Answered step by step

Verified Expert Solution

Question

1 Approved Answer

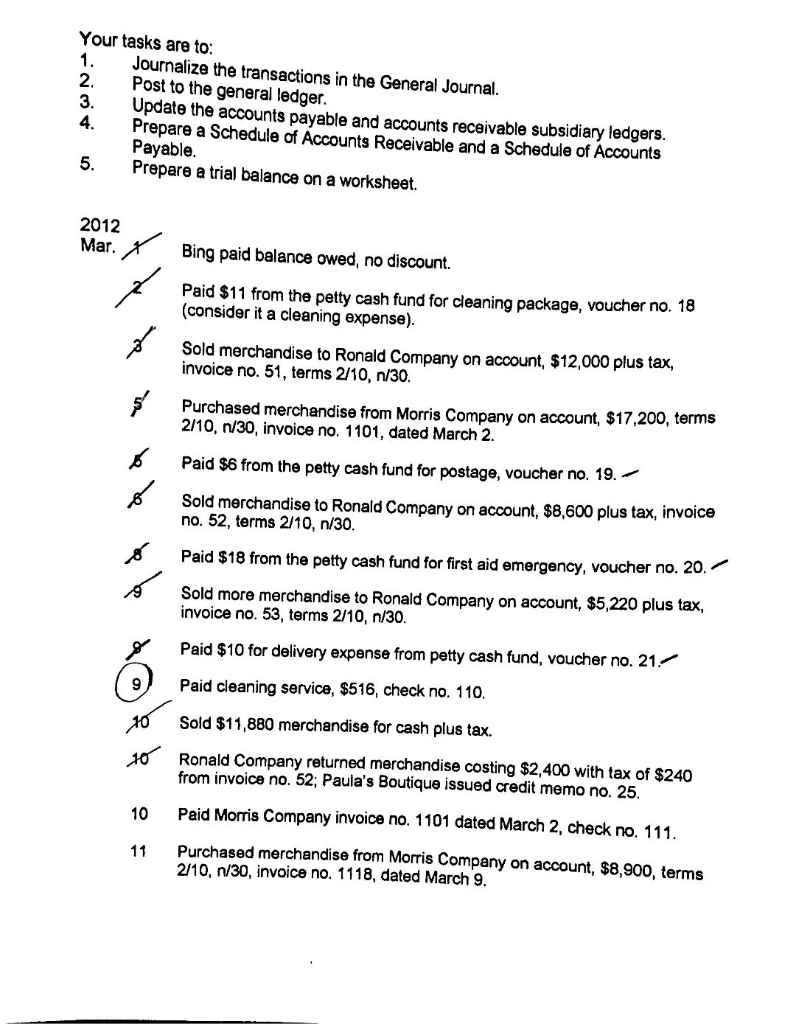

Could I get these journalized.. Thank you Especially the one's dated: March 10 (check no 111), March 14 (invoice no 52), March 18 (invoice no

Could I get these journalized.. Thank you

Especially the one's dated: March 10 (check no 111), March 14 (invoice no 52), March 18 (invoice no 51), March 23 (check no 114)

