Could I please get help on the entire problem?

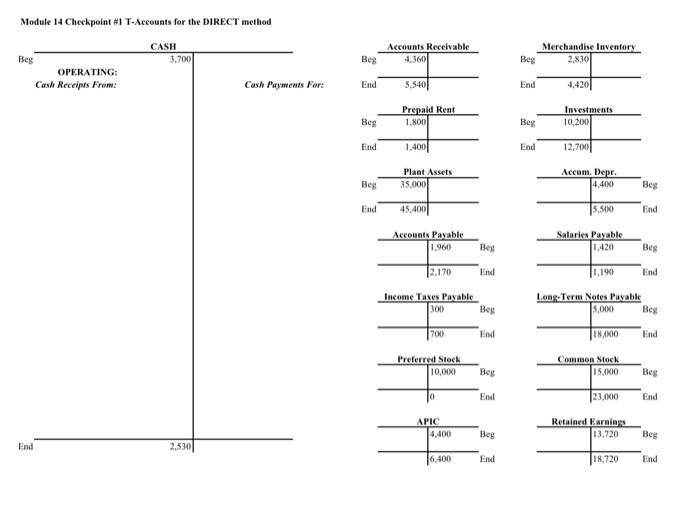

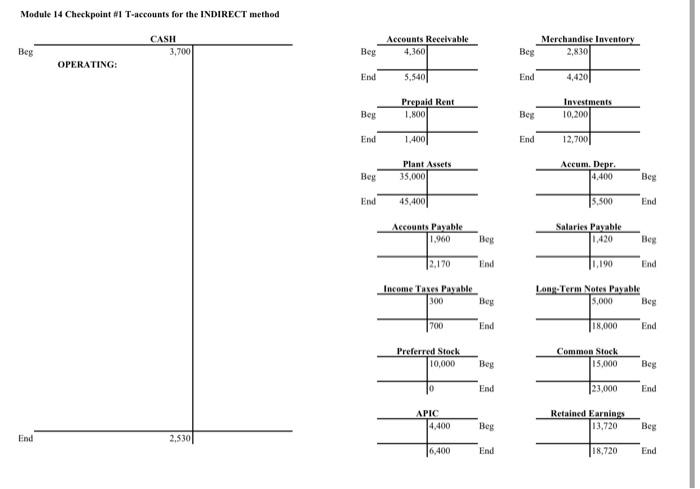

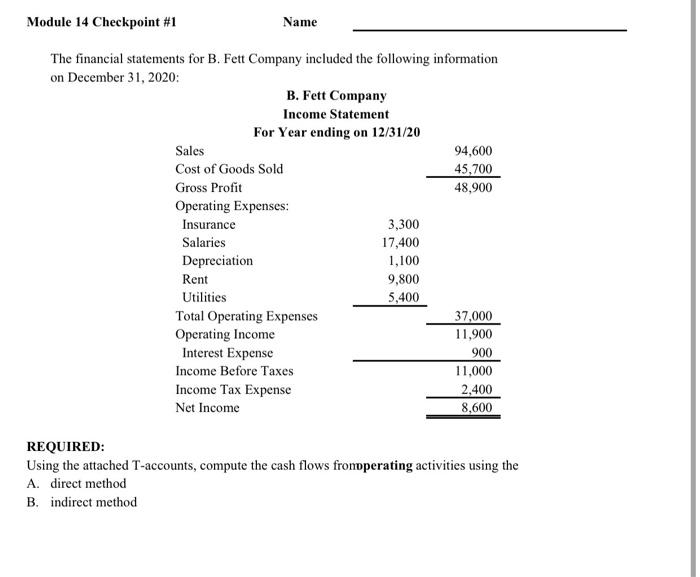

Module 14 Checkpoint #1 T-Accounts for the DIRECT method CASH 3,700 Accounts Receivable 4.3601 Merchandise Inventory 2,830 Beg Beg Beg OPERATING: Cash Receipts From: Cash Payments For: End 5.5401 End Prepaid Rent 1.100 Investments 10,200 Beg Beg End 1.400 End 12,700 Plant Assets 35.000 Accum. Depr. 4,400 Beg Beg End 45,400 15.500 End Accounts Payable 1.960 Salaries Payable 1.420 Beg Beg 12.170 End 1.190 End Income Taxes Payable 300 Beg Long Term Notes Payable 5.000 Bes 700 End 18/10 End Preferred Stock 10,000 Common Stock 15.000 Beg Beg 10 End 23,000 End APIC 4.400 Retained Earnings 13,720 Beg Beg End 2,530 End 18,720 End Module 14 Checkpoint #1 T-accounts for the INDIRECT method CASH 3,700 Accounts Receivable 4.360 Merchandise Inventory 2,830 Beg Beg Beg OPERATING: End 5,540 End 4,4201 Prepaid Rent 1.800 Investments 10,200 Beg Beg End 1.400 End 12,700 Plant Assets 35,0001 Accum. Depr. 4.400 Beg Beg End 45,4001 15.500 End Accounts Payable 1.960 Salaries Payable 1.420 Beg Beg 12.170 End 1.190 End Income Taxes Payable 300 Long Term Notes Payable 5.000 Beg Beg 700 End 18,000 End Preferred Stock 10,000 Common Stock 15,000 Beg Beg 0 End 23.000 End APIC 4.400 Retained Earnings 13,720 Beg Beg End 2.530 6,400 End 18,720 End Module 14 Checkpoint #1 Name The financial statements for B. Fett Company included the following information on December 31, 2020: B. Fett Company Income Statement For Year ending on 12/31/20 Sales 94,600 Cost of Goods Sold 45,700 Gross Profit 48,900 Operating Expenses: Insurance 3,300 Salaries 17,400 Depreciation 1,100 Rent 9,800 Utilities 5,400 Total Operating Expenses 37,000 Operating Income 11,900 Interest Expense Income Before Taxes 11,000 Income Tax Expense 2.400 Net Income 8,600 900 REQUIRED: Using the attached T-accounts, compute