Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost Approach: Land Value, Adjustment Chart, Adjustment Analysis, and Reconciliation (BUSI 330.12-15) You must estimate the land value of your subject property, so that you

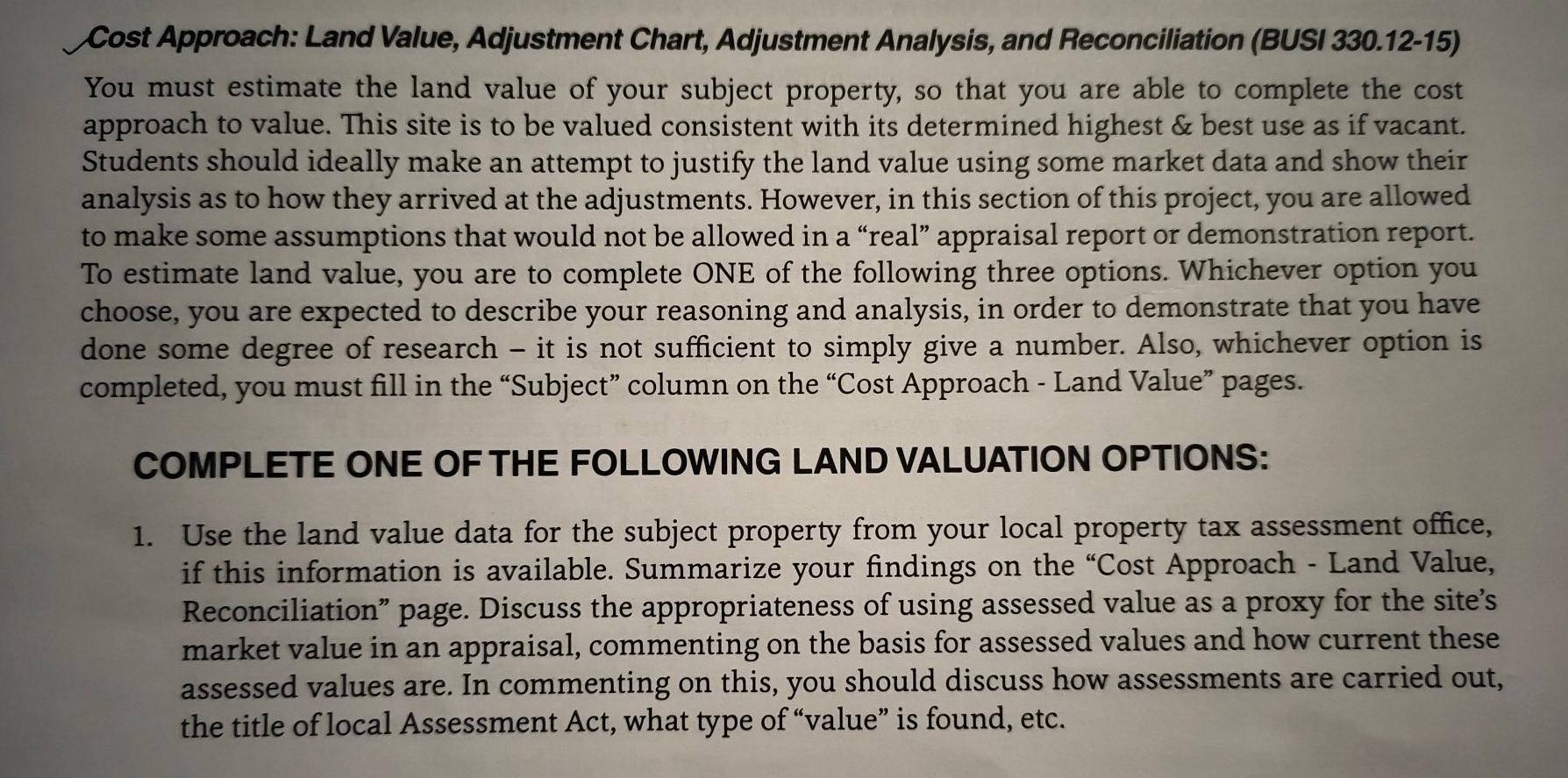

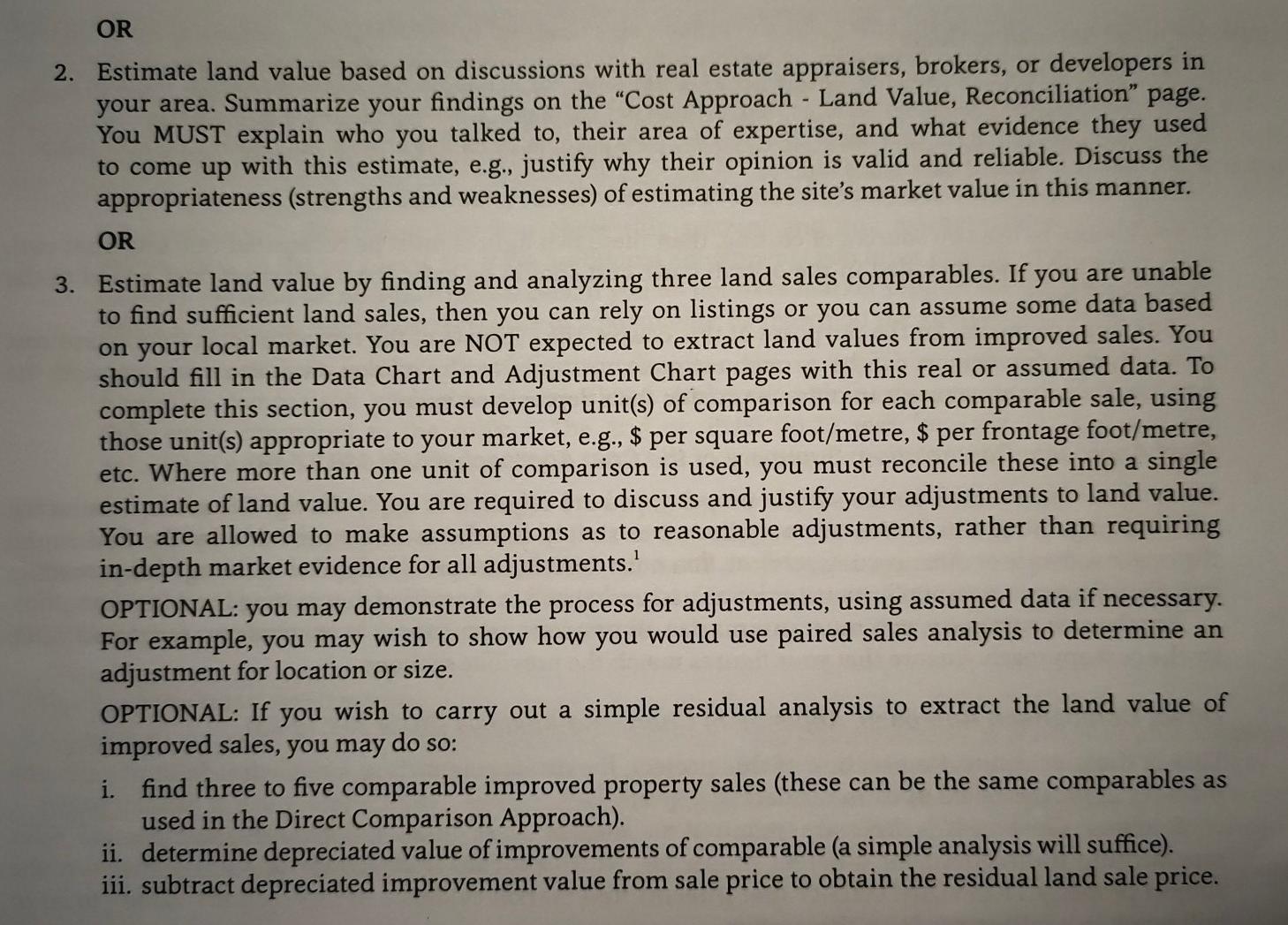

Cost Approach: Land Value, Adjustment Chart, Adjustment Analysis, and Reconciliation (BUSI 330.12-15) You must estimate the land value of your subject property, so that you are able to complete the cost approach to value. This site is to be valued consistent with its determined highest & best use as if vacant. Students should ideally make an attempt to justify the land value using some market data and show their analysis as to how they arrived at the adjustments. However, in this section of this project, you are allowed to make some assumptions that would not be allowed in a real appraisal report or demonstration report. To estimate land value, you are to complete ONE of the following three options. Whichever option you choose, you are expected to describe your reasoning and analysis, in order to demonstrate that you have done some degree of research - it is not sufficient to simply give a number. Also, whichever option is completed, you must fill in the Subject" column on the Cost Approach - Land Value pages. COMPLETE ONE OF THE FOLLOWING LAND VALUATION OPTIONS: 1. Use the land value data for the subject property from your local property tax assessment office, if this information is available. Summarize your findings on the Cost Approach - Land Value, Reconciliation" page. Discuss the appropriateness of using assessed value as a proxy for the site's market value in an appraisal, commenting on the basis for assessed values and how current these assessed values are. In commenting on this, you should discuss how assessments are carried out, the title of local Assessment Act, what type of value" is found, etc. ton, you OR 2. Estimate land value based on discussions with real estate appraisers, brokers, or developers in your area. Summarize your findings on the "Cost Approach - Land Value, Reconciliation" page. You MUST explain who you talked to, their area of expertise, and what evidence they used to come up with this estimate, e.g., justify why their opinion is valid and reliable. Discuss the appropriateness (strengths and weaknesses) of estimating the site's market value in this manner. OR 3. Estimate land value by finding and analyzing three land sales comparables. If you are unable to find sufficient land sales, then you