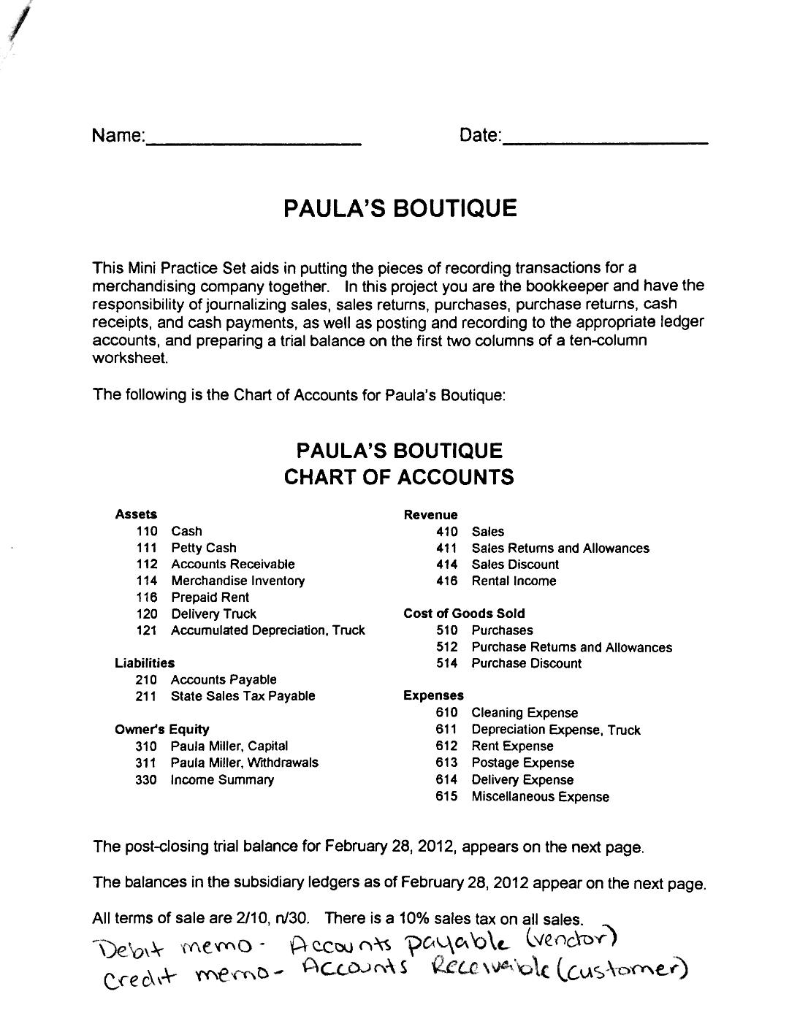

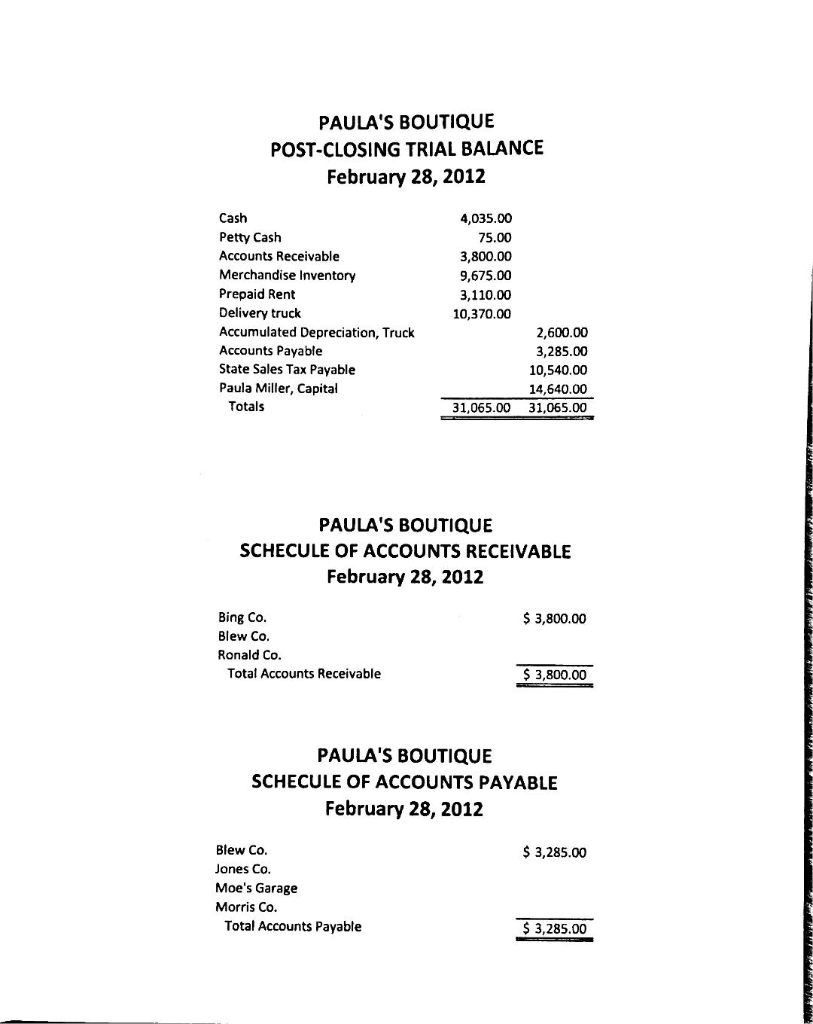

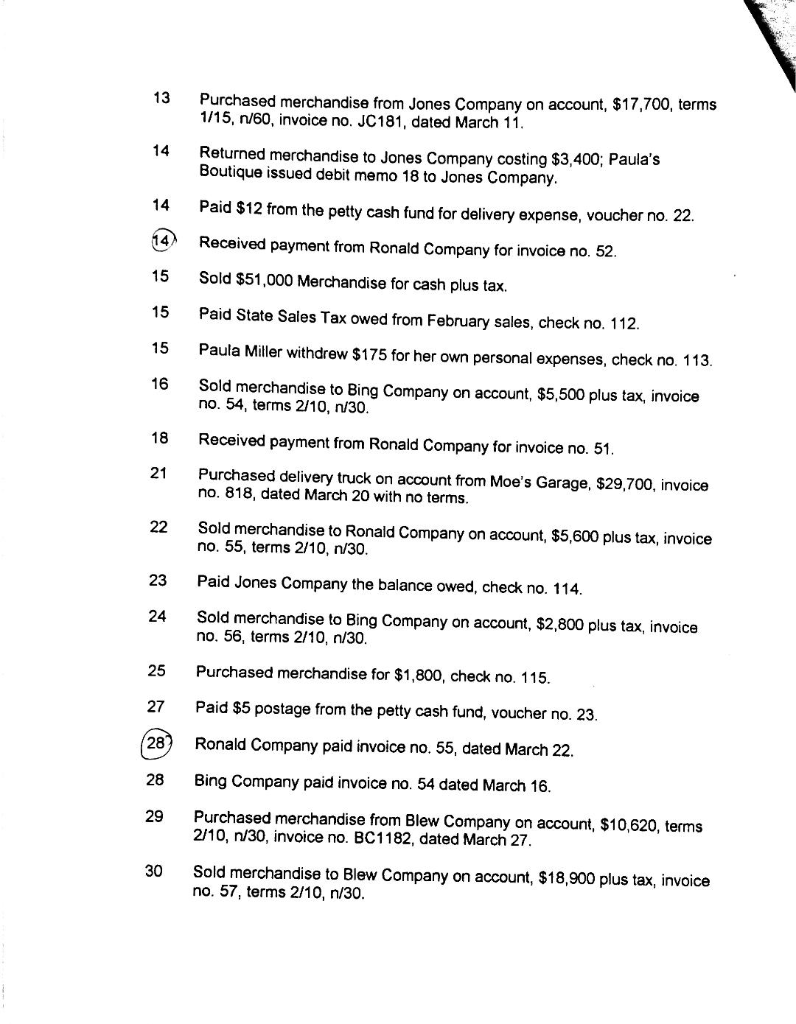

PAULA'S BOUTIQUE POST-CLOSING TRIAL BALANCE February 28, 2012 Cash Petty Cash Accounts Receivable Merchandise Inventory Prepaid Rent Delivery truck Accumulated Depreciation, Truck Accounts Payable State Sales Tax Payable Paula Miller, Capital Totals 4,035.00 75.00 3,800.00 9,675.00 3,110.00 10,370.00 2,600.00 3,285.00 10,540.00 14,640.00 31,065.00 31,065.00 PAULA'S BOUTIQUE SCHECULE OF ACCOUNTS RECEIVABLE February 28, 2012 $ 3,800.00 Bing Co. Blew Co. Ronald Co. Total Accounts Receivable $ 3,800.00 PAULA'S BOUTIQUE SCHECULE OF ACCOUNTS PAYABLE February 28, 2012 $ 3,285.00 Blew Co. Jones Co. Moe's Garage Morris Co. Total Accounts Payable $ 3,285.00 in Your tasks are to: Journalize the transactions in the General Journal. Post to the general ledger. Update the accounts payable and accounts receivable subsidiary ledgers. Prepare a Schedule of Accounts Receivable and a Schedule of Accounts Payable. Prepare a trial balance on a worksheet. w 2012 Mar. Bing paid balance owed, no discount. Paid $11 from the petty cash fund for cleaning package, voucher no. 18 (consider it a cleaning expense). Sold merchandise to Ronald Company on account, $12,000 plus tax, invoice no. 51, terms 2/10, n/30. Purchased