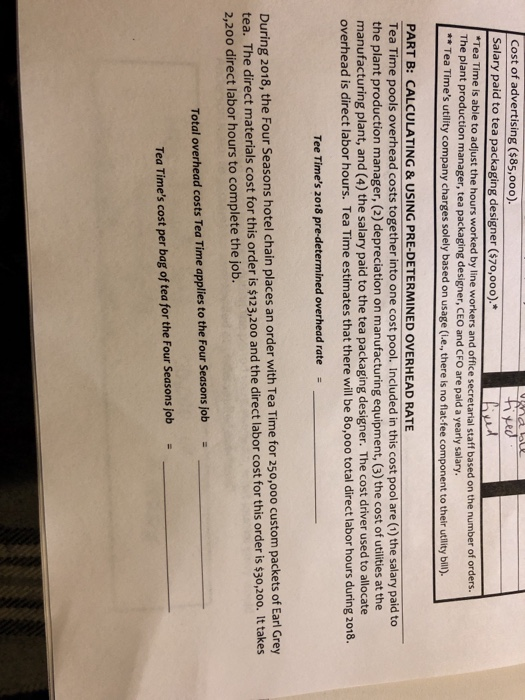

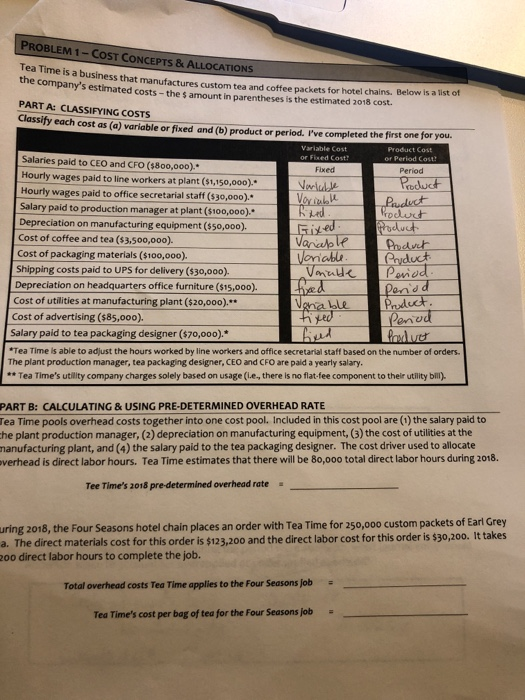

Cost of advertising ($85,000). Salary paid to tea packaging designer ($70,000).* Tea Time is able to adjust the hours worked by line workers and office secretarial staff based on the number of orders. The plant production manager, tea packaging designer, CEO and CFO are paid a yearly salary ** Tea Time's utility company charges solely based on usage (i.e., there is no flat-fee component to their utility bill). PART B: CALCULATING&USING PRE-DETERMINED OVERHEAD RATE Tea Time pools overhead costs together into one cost pool. Included in this cost pool are (1) the salary paid to the plant production manager, (2) depreciation on manufacturing equipment, (3) the cost of utilities at the manufacturing plant, and (4) the salary paid to the tea packaging designer. The cost driver used to allocate overhead is direct labor hours. Tea Time estimates that there will be 80,000 total direct labor hours during 2018. Tee Time's 2018 pre-determined overhead rate During 2018, the Four Seasons hotel chain places an order with Tea Time for 250,000 customp tea. The direct materials cost for this order is $123,200 and the direct labor cost for this order is $30,200. It takes 2,200 direct labor hours to complete the job. ackets of Earl Grey Total overhead costs Tea Time applies to the Four Seasons job Tea Time's cost per bag of tea for the Four Seasons job PROBLEM 1-COST CONCEPTS & ALLOCATIONS Tea the Time is a business that company's estimated costs manufactures custom tea and coffee packets for hotel chains. Below is a list of -the s amount in parentheses is the estimated 2018 cost. PART A: CLASSIFYING COSTS Classify each cost as (a) variable or fixed and (b) product or period. I've completed the first one for you Salaries paid to CEO and CFO ($800,000).* Hourly wages paid to line workers at plat (s 1,150,000."- Hourly wages paid to office secretarial staff (s30,000). Salary paid to production manager at plant ($100,000). Depreciation on manufacturing equipment ($50,00o) Cost of coffee and tea ($3,500,0oo). Cost of packaging materials ($10o,o00). Shipping costs paid to UPS for delivery ($30,000). Depreciation on headquarters office furniture ($15,000). Cost of utilities at manufacturing plant ($20,000).* Fixed Period Nerul).- ed ed anap enod ale Penvd Cost of advertising ($85,000). Salary paid to tea packaging designer ($7o,000).* Tea Time is able to adjust the hours worked by line workers and office secretarial staff based on the number of orders. The plant production manager, tea packaging designer, CEO and CFO are paid a yearly salary ** Tea Time's utility company charges solely based on usage (le-, there is no flat-fee component to their utility bill). PART B: CALCULATING&USING PRE-DETERMINED OVERHEAD RATE Tea Time pools overhead costs together into one cost pool. Included in this cost pool are (1) the salary paid to he plant production manager, (2) depreciation on manufacturing equipment, (3) the cost of utilities at the manufacturing plant, and (4) the salary paid to the tea packaging designer. The cost driver used to allocate verhead is direct labor hours. Tea Time estimates that there will be 80,000 total direct labor hours during 2018 Tee Times 2018 predetermined overhead rate uring 2018, the Four Seasons hotel chain places an order with Tea Time for 250,000 custom packets of Earl Grey a. The direct materials cost for this order is $123,200 and the direct labor cost for this order is $30,200. It takes 2o0 direct labor hours to complete the job. Total overhead costs Tea Time applies to the Four Seasons job Tea Time's cost per bag of tea for the Four Seasons job