Answered step by step

Verified Expert Solution

Question

1 Approved Answer

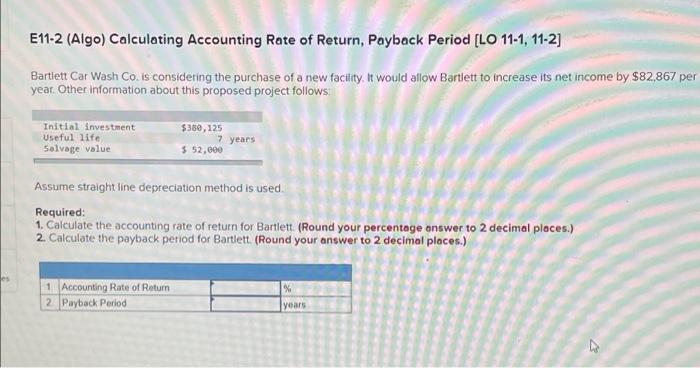

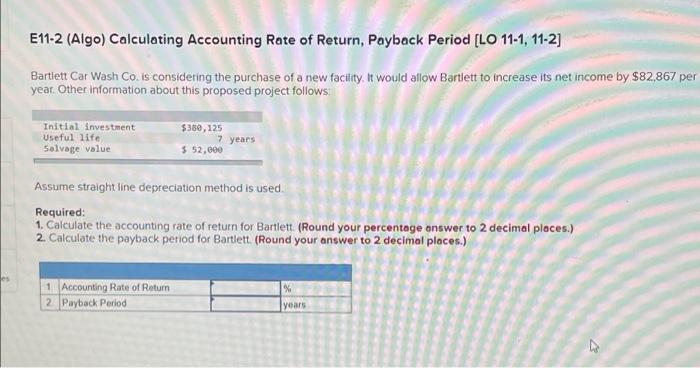

could some one help me step by step i have a test soon. E11-2 (Algo) Calculating Accounting Rate of Return, Payback Period [LO 11-1, 11-2]

could some one help me step by step i have a test soon.

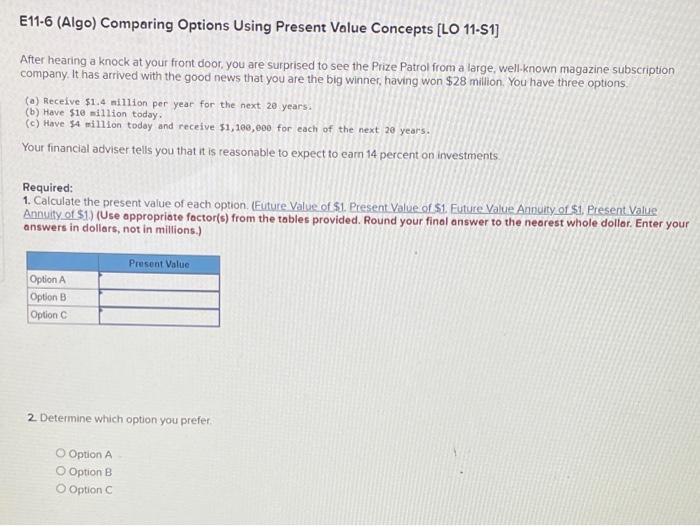

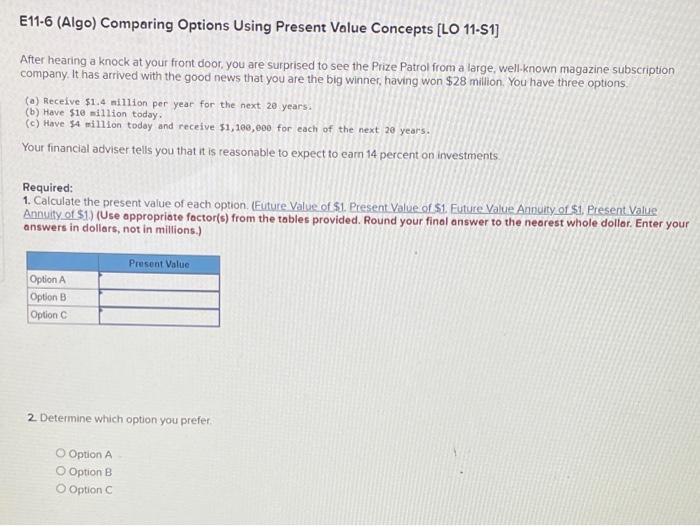

E11-2 (Algo) Calculating Accounting Rate of Return, Payback Period [LO 11-1, 11-2] Bartlett Car Wash Co is considering the purchase of a new facility. It would allow Bartlett to increase its net income by $82,867 per year. Other information about this proposed project follows: Initial investment Useful life Salvage value $380,125 7 years $ 52,600 Assume straight line depreciation method is used. Required: 1. Calculate the accounting rate of return for Bartlett (Round your percentage onswer to 2 decimal places.) 2. Calculate the payback period for Bartlett. (Round your answer to 2 decimal places.) 1 Accounting Rate of Return 2 Payback Period % years E11-6 (Algo) Comparing Options Using Present Value Concepts [LO 11-S1] After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription company. It has arrived with the good news that you are the big winner, having won $28 million. You have three options (o) Receive $1.4 million per year for the next 20 years. (b) Have $10 million today. (c) Have 54 million today and receive $1,100,000 for each of the next 20 years. Your financial adviser tells you that it is reasonable to expect to earn 14 percent on investments Required: 1. Calculate the present value of each option (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of S1) (Use appropriate factor(s) from the tables provided. Round your final answer to the nearest whole dollar. Enter your answers in dollars, not in millions.) Present Value Option A Option B Optionc 2. Determine which option you prefer O Option A Option B Optionc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started