can rely on listings or you can assume some data based on your local market. You are NOT expected to extract land values from improved sales. You should fill in the Data Chart and Adjustment Chart pages with this real or assumed data. To complete this se nust develop unit(s) of comparison for each comparable sale, using those unit(s) appropriate to your market, e.g., $ per square foot/metre, $ per frontage foot/metre, etc. Where more than one unit of comparison is used, you must reconcile these into a single estimate of land value. You are required to discuss and justify your adjustments to land value. You are allowed to make assumptions as to reasonable adjustments, rather than requiring in-depth market evidence for all adjustments. OPTIONAL: you may demonstrate the process for adjustments, using assumed data if necessary. For example, you may wish to show how you would use paired sales analysis to determine an adjustment for location or size. OPTIONAL: If you wish to carry out a simple residual analysis to extract the land value of improved sales, you may do so: i. find three to five comparable improved property sales (these can be the same comparables as used in the Direct Comparison Approach). ii. determine depreciated value of improvements of comparable (a simple analysis will suffice). iii. subtract depreciated improvement value from sale price to obtain the residual land sale price. Cost Approach: Land Value, Adjustment Chart, Adjustment Analysis, and Reconciliation (BUSI 330.12-15) You must estimate the land value of your subject property, so that you are able to complete the cost approach to value. This site is to be valued consistent with its determined highest & best use as if vacant. Students should ideally make an attempt to justify the land value using some market data and show their analysis as to how they arrived at the adjustments. However, in this section of this project, you are allowed to make some assumptions that would not be allowed in a real appraisal report or demonstration report. To estimate land value, you are to complete ONE of the following three options. Whichever option you choose, you are expected to describe your reasoning and analysis, in order to demonstrate that you have done some degree of research - it is not sufficient to simply give a number. Also, whichever option is completed, you must fill in the Subject" column on the Cost Approach - Land Value pages. COMPLETE ONE OF THE FOLLOWING LAND VALUATION OPTIONS: 1. Use the land value data for the subject property from your local property tax