Answered step by step

Verified Expert Solution

Question

1 Approved Answer

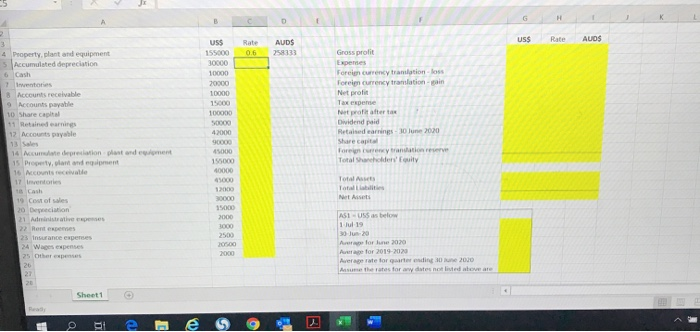

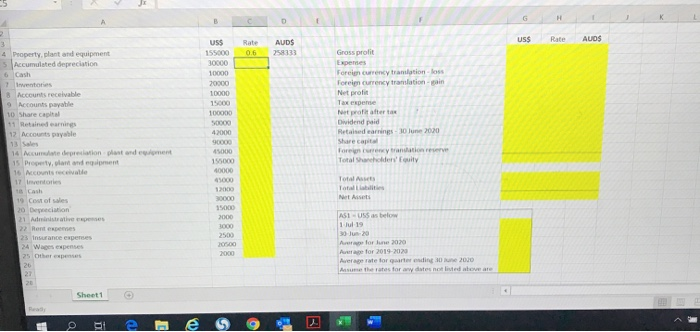

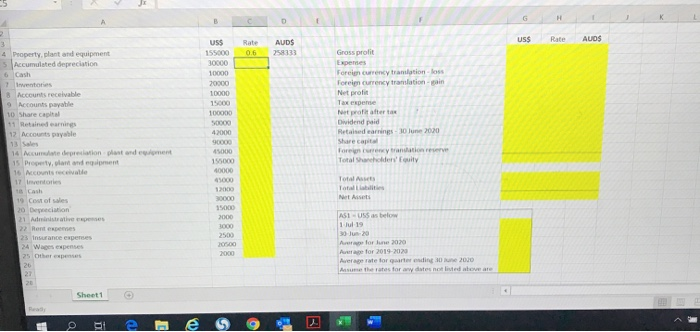

could please help converting the below into this this tenplate template provided 1. 2. G H B 2 US$ Rate AUDS AUDS Rate 0.6 USS

could please help converting the below into this this tenplate  template provided

template provided  1.

