Answered step by step

Verified Expert Solution

Question

1 Approved Answer

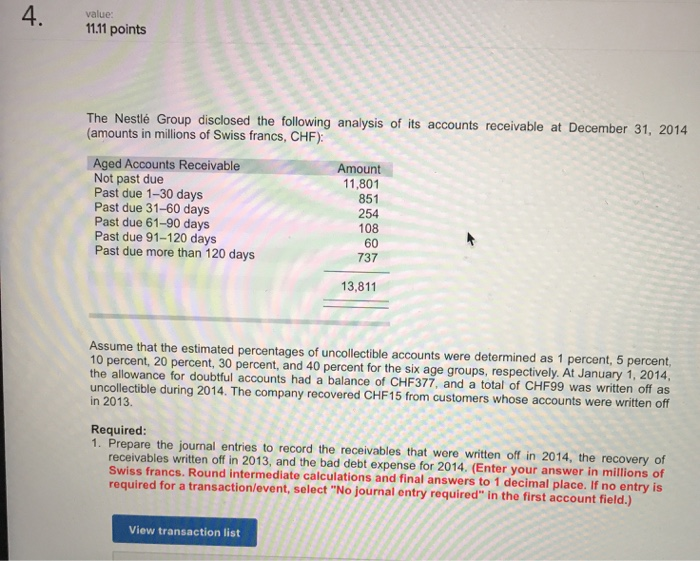

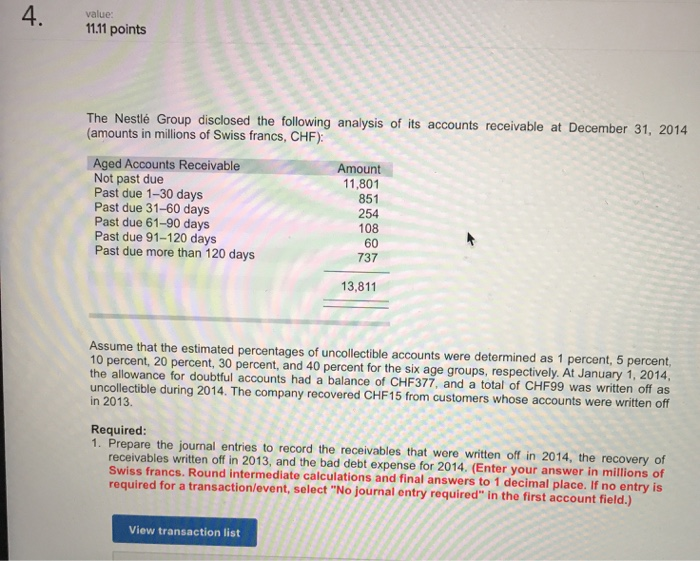

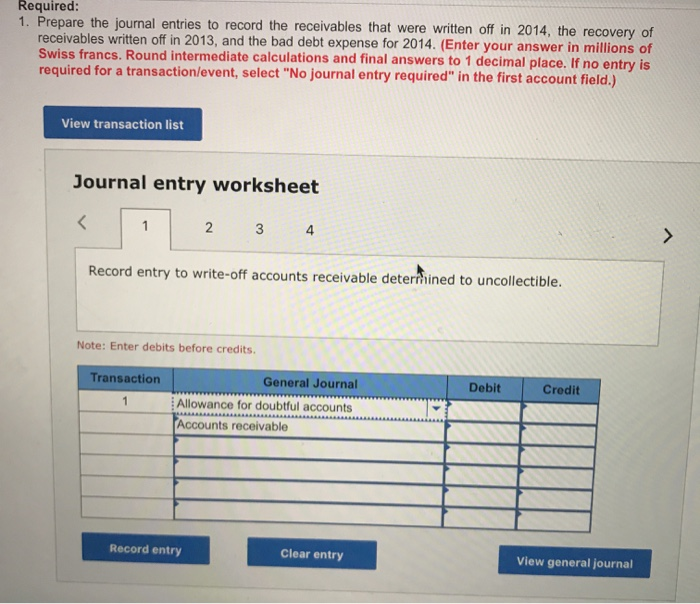

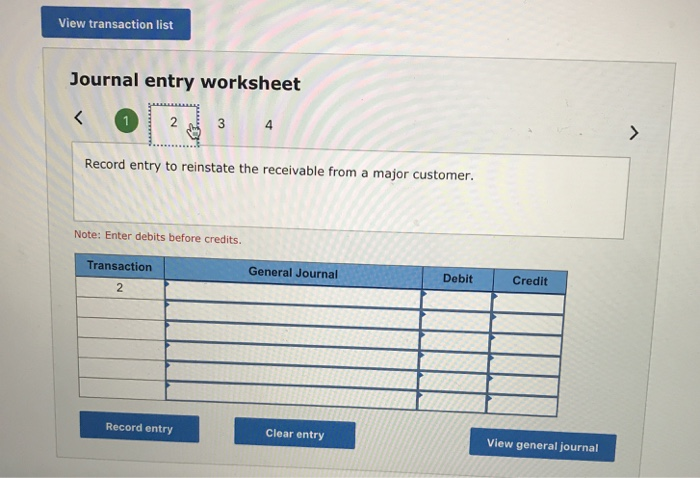

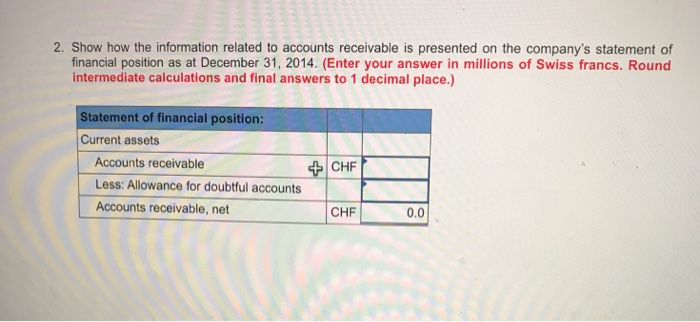

Could anyone explain this question to me? Thank you! value: 11.11 