could help with q1 d and e

q2 a b c

q3 a and b

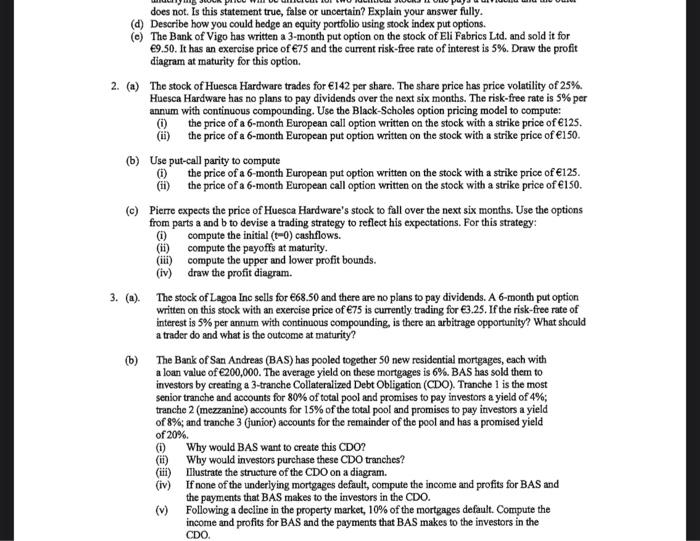

does not. Is this statement true, false or uncertain? Explain your answer fully. (d) Describe how you could bedge an equity portfolio using stock index put options. (c) The Bank of Vigo has written a 3-month put option on the stock of Eli Fabrics Ltd. and sold it for .50. It has an exercise price of 75 and the current risk-free rate of interest is 5%. Draw the profit diagram at maturity for this option. 2. (a) The stock of Huesca Hardware trades for 6142 per share. The share price has price volatility of 25%. Huesca Hardware has no plans to pay dividends over the next six months. The risk-free rate is 5% per annum with continuous compounding. Use the Black-Scholes option pricing model to compute: (i) the price of a 6-month European call option written on the stock with a strike price of 125. (ii) the price of a 6-month European put option written on the stock with a strike price of 150. (b) Use put-call parity to compute (i) the price of a 6-month European put option written on the stock with a strike price of 125. (ii) the price of a 6-month European call option written on the stock with a strike price of 150. (c) Pierre expects the price of Huesca Hardware's stock to fall over the next six months. Use the options from parts a and b to devise a trading strategy to reflect his expectations. For this strategy: (i) compute the initial (t=0) cashflows. (ii) compute the payoffs at maturity. (iii) compute the upper and lower profit bounds. (iv) draw the profit diagram. 3. (a). The stock of Lagoa Ine sells for 668.50 and there are no plans to pay dividends. A 6-month put option written on this stock with an exercise price of 75 is currently trading for 3.25. If the risk-free rate of interest is 5% per anmum with continuous compounding, is there an arbitrage opportunity? What should a trader do and what is the outcome at maturity? (b) The Bank of San Andreas (BAS) has pooled together 50 new residential mortgages, each with a loan value of 200,000. The average yield on these mortgages is 6%.BAS has sold them to investors by creating a 3-tranche Collateralized Debt Obligation (CDO). Tranche 1 is the most senior tranche and accounts for 80% of total pool and promises to pay investors a yield of 4%; tranche 2 (mezzanine) accounts for 15% of the total pool and promises to pay investors a yield of 8%; and tranche 3 (funior) accounts for the remainder of the pool and has a promised yield of 20%. (i) Why would BAS want to create this CDO ? (ii) Why would investors purchase these CDO tranches? (iii) Ilustrate the structure of the CDO on a diagram. (iv) If none of the underlying mortgages default, compute the inoome and profits for BAS and the payments that BAS makes to the investors in the CDO. (v) Following a decline in the property market, 10\% of the mortgages default. Compute the income and profits for BAS and the payments that BAS makes to the investors in the CDO