Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COST OF EQUITY will remain at 7.44%!!!! The senior management of Fold's Ltd. (Fold's) is anticipating a change to its capital structure. The interest cost

COST OF EQUITY will remain at 7.44%!!!!

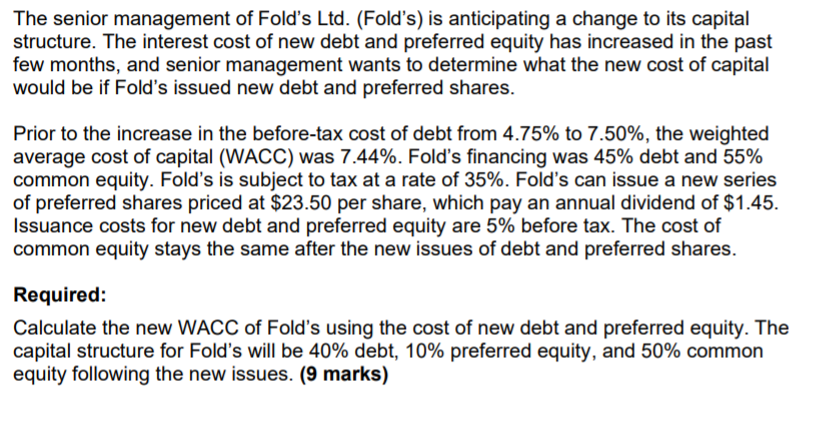

The senior management of Fold's Ltd. (Fold's) is anticipating a change to its capital structure. The interest cost of new debt and preferred equity has increased in the past few months, and senior management wants to determine what the new cost of capital would be if Fold's issued new debt and preferred shares. Prior to the increase in the before-tax cost of debt from 4.75% to 7.50%, the weighted average cost of capital (WACC) was 7.44%. Fold's financing was 45% debt and 55% common equity. Fold's is subject to tax at a rate of 35%. Fold's can issue a new series of preferred shares priced at $23.50 per share, which pay an annual dividend of $1.45. Issuance costs for new debt and preferred equity are 5% before tax. The cost of common equity stays the same after the new issues of debt and preferred shares. Required: Calculate the new WACC of Fold's using the cost of new debt and preferred equity. The capital structure for Fold's will be 40% debt, 10% preferred equity, and 50% common equity following the new issues. (9 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started