Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could anyone please help me with these questions? Betaincorporated uses the time value of money when determining investments to make. In 10 years, they will

could anyone please help me with these questions?

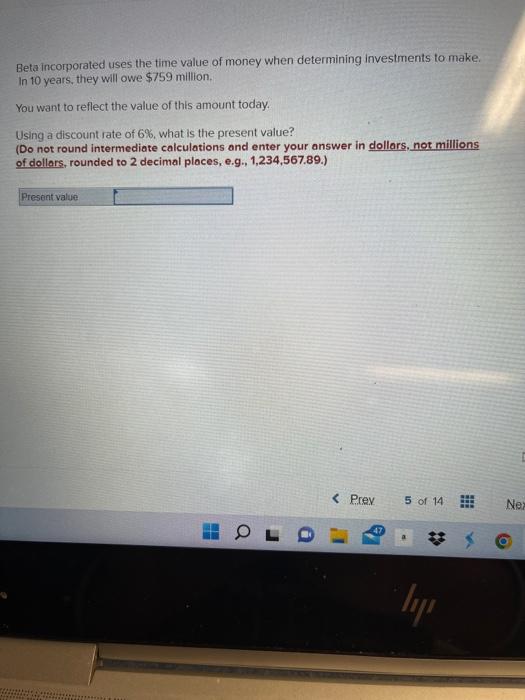

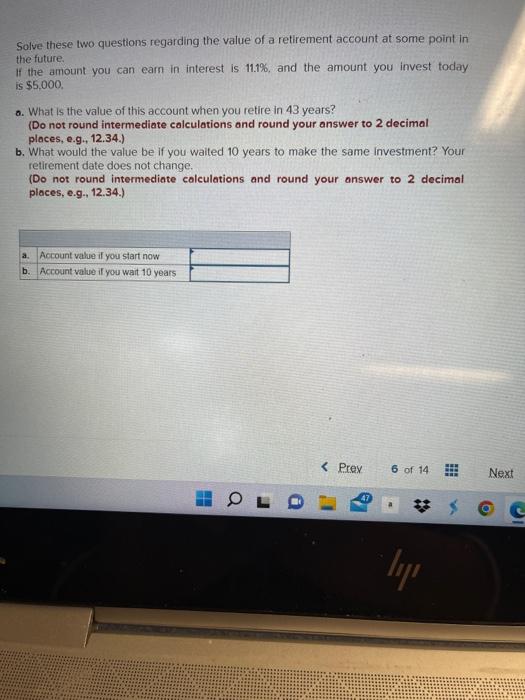

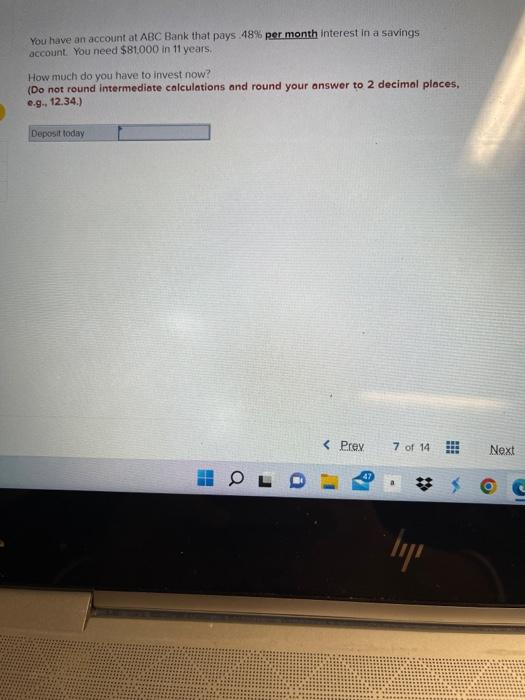

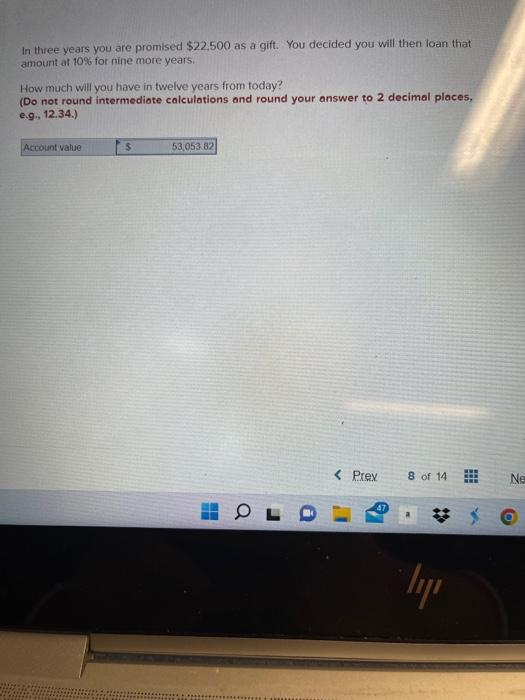

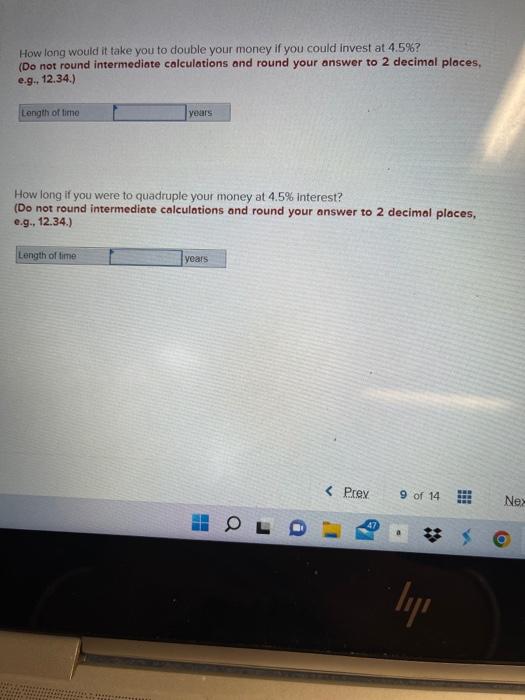

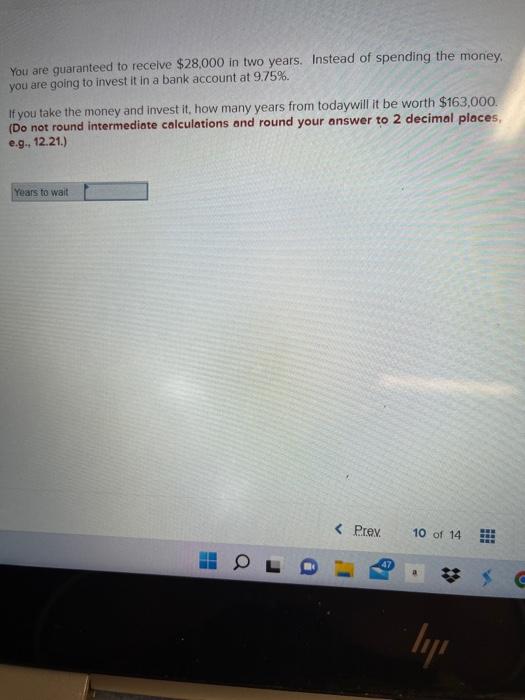

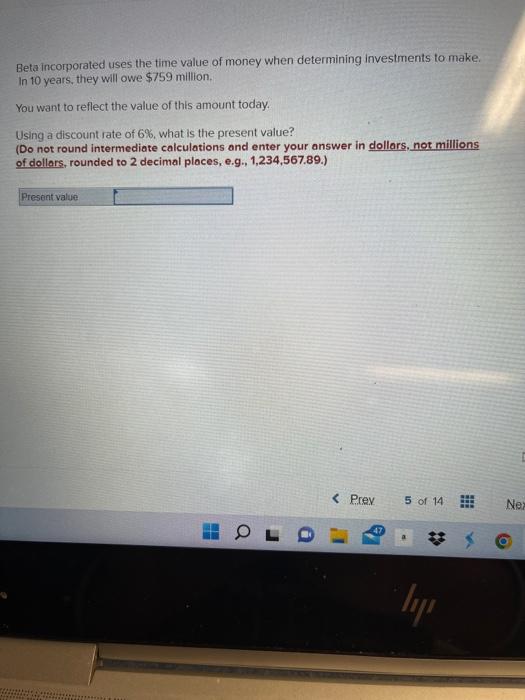

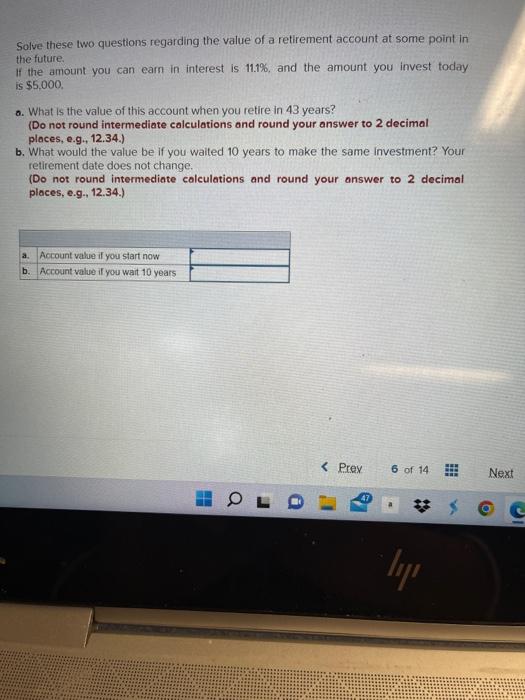

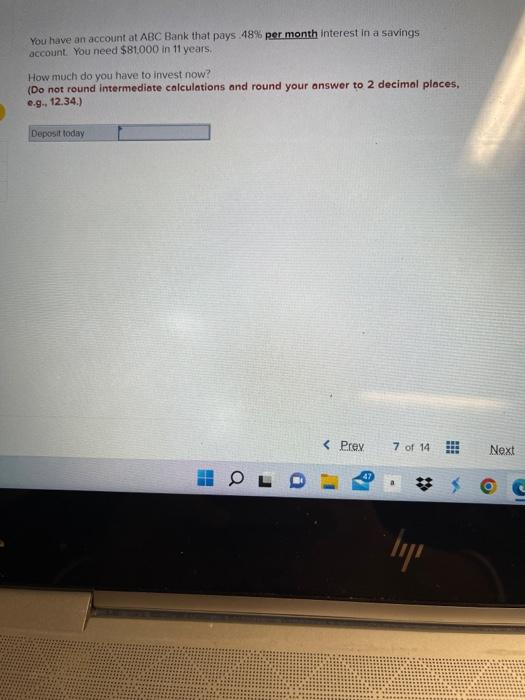

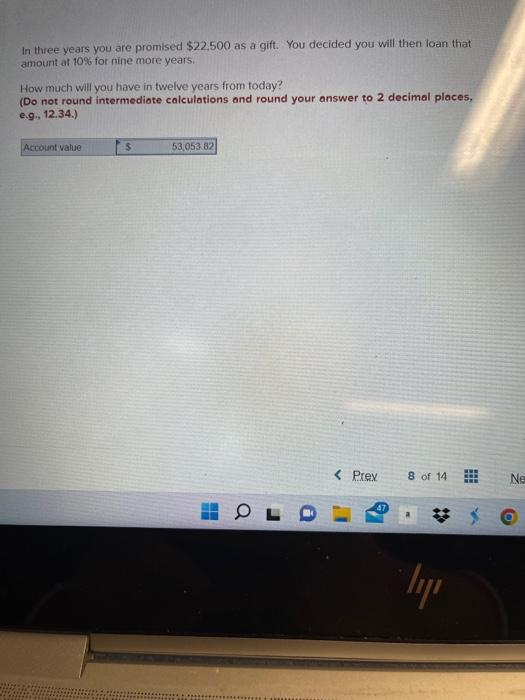

