Answered step by step

Verified Expert Solution

Question

1 Approved Answer

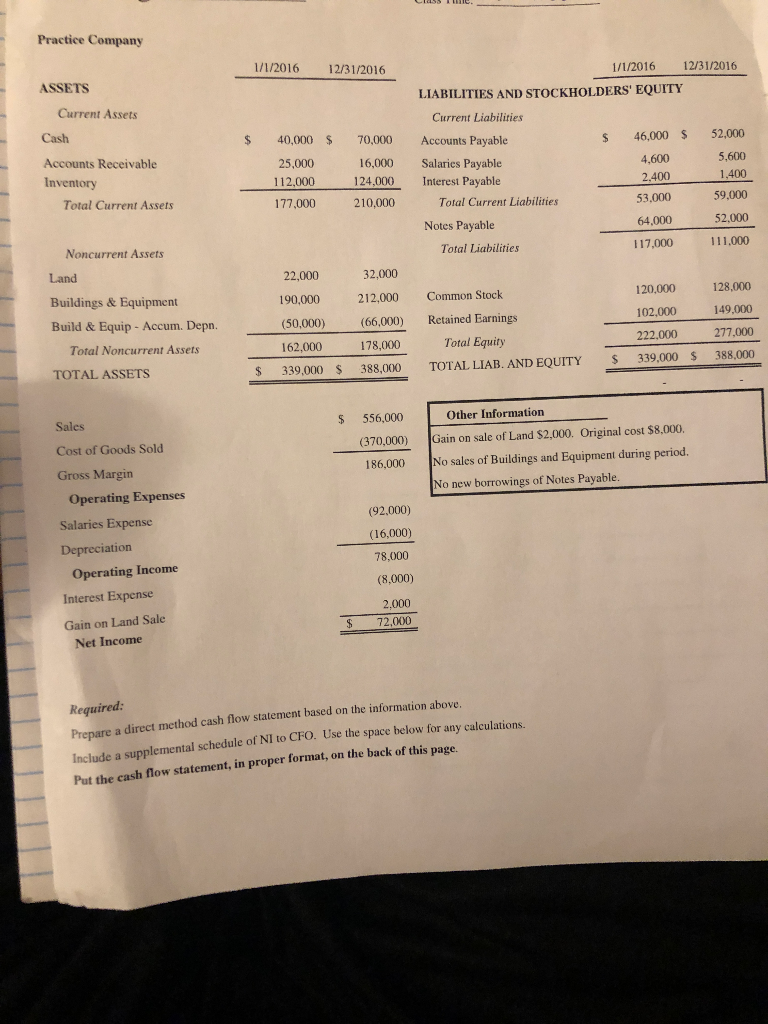

could i have please have help with the supplemental schedule of NI to CFO Practice Company 1/1/2016 12/31/2016 ASSETS 1/1/2016 12/31/2016 LIABILITIES AND STOCKHOLDERS' EQUITY

could i have please have help with the supplemental schedule of NI to CFO

Practice Company 1/1/2016 12/31/2016 ASSETS 1/1/2016 12/31/2016 LIABILITIES AND STOCKHOLDERS' EQUITY Current Assets Current Liabilities Cash $ $ $ 52,000 Accounts Receivable Inventory Total Current Assets 40,000 25,000 112,000 177,000 70,000 16,000 124,000 Accounts Payable Salaries Payable Interest Payable Total Current Liabilities Notes Payable Total Liabilities 46,000 4,600 2.400 53,000 64,000 117,000 5,600 1,400 59,000 52.000 210,000 111.000 128.000 149,000 Noncurrent Assets Land Buildings & Equipment Build & Equip - Accum. Depn. Total Noncurrent Assets TOTAL ASSETS 22,000 190,000 (50,000) 162,000 339,000 32,000 212,000 (66,000) 178,000 388,000 Common Stock Retained Earnings Total Equity TOTAL LIAB. AND EQUITY 120,000 102,000 222.000 339,000 $ 277,000 388,000 $ $ $ $ 556,000 (370,000) Sales Cost of Goods Sold Gross Margin Operating Expenses Other Information Gain on sale of Land $2,000. Original cost $8,000. No sales of Buildings and Equipment during period. No new borrowings of Notes Payable. 186,000 Salaries Expense Depreciation Operating Income (92.000) (16,000) 78,000 (8,000) Interest Expense 2.000 72.000 Gain on Land Sale Net Income Required: Prepare a direct method cash flow statement based on the information above. Include a supplemental se supplemental schedule of NI to CFO. Use the space below for any calculations. Put the cash flow statement, in proper format, on the back of this pageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started