Question

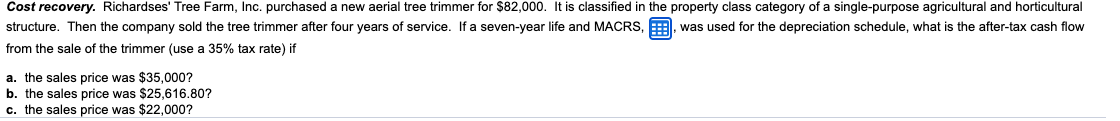

Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $82,000. It is classified in the property class category of a single-purpose

Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $82,000. It is classified in the property class category of a single-purpose agricultural and horticultural structure.

Year 3-Year 5-Year 7-Year 10-Year 1 33.33% 20.00% 14.29% 10.00% 2 44.45% 32.00% 24.49% 18.00% 3 14.81% 19.20% 17.49% 14.40% 4 7.41% 11.52% 12.49% 11.52% 5,,,,,,,,,,,,,,,,,, 11.52% 8.93% 9.22% 6 ,,,,,,,,,,,,,,,,,,,,,5.76% 8.93% 7.37% 7 ,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,8.93% 6.55% 8 ,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,4.45% 6.55% 9 ,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,6.55% 10 ...............................................6.55% 11 .................................. 3.28%

Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $82,000. It is classified in the property class category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS, was used for the depreciation schedule, what is the after-tax cash flow from the sale of the trimmer (use a 35% tax rate) if a. the sales price was $35,000? b. the sales price was $25,616.80? c. the sales price was $22,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started