assessment office, if this information is available. Summarize your findings on the Cost Approach - Land Value, Reconciliation" page. Discuss the appropriateness of using assessed value as a proxy for the site's market value in an appraisal, commenting on the basis for assessed values and how current these assessed values are. In commenting on this, you should discuss how assessments are carried out, the title of local Assessment Act, what type of value" is found, etc. ton, you OR 2. Estimate land value based on discussions with real estate appraisers, brokers, or developers in your area. Summarize your findings on the "Cost Approach - Land Value, Reconciliation" page. You MUST explain who you talked to, their area of expertise, and what evidence they used to come up with this estimate, e.g., justify why their opinion is valid and reliable. Discuss the appropriateness (strengths and weaknesses) of estimating the site's market value in this manner. OR 3. Estimate land value by finding and analyzing three land sales comparables. If you are unable to find sufficient land sales, then you can rely on listings or you can assume some data based on your local market. You are NOT expected to extract land values from improved sales. You should fill in the Data Chart and Adjustment Chart pages with this real or assumed data. To complete this se nust develop unit(s) of comparison for each comparable sale, using those unit(s) appropriate to your market, e.g., $ per square foot/metre, $ per frontage foot/metre, etc. Where more than one unit of comparison is used, you must reconcile these into a single estimate of land value. You are required to discuss and justify your adjustments to land value. You are allowed to make assumptions as to reasonable adjustments, rather than requiring in-depth market evidence for all adjustments. OPTIONAL: you may demonstrate the process for adjustments, using assumed data if necessary. For example, you may wish to show how you would use paired sales analysis to determine an adjustment for location or size. OPTIONAL: If you wish to carry out a simple residual analysis to extract the land value of improved sales, you may do so: i. find three to five comparable improved property sales (these can be the same comparables as used in the Direct Comparison Approach). ii. determine depreciated value of improvements of comparable (a simple analysis will suffice). iii. subtract depreciated improvement value from sale price to obtain the residual land sale price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started