points The Nestl Group disclosed the following analysis of its accounts receivable at December

Could anyone explain this question to me? Thank you!

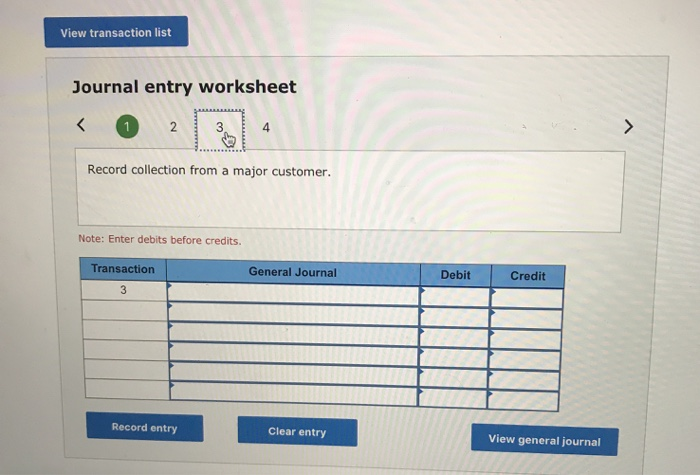

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

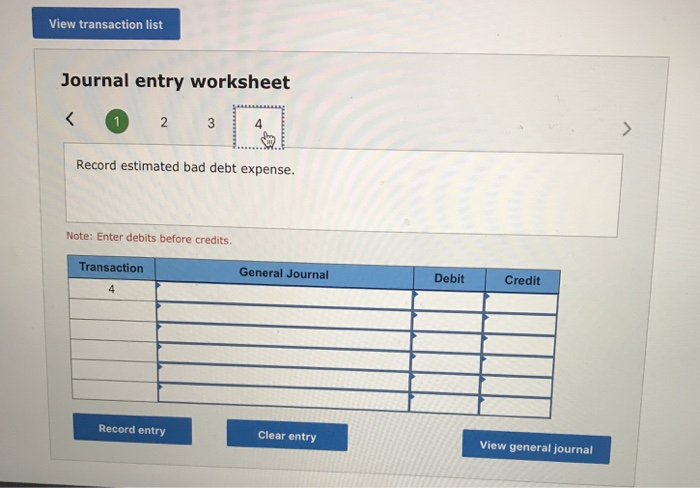

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started