Answered step by step

Verified Expert Solution

Question

1 Approved Answer

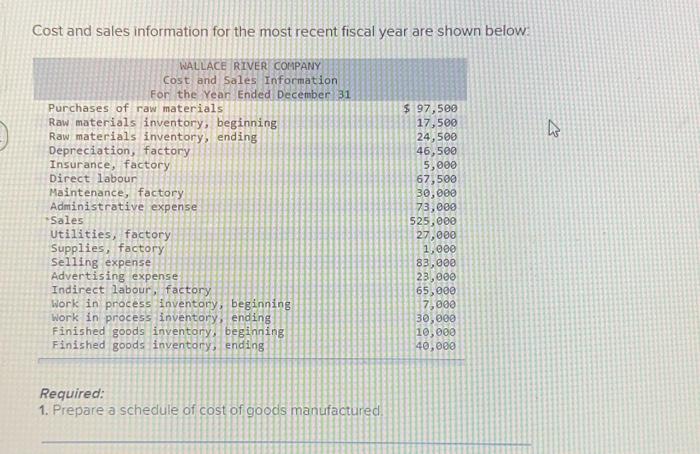

Cost and sales information for the most recent fiscal year are shown below: WALLACE RIVER COMPANY Cost and Sales Information For the Year Ended December

Cost and sales information for the most recent fiscal year are shown below: WALLACE RIVER COMPANY Cost and Sales Information For the Year Ended December 31 Purchases of raw materials Raw materials inventory, beginning Raw materials inventory, ending Depreciation, factory Insurance, factory Direct labour Maintenance, factory Administrative expense Sales Utilities, factory Supplies, factory Selling expense Advertising expense Indirect labour, factory Work in process inventory, beginning Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Required: 1. Prepare a schedule of cost of goods manufactured. $ 97,500 17,500 24,500 46,500 5,000 67,500 30,000 73,000 525,000 27,000 1,000 83,000 23,000 65,000 7,000 30,000 10,000 40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started