Answered step by step

Verified Expert Solution

Question

1 Approved Answer

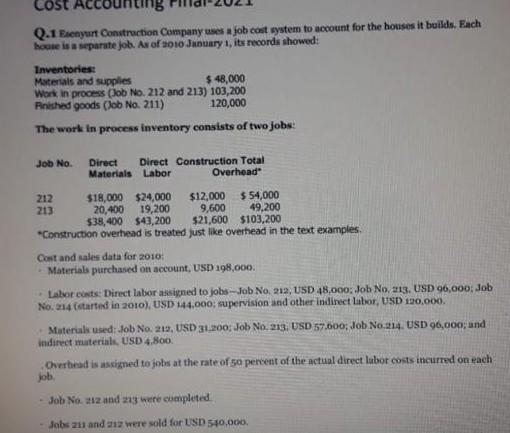

Cost Q.1 Esenyurt Construction Company uses a job cost system to account for the houses it builds. Each house is a separate job. As

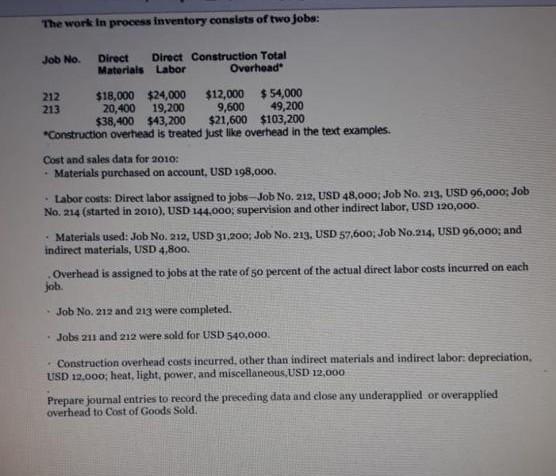

Cost Q.1 Esenyurt Construction Company uses a job cost system to account for the houses it builds. Each house is a separate job. As of 2010 January 1, its records showed: Inventories: Materials and supplies $ 48,000 Work in process (Job No. 212 and 213) 103,200 Finished goods (Job No. 211) 120,000 The work in process inventory consists of two jobs: Job No. Direct Direct Construction Total Materials Labor Overhead 212 213 $18,000 $24,000 $12,000 $ 54,000 49,200 20,400 9,600 $38,400 19,200 $43,200 $21,600 $103,200 "Construction overhead is treated just like overhead in the text examples. Cost and sales data for 2010: Materials purchased on account, USD 198,000. Labor costs: Direct labor assigned to jobs-Job No. 212, USD 48,000; Job No. 213. USD 96,000; Job No. 214 (started in 2010), USD 144,000; supervision and other indirect labor, USD 120,000. Materials used: Job No. 212, USD 31,200; Job No. 213, USD 57.600; Job No.214. USD 96,000; and indirect materials, USD 4,800. Overhead is assigned to jobs at the rate of 50 percent of the actual direct labor costs incurred on each job. - Job No. 212 and 213 were completed - Jobs 211 and 212 were sold for USD 540,000. The work in process inventory consists of two jobs: Job No. Direct Direct Construction Total Materials Labor Overhead $12,000 $54,000 9,600 49,200 $21,600 $103,200 *Construction overhead is treated just like overhead in the text examples. 212 213 $18,000 $24,000 20,400 19,200 $38,400 $43,200 Cost and sales data for 2010: - Materials purchased on account, USD 198,000. Labor costs: Direct labor assigned to jobs-Job No. 212, USD 48,000; Job No. 213, USD 96,000; Job No. 214 (started in 2010), USD 144,000; supervision and other indirect labor, USD 120,000. Materials used: Job No. 212, USD 31,200; Job No. 213, USD 57,600; Job No.214, USD 96,000; and indirect materials, USD 4,800. Overhead is assigned to jobs at the rate of 50 percent of the actual direct labor costs incurred on each job. Job No. 212 and 213 were completed. Jobs 211 and 212 were sold for USD 540,000. - Construction overhead costs incurred, other than indirect materials and indirect labor: depreciation. USD 12,000; heat, light, power, and miscellaneous,USD 12,000 Prepare journal entries to record the preceding data and close any underapplied or overapplied overhead to Cost of Goods Sold.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started