Answered step by step

Verified Expert Solution

Question

1 Approved Answer

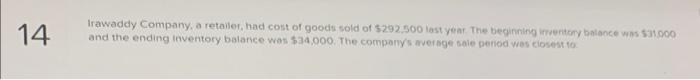

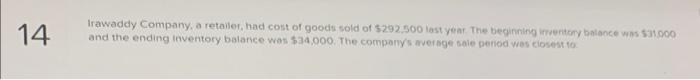

Could i get some help please! I will like/thimbs up the answer ! thanks ! and the ending invertory balarice waw 534,000 . The compary's

Could i get some help please!

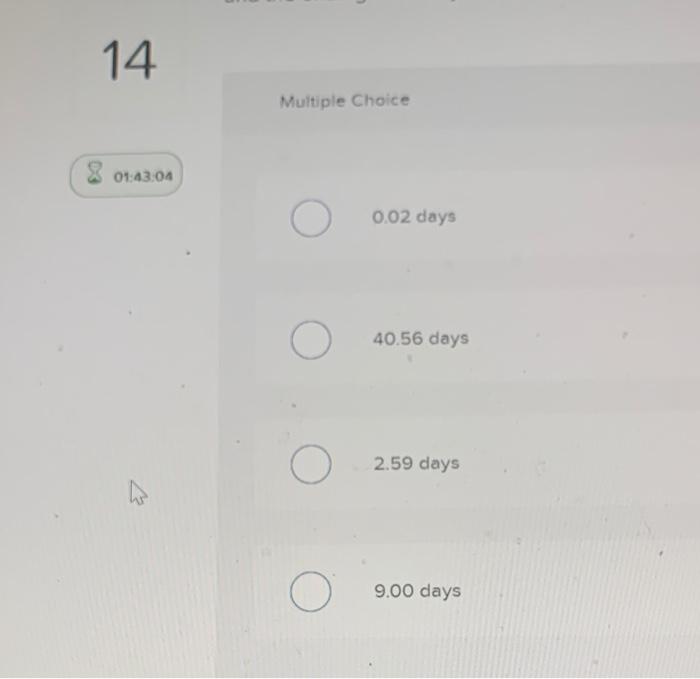

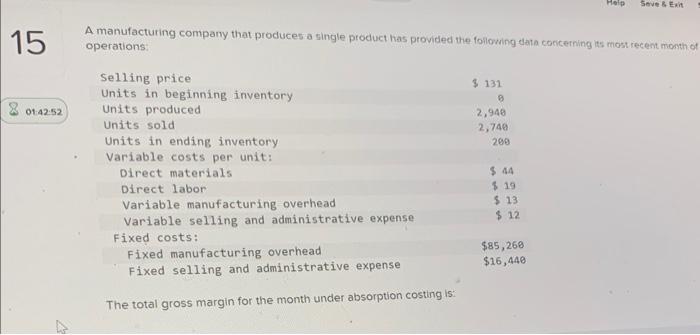

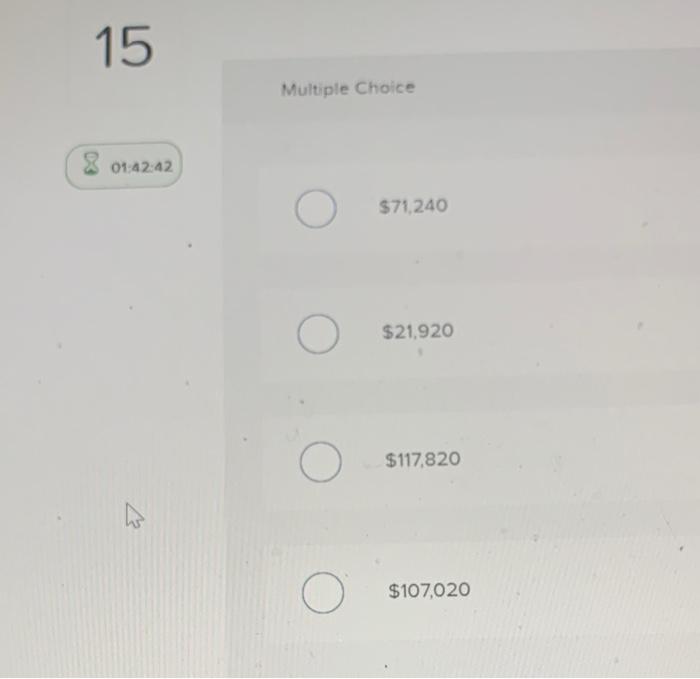

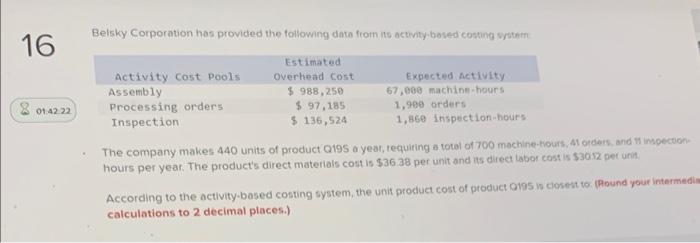

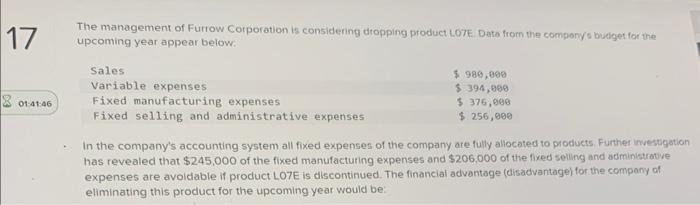

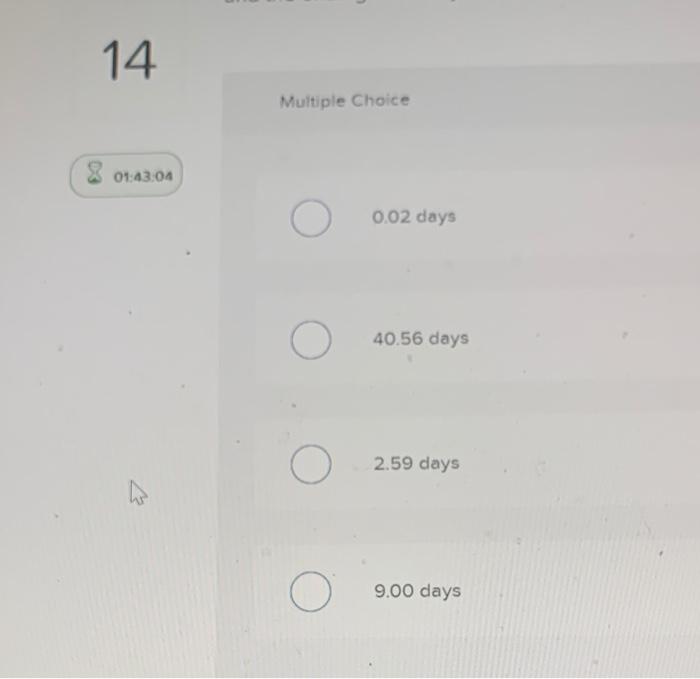

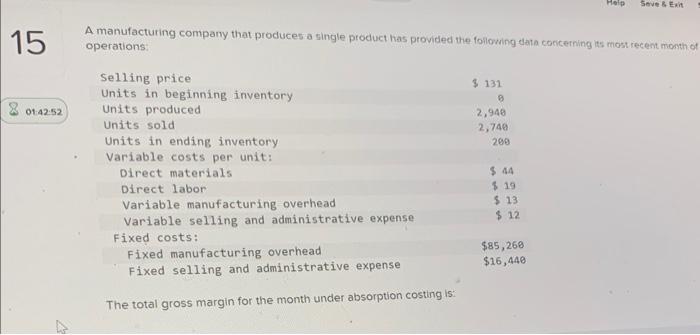

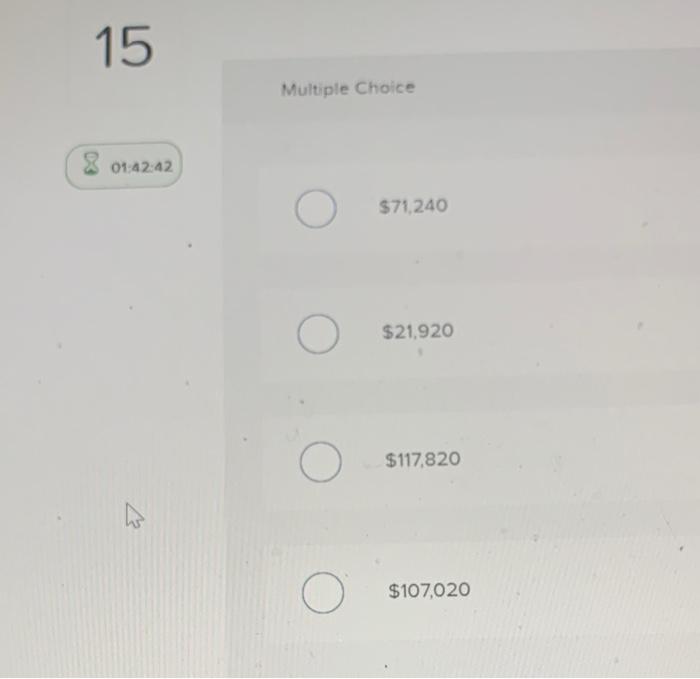

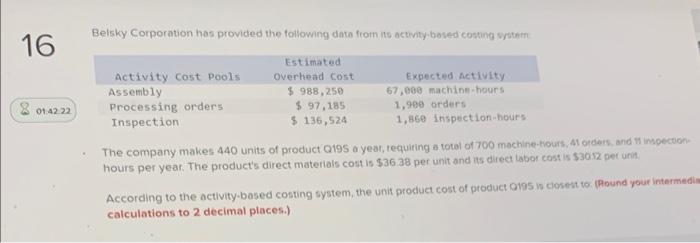

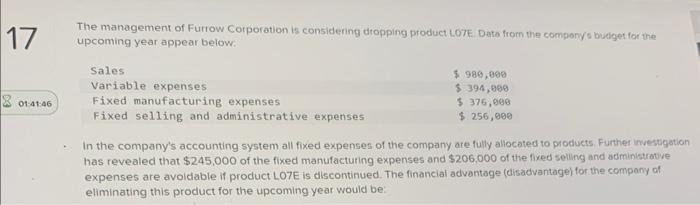

and the ending invertory balarice waw 534,000 . The compary's anersge saie perod yes eiosest to. Multiple Choice 0.02 days 40.56 days 2.59 days 9.00 days A manufacturing company that produces a single product has provided the following data concerning its most recent month Operations: The total gross margin for the month under absorption costing is: Multiple Choice $71,240 $21,920 $117,820 $107,020 The company makes 440 units of product Q19S a year, tequiring a total of 700 machine-tiours, A1 orders. and inspection: hours per year. The product's direct materials cost is $36.38 per unit and is direct labor cost is $302 pet unit). According to the activity-based costing system, the unit product cost of product 0195 in ciosest to (Pbund your intermed calculations to 2 decimal places.) Multiple Choice $96.57 per unit $88.15 per unit $66.50 per unit $94.95 per unit The management of Furrow Corporation is considening dropping product Lo7t Data from the compony's budget for the upcoming year appear below: In the company's accounting system all fixed expenses of the company are fully allocated to products. Further irvestgati has revealed that $245,000 of the fixed manufacturing expenses and $206,000 of the fixed seiling and administratve expenses are avoidable if product LO7E is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be: Multiple Choice $46,000 $(46,000) $135,000 $(135,000) I will like/thimbs up the answer !

thanks !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started