Question

Cost of production reportfifo process costing method; joint products and by-product. The following data were gathered from the records of Rodomontade Company for February. Materials

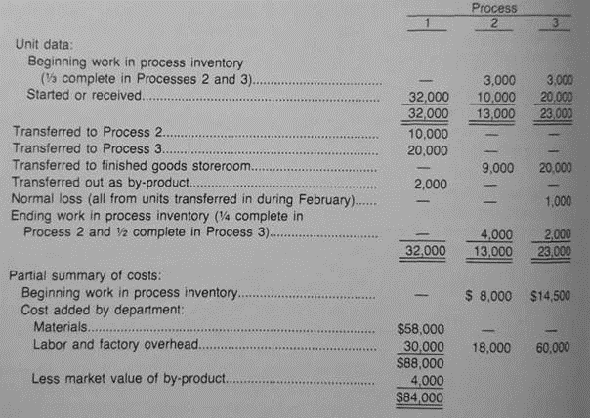

Cost of production reportfifo process costing method; joint products and by-product. The following data were gathered from the records of Rodomontade Company for February.

Materials are issued in Process 1. At the end of processing in Process 1, the by-product appears and the balance of production is transferred to Process 2 for additional processing of one main product and to Process 3 for additional processing of the other main product.

The joint cost of Process 1, less the market value of the by-product, is apportioned to the main products using the market value method at the split-off point. Sales prices for the finished products of Processes 2 and 3 are $10 and $15, respectively. The by-product sells for $2. The company uses the fifo costing method.

Required: Prepare a departmental cost of production report for February. (Carry unit cost computations to four decimal places and round off the adjusted cost from preceding department unit cost to the nearest cent.)

Unit data: Boginning work in process inventory (1/3 complete in Processes 2 and 3 ) Started or recelved. Transferred to Process 2. Transferred to Process 3. Transfered to finished goods storeroom. Ending work in process inventory ( 1/4 complete in Process 2 and 1/2 complete in Process 3) Partial summary of costs: Beginning work in process inventory. 32,00013,00023,0002,0004,000 Cost added by department: Materials. Labor and factory overhead. Less market value of by-product. $58,000$88,00030,000$8,00018,000$14,50060,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started