210)*13010-400 depreciation) 16,93 Total manufacturing cost Allocation key: Direct costs Direct costs Depreciation costs Indirect costs (without depreciation) Total manufacturing cost Allocation key: Number of man-hours Direct costs Depreciation costs Indirect costs (without depreciation) Total manufacturing cost Allocation key: Use the production workshop area Direct costs Depreciation costs Indirect costs (without depreciation) Total manufacturing cost Data on costs incurred in January in terms of production activities + Cost items of Total Direct materials Production of Production accessories capsules 39800- allocation 65000 key for production of accessories 15200 13010 104800- Allocation key 28210 X 4330 4330 Direct wages Foreign Service Other direct costs Total direct costs Depreciation 700 1650 2350 55700 83990 139690 22430 5430- depreciation 17000 cost for production of accessories we should add 24650-indirect cost Common devices depreciation Costs of maintaining common rooms and facilities 24800 24800 Health and safety costs 3940 3940 21000 15800 21000 15800 Energy and heating costs Auxiliary materials Wages and salaries Other indirect costs 11050 11050 10180 10180 costs (without 86770 86770 Total indirect depreciation) Total manufacturing costs 273540 273540 124 3 127 Non-financial production data Number of man-hours 623 566 1189 Use of the production workshop area 350 710 1060

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started