merchandise from Morris Company on account. $17,200, terms 2/10, 1/30, invoice no. 1101, dated March 2. Paid $6 from the petty cash fund for postage, voucher no. 19. Sold merchandise to Ronald Company on account, $8,600 plus tax, invoice no. 52, terms 2/10, n/30. Paid $18 from the petty cash fund for first aid emergency, voucher no. 20. Sold more merchandise to Ronald Company on account, $5,220 plus tax, invoice no. 53, terms 2/10, n/30. Paid $10 for delivery expense from petty cash fund, voucher no. 21. Paid cleaning service, $516, check no. 110, Sold $11,880 merchandise for cash plus tax. to Ronald Company returned merchandise costing $2,400 with tax of $240 from invoice no. 52; Paula's Boutique issued credit memo no. 25. 10 Paid Morris Company invoice no. 1101 dated March 2, check no. 111. 11 Purchased merchandise from Morris Company on account, $8,900, terms 2/10, 1/30, invoice no. 1118, dated March 9. 13 Purchased merchandise from Jones Company on account, $17,700, terms 1/15, 1/60, invoice no. JC 181, dated March 11. Returned merchandise to Jones Company costing $3,400; Paula's Boutique issued debit memo 18 to Jones Company. Paid $12 from the petty cash fund for delivery expense, voucher no. 22. Received payment from Ronald Company for invoice no. 52. Sold $51,000 Merchandise for cash plus