Question

Cost of Goods Sold Budget For the month of June Beg. FG inventory June 1 $974 (500+$474) DM Used $2,326 DML $8,620 MOH $2,657 Total

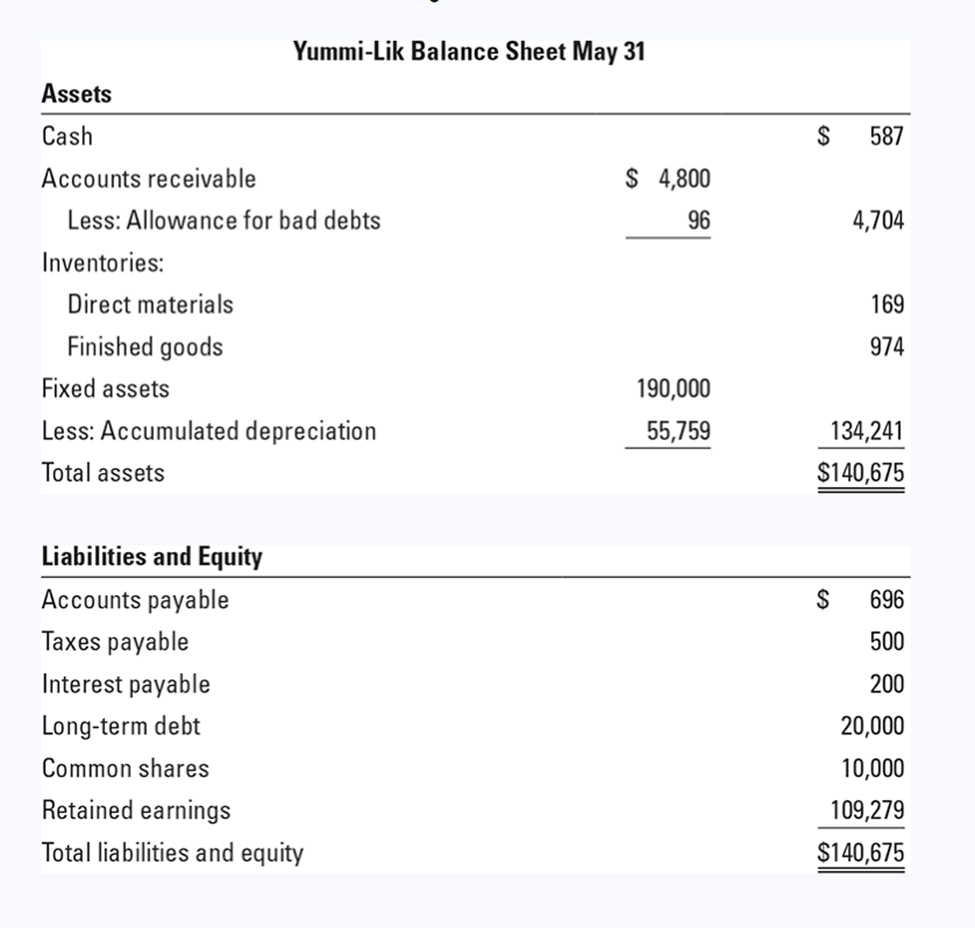

Cost of Goods Sold Budget For the month of June Beg. FG inventory June 1 $974 (500+$474) DM Used $2,326 DML $8,620 MOH $2,657 Total of Cost of goods manufactured $13,603 Cost of goods available for sale $14,577 Less: ending FG inventory June 30 ($1,326) COGS $13,251 Grant knows that 80% of sales are on account, of which half are collected in the month of the sale, 49% are collected the following month, and 1% are never collected and written off as bad debts, which has an impact on net revenues. In addition to this, all purchases of materials are on account. Yummi-Lik pays for 70% of purchases in the month of purchase and 30% in the following month. However, all other costs are paid in the month incurred. Knowing this, Grant must create. Required 2. A cash budget for Yummi-Lik for June 3. budgeted balance sheet for Yummi-Lik as of June 30 The following information is necessary: 1. Yummi-Liks balance sheet for May 31 follows. Use it and the following information to prepare a cash budget for Yummi-Lik for June. 2. Yummi-Lik is making monthly interest payments of 1% (12% per year) on a $20,000 long-term loan. 3. Yummi-Lik plans to pay the $500 of taxes owed as of May 31 in the month of June. Income tax expense for June is zero. 4. 40% of processing and setup costs, and 30% of marketing and general administration costs, are depreciation.

Yummi-Lik Balance Sheet May 31 Assets \begin{tabular}{|c|c|c|} \hline Cash & & 587 \\ \hline Accounts receivable & $4,800 & \\ \hline Less: Allowance for bad debts & 96 & 4,704 \\ \hline \multicolumn{3}{|l|}{ Inventories: } \\ \hline Direct materials & & 169 \\ \hline Finished goods & & 974 \\ \hline Fixed assets & 190,000 & \\ \hline Less: Accumulated depreciation & 55,759 & 134,241 \\ \hline Total assets & & $140,675 \\ \hline \end{tabular} \begin{tabular}{lr} Liabilities and Equity & \\ \hline Accounts payable & $96 \\ Taxes payable & 500 \\ Interest payable & 200 \\ Long-term debt & 20,000 \\ Common shares & 10,000 \\ Retained earnings & 109,279 \\ Total liabilities and equity & $140,675 \end{tabular}

Yummi-Lik Balance Sheet May 31 Assets \begin{tabular}{|c|c|c|} \hline Cash & & 587 \\ \hline Accounts receivable & $4,800 & \\ \hline Less: Allowance for bad debts & 96 & 4,704 \\ \hline \multicolumn{3}{|l|}{ Inventories: } \\ \hline Direct materials & & 169 \\ \hline Finished goods & & 974 \\ \hline Fixed assets & 190,000 & \\ \hline Less: Accumulated depreciation & 55,759 & 134,241 \\ \hline Total assets & & $140,675 \\ \hline \end{tabular} \begin{tabular}{lr} Liabilities and Equity & \\ \hline Accounts payable & $96 \\ Taxes payable & 500 \\ Interest payable & 200 \\ Long-term debt & 20,000 \\ Common shares & 10,000 \\ Retained earnings & 109,279 \\ Total liabilities and equity & $140,675 \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started