Question

As of late 2019, Toyota Motor Corporation has twelve engineering and manufacturing facilities in the United States. Recently, Toyota has been considering expanding the production

As of late 2019, Toyota Motor Corporation has twelve engineering and manufacturing facilities in the United States. Recently, Toyota has been considering expanding the production of their gas- electric hybrid drive systems in the U.S. To enable the expansion, they are contemplating investing $1.5 billion at the end of 2021 (Year 0) in a new plant with an expected 10-year life. In the meantime, they also need to invest $30 million upfront in net working capital before the production can take place.

The projected financials of the new project for the Year 1 operation (2022) are as follows:

Earnings before interest and taxes (EBIT): Depreciation expense:

Increase in net working capital:

$170 million $150 million $40 million

The anticipated unlevered free cash flows from the new plant will grow by 5% for each of the next two years (Years 2 and 3) and then 2% per year for the remaining seven years. As a newly hired MBA in the capital budgeting division, you have been asked to evaluate the new project using the WACC method. You will estimate the cash flows and compute the appropriate cost of capital and the net present values. Assume that Toyota’s corporate tax rate is 21%.

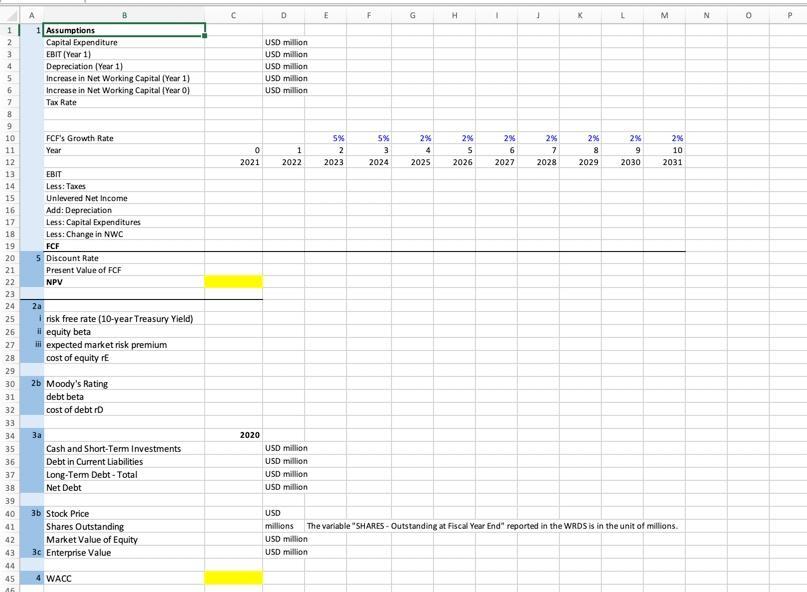

Question: In the sheet “Toyota's cost of capital”, estimate the project’s unlevered free cash flows from Year 0 to Year 10 (or equivalently from Year 2021 to 2031, the end year of the project). **Please show excel formulas as well.**

B C D E F G H K L M N 0 2021 1 5% 2 5% 3 2% 4 2% 2% 2% 2% 2% 2% S 2022 2023 2024 2025 2026 6 2027 7 2028 8 2029 9 2030 10 2031 A 1 2 1 Assumptions Capital Expenditure USD million 3 EBIT (Year 1) USD million 4 Depreciation (Year 1) USD million 5 Increase in Net Working Capital (Year 1) USD million 6 7 Increase in Net Working Capital (Year 0) Tax Rate USD million 8 9 10 FCF's Growth Rate 11 Year 12 13 EBIT 14 Less: Taxes 15 Unlevered Net Income 16 Add: Depreciation 17 Less: Capital Expenditures 18 19 20 21 22 Less: Change in NWC FCF 5 Discount Rate Present Value of FCF NPV 23 24 2a 25 26 27 28 29 30 31 debt beta 32 irisk free rate (10-year Treasury Yield) ii equity beta iii expected market risk premium cost of equity re 2b Moody's Rating cost of debt rD 33 34 35 Cash and Short-Term Investments 36 Debt in Current Liabilities 2020 USD million USD million 37 Long-Term Debt - Total 38 Net Debt 39 40 3b Stock Price 41 Shares Outstanding 42 Market Value of Equity 43 3c Enterprise Value USD million 44 45 4 WACC USD million USD million USD millions USD million The variable "SHARES-Outstanding at Fiscal Year End" reported in the WRDS is in the unit of millions. P

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Lets break down the steps you need to take to solve this case study Part I Toyotas Hybrid Drive Systems 1 Unlevered Free Cash Flows FCF Use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started