tax. Paid State Sales Tax owed from February sales, check no. 112. Paula Miller withdrew $175 for her own personal expenses, check no. 113. Sold merchandise to Bing Company on account, $5,500 plus tax, invoice no. 54, terms 2/10, 1/30. Received payment from Ronald Company for invoice no. 51. Purchased delivery truck on account from Moe's Garage, $29,700, invoice no. 818, dated March 20 with no terms. Sold merchandise to Ronald Company on account, $5,600 plus tax, invoice no. 55, terms 2/10, n/30. Paid Jones Company the balance owed, check no. 114. Sold merchandise to Bing Company on account, $2,800 plus tax, invoice no. 56, terms 2/10, n/30. Purchased merchandise for $1,800, check no. 115. Paid $5 postage from the petty cash fund, voucher no. 23. Ronald Company paid invoice no. 55, dated March 22. Bing Company paid invoice no. 54 dated March 16. 29 Purchased merchandise from Blew Company on account, $10,620, terms 2/10, n/30, invoice no. BC1182, dated March 27. 30 Sold merchandise to Blew Company on account, $18,900 plus tax, invoice no. 57, terms 2/10, n/30. 31 Purchased merchandise from Morris Company on account, $15,600, terms 2/10, n/30, invoice no. 1136, dated March 29. 31 Issued check no. 116 to replenish to the same level the petty cash fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started