the cash flows fronoperating activities using the A. direct method B. indirect method Module 14 Checkpoint #1 T-Accounts for the DIRECT method CASH 3,700 Accounts Receivable 4.3601 Merchandise Inventory 2,830 Beg Beg Beg OPERATING: Cash Receipts From: Cash Payments For: End 5.5401 End Prepaid Rent 1.100 Investments 10,200 Beg Beg End 1.400 End 12,700 Plant Assets 35.000 Accum. Depr. 4,400 Beg Beg End 45,400 15.500 End Accounts Payable 1.960 Salaries Payable 1.420 Beg Beg 12.170 End 1.190 End Income Taxes Payable 300 Beg Long Term Notes Payable 5.000 Bes 700 End 18/10 End Preferred Stock 10,000 Common Stock 15.000 Beg Beg 10 End 23,000 End APIC 4.400 Retained Earnings 13,720 Beg Beg End 2,530 End 18,720 End Module 14 Checkpoint #1 T-accounts for the INDIRECT method CASH 3,700 Accounts Receivable 4.360 Merchandise Inventory 2,830 Beg Beg Beg OPERATING: End 5,540 End 4,4201 Prepaid Rent 1.800 Investments 10,200 Beg Beg End 1.400 End 12,700 Plant Assets 35,0001 Accum. Depr. 4.400 Beg Beg End 45,4001 15.500 End Accounts Payable 1.960 Salaries Payable 1.420 Beg Beg 12.170 End 1.190 End Income Taxes Payable 300 Long Term Notes Payable 5.000 Beg Beg 700 End 18,000 End Preferred Stock 10,000 Common Stock 15,000 Beg Beg 0 End 23.000 End APIC 4.400 Retained Earnings 13,720 Beg Beg End 2.530 6,400 End 18,720 End Module 14 Checkpoint #1 Name The financial statements for B. Fett Company included the following information on December 31, 2020: B. Fett Company Income Statement For Year ending on 12/31/20 Sales 94,600 Cost of Goods Sold 45,700 Gross Profit 48,900 Operating Expenses: Insurance 3,300 Salaries 17,400 Depreciation 1,100 Rent 9,800 Utilities 5,400 Total Operating Expenses 37,000 Operating Income 11,900 Interest Expense Income Before Taxes 11,000 Income Tax Expense 2.400 Net Income 8,600 900 REQUIRED: Using the attached T-accounts, compute the cash flows fronoperating activities using the A. direct method B. indirect method