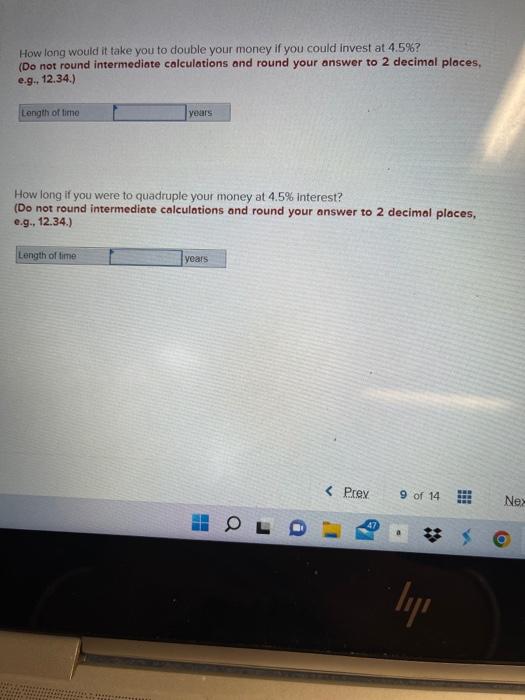

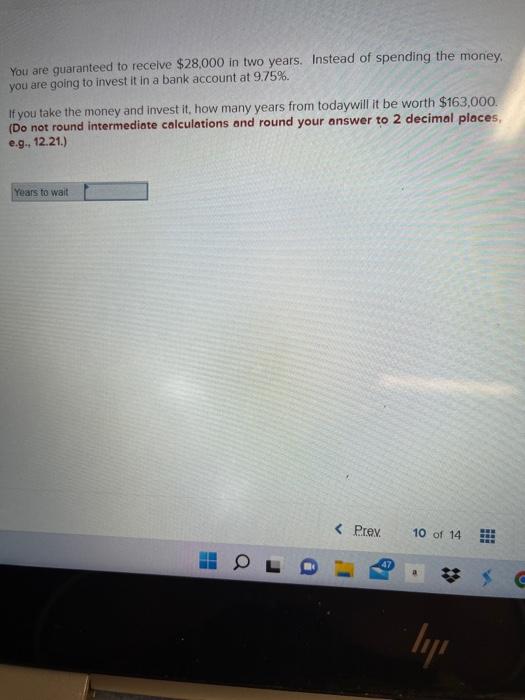

Betaincorporated uses the time value of money when determining investments to make. In 10 years, they will owe $759 million. You want to reflect the value of this amount today. Using a discount rate of 6%, what is the present value? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal ploces, e.g., 1,234,567.89.) Solve these two questions regarding the value of a retirement account at some point in the future. If the amount you can eam in interest is 11.1%, and the amount you invest today is $5.000. o. What is the value of this account when you retire in 43 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) b. What would the value be if you waited 10 years to make the same investment? Your retirement date does not change. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) You have an account at ABC Bank that pays 48% per month interest in a savings account. You need $81,000 in 11 years. How much do you have to invest now? (Do not round intermediate calculations and round your answer to 2 decimal places. e.g., 12.34.) In three years you are promised $22,500 as a gift. You decided you will then loan that amount at 10% for nine more years. How much will you have in twelve years from today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) How long would it take you to double your money if you could invest at 4.5%? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 12.34.) How long if you were to quadruple your money at 4.5% interest? (Do not round intermediate calculations and round your answer to 2 decimal places, e.9.12.34.) You are guaranteed to recelve $28,000 in two years. Instead of spending the money. you are going to invest it in a bank account at 9.75%. If you take the money and invest it, how many years from todaywill it be worth $163,000. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 12.21.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started