Answered step by step

Verified Expert Solution

Question

1 Approved Answer

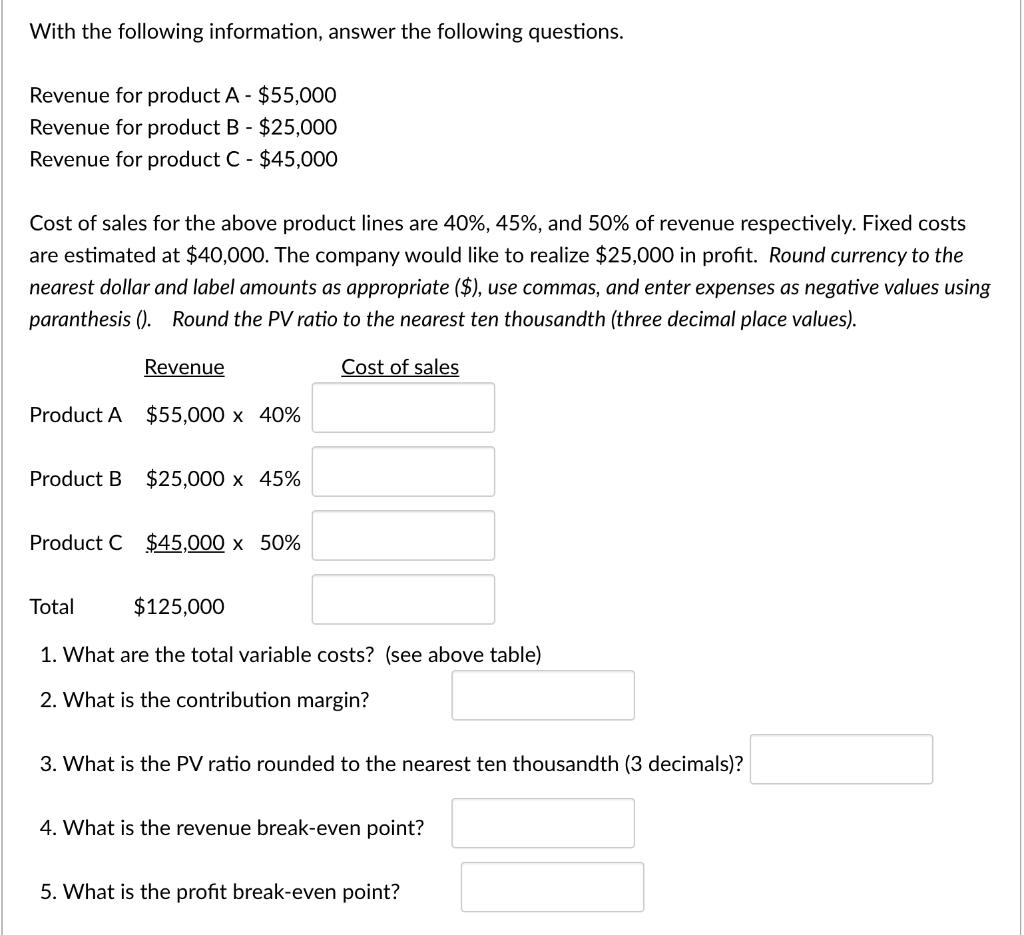

With the following information, answer the following questions. Revenue for product A - $55,000 Revenue for product B - $25,000 Revenue for product C

With the following information, answer the following questions. Revenue for product A - $55,000 Revenue for product B - $25,000 Revenue for product C - $45,000 Cost of sales for the above product lines are 40%, 45%, and 50% of revenue respectively. Fixed costs are estimated at $40,000. The company would like to realize $25,000 in profit. Round currency to the nearest dollar and label amounts as appropriate ($), use commas, and enter expenses as negative values using paranthesis (). Round the PV ratio to the nearest ten thousandth (three decimal place values). Revenue Cost of sales Product A $55,000 x 40% Product B $25,000 x 45% Product C $45,000 x 50% Total $125,000 1. What are the total variable costs? (see above table) 2. What is the contribution margin? 3. What is the PV ratio rounded to the nearest ten thousandth (3 decimals)? 4. What is the revenue break-even point? 5. What is the profit break-even point?

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of total Variable Cost Revenue Variable Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started