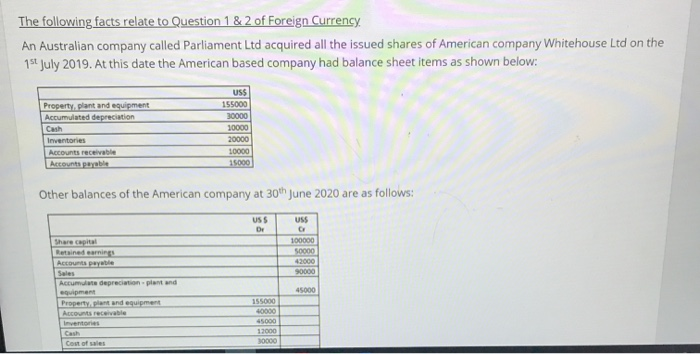

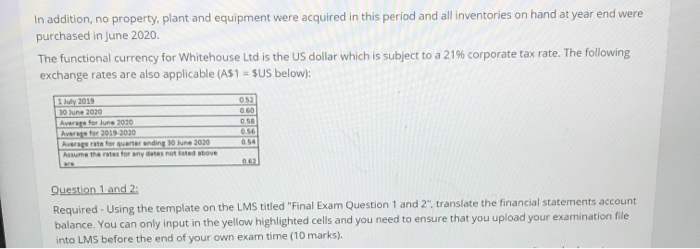

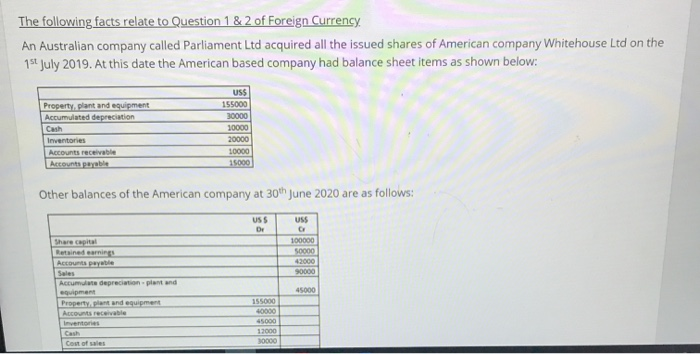

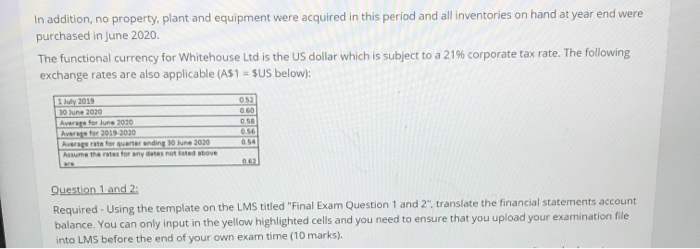

1.  2. G H B 2 US$ Rate AUDS AUDS Rate 0.6 USS 155000 30000 10000 20000 10000 15000 100000 3 4 Property, plant and equipment Accumulated depreciation 6 Casti 7 notes 8 Accounts receivable 9 Accounts payable 10 Share capital 1 Retained earnings 12 Accounts payable 13 Sales 14 Nume depreciation plant and woment 15 Property and 16 Accounts receive 17 Inventores Cash 19 Cost of sales 20 Depreciation 21 Mistrative pense Gross profit Expenses Foreign currency translation loss Foreign currency tranlation-main Net profit Tax expense Net profit after to Dividend paid Related earrings - 30 June 2020 Share Capital 42000 49000 155000 40000 Total Shareholder uit Total Assets 30000 Net Assets A51-US as below 2000 3000 23 Insurance expenses 24 Wages expenses 25 Others 26 2000 JU for lune 2020 Aus for 2019-2020 Average rate for trending on 2000 As the rates for awes not lived here 20 Sheet1 D S The following facts relate to Question 1 & 2 of Foreign Currency. An Australian company called Parliament Ltd acquired all the issued shares of American company Whitehouse Ltd on the 1st July 2019. At this date the American based company had balance sheet items as shown below: Property, plant and equipment Accumulated depreciation Cash Inventories Accounts receivable Accounts payable USS 155000 30000 10000 20000 10000 15000 Other balances of the American company at 30th June 2020 are as follows: USS De USS 100000 50000 42000 90000 Share Capital Retained earning Accounts payable Sales Accumulate depreciation plant and ipment Property plant and equipment Accounts receivable Inventores 45000 155000 12000 30000 Cost of sales In addition, no property, plant and equipment were acquired in this period and all inventories on hand at year end were purchased in June 2020. The functional currency for Whitehouse Ltd is the US dollar which is subject to a 21% corporate tax rate. The following exchange rates are also applicable (A$1 = $US below): 1 July 2019 30 June 2010 Average for June 2020 Average for 2019 2020 Average rate for quarter ending solune 2020 Asume the rates for any dates noted above 0.52 0.60 0.58 056 054 Question 1 and 2: Required - Using the template on the LMS titled "Final Exam Question 1 and 2", translate the financial statements account balance. You can only input in the yellow highlighted cells and you need to ensure that you upload your examination file into LMS before the end of your own exam time (10 marks)

2. G H B 2 US$ Rate AUDS AUDS Rate 0.6 USS 155000 30000 10000 20000 10000 15000 100000 3 4 Property, plant and equipment Accumulated depreciation 6 Casti 7 notes 8 Accounts receivable 9 Accounts payable 10 Share capital 1 Retained earnings 12 Accounts payable 13 Sales 14 Nume depreciation plant and woment 15 Property and 16 Accounts receive 17 Inventores Cash 19 Cost of sales 20 Depreciation 21 Mistrative pense Gross profit Expenses Foreign currency translation loss Foreign currency tranlation-main Net profit Tax expense Net profit after to Dividend paid Related earrings - 30 June 2020 Share Capital 42000 49000 155000 40000 Total Shareholder uit Total Assets 30000 Net Assets A51-US as below 2000 3000 23 Insurance expenses 24 Wages expenses 25 Others 26 2000 JU for lune 2020 Aus for 2019-2020 Average rate for trending on 2000 As the rates for awes not lived here 20 Sheet1 D S The following facts relate to Question 1 & 2 of Foreign Currency. An Australian company called Parliament Ltd acquired all the issued shares of American company Whitehouse Ltd on the 1st July 2019. At this date the American based company had balance sheet items as shown below: Property, plant and equipment Accumulated depreciation Cash Inventories Accounts receivable Accounts payable USS 155000 30000 10000 20000 10000 15000 Other balances of the American company at 30th June 2020 are as follows: USS De USS 100000 50000 42000 90000 Share Capital Retained earning Accounts payable Sales Accumulate depreciation plant and ipment Property plant and equipment Accounts receivable Inventores 45000 155000 12000 30000 Cost of sales In addition, no property, plant and equipment were acquired in this period and all inventories on hand at year end were purchased in June 2020. The functional currency for Whitehouse Ltd is the US dollar which is subject to a 21% corporate tax rate. The following exchange rates are also applicable (A$1 = $US below): 1 July 2019 30 June 2010 Average for June 2020 Average for 2019 2020 Average rate for quarter ending solune 2020 Asume the rates for any dates noted above 0.52 0.60 0.58 056 054 Question 1 and 2: Required - Using the template on the LMS titled "Final Exam Question 1 and 2", translate the financial statements account balance. You can only input in the yellow highlighted cells and you need to ensure that you upload your examination file into LMS before the end of your own exam time (10 marks)

could please help converting the below into this this tenplate  template provided

template provided

template provided

template provided  1.

1. 2.

2.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started