Answered step by step

Verified Expert Solution

Question

1 Approved Answer

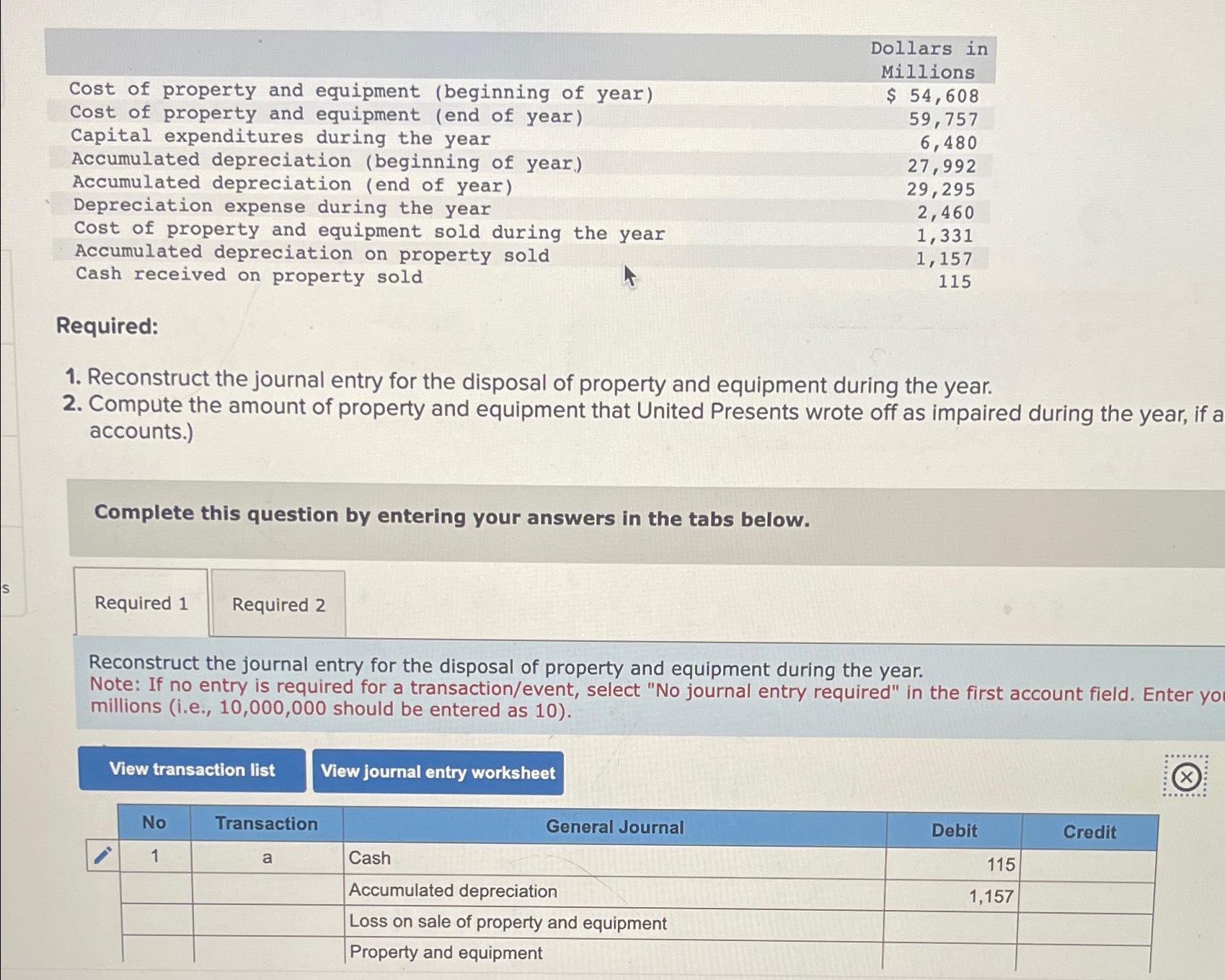

Cost of property and equipment (beginning of year) Cost of property and equipment (end of year) Capital expenditures during the year Dollars in Millions

Cost of property and equipment (beginning of year) Cost of property and equipment (end of year) Capital expenditures during the year Dollars in Millions $ 54,608 59,757 6,480 Accumulated depreciation (beginning of year) Accumulated depreciation (end of year) Depreciation expense during the year 27,992 29,295 2,460 Cost of property and equipment sold during the year Accumulated depreciation on property sold Cash received on property sold 1,331 1,157 115 Required: 1. Reconstruct the journal entry for the disposal of property and equipment during the year. 2. Compute the amount of property and equipment that United Presents wrote off as impaired during the year, if a accounts.) Complete this question by entering your answers in the tabs below. S Required 1 Required 2 Reconstruct the journal entry for the disposal of property and equipment during the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter you millions (i.e., 10,000,000 should be entered as 10). View transaction list View journal entry worksheet No Transaction General Journal 1 a Cash Accumulated depreciation Loss on sale of property and equipment Property and equipment Debit Credit 115 1,157

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started