Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost of Machinery Rs. 20 crore Less: Grant received Rs. 2 crore Cost of Machinery Rs. 18 crore Useful life of Machinery 9 years Depreciation

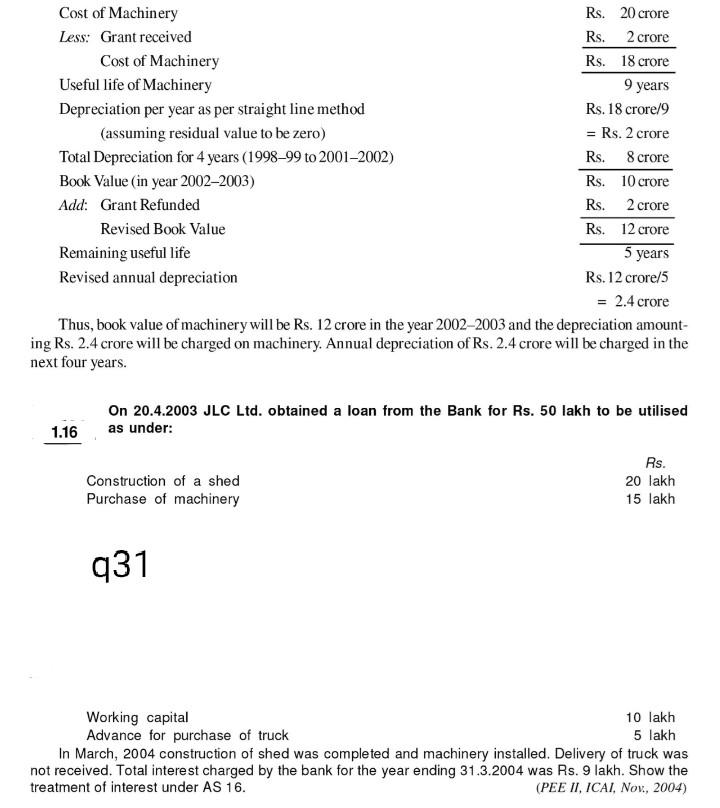

Cost of Machinery Rs. 20 crore Less: Grant received Rs. 2 crore Cost of Machinery Rs. 18 crore Useful life of Machinery 9 years Depreciation per year as per straight line method Rs. 18 crore/9 (assuming residual value to be zero) = Rs. 2 crore Total Depreciation for 4 years (199899 to 2001-2002) Rs. 8 crore Book Value (in year 20022003) Rs. 10 crore Add: Grant Refunded 2 crore Revised Book Value Rs. 12 crore Remaining useful life 5 years Revised annual depreciation Rs. 12 crore/5 = 2.4 crore Thus, book value of machinery will be Rs. 12 crore in the year 2002-2003 and the depreciation amount- ing Rs. 2.4 crore will be charged on machinery. Annual depreciation of Rs. 2.4 crore will be charged in the next four years. Rs. 1.16 On 20.4.2003 JLC Ltd. obtained a loan from the Bank for Rs. 50 lakh to be utilised as under: Rs. Construction of a shed 20 lakh Purchase of machinery 15 lakh 931 Working capital 10 lakh Advance for purchase of truck 5 lakh In March, 2004 construction of shed was completed and machinery installed. Delivery of truck was not received. Total interest charged by the bank for the year ending 31.3.2004 was Rs. 9 lakh. Show the treatment of interest under AS 16. (PEE II, ICAI, Nov, 2004)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started