Answered step by step

Verified Expert Solution

Question

1 Approved Answer

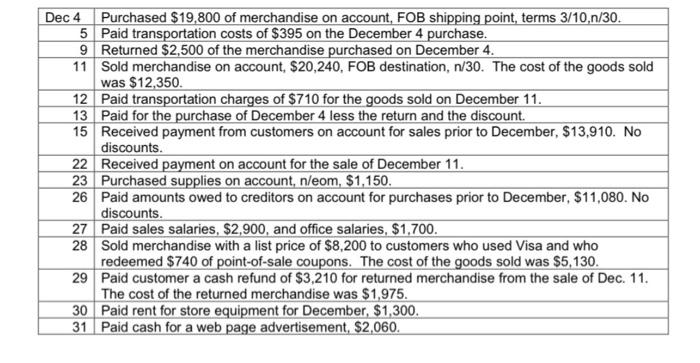

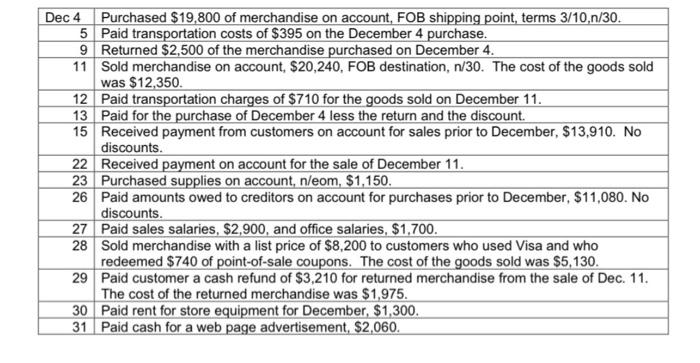

could someone help with a general journal and ledger? begin{tabular}{|c|c|} hline Dec 4 & Purchased $19,800 of merchandise on account, FOB shipping point, terms 3/10,n/30.

could someone help with a general journal and ledger?

\begin{tabular}{|c|c|} \hline Dec 4 & Purchased $19,800 of merchandise on account, FOB shipping point, terms 3/10,n/30. \\ \hline 5 & Paid transportation costs of $395 on the December 4 purchase. \\ \hline 9 & Returned $2,500 of the merchandise purchased on December 4. \\ \hline 11 & Soldmerchandiseonaccount,$20,240,FOBdestination,n/30.Thecostofthegoodssoldwas$12,350. \\ \hline 12 & Paid transportation charges of $710 for the goods sold on December 11 . \\ \hline 13 & Paid for the purchase of December 4 less the return and the discount. \\ \hline 15 & ReceivedpaymentfromcustomersonaccountforsalespriortoDecember,$13,910.Nodiscounts. \\ \hline 22 & Received payment on account for the sale of December 11. \\ \hline 23 & Purchased supplies on account, n/eom, $1,150. \\ \hline 26 & PaidamountsowedtocreditorsonaccountforpurchasespriortoDecember,$11,080.Nodiscounts. \\ \hline 27 & Paid sales salaries, $2,900, and office salaries, $1,700. \\ \hline 28 & Soldmerchandisewithalistpriceof$8,200tocustomerswhousedVisaandwhoredeemed$740ofpoint-of-salecoupons.Thecostofthegoodssoldwas$5,130. \\ \hline 29 & Paidcustomeracashrefundof$3,210forreturnedmerchandisefromthesaleofDec.11.Thecostofthereturnedmerchandisewas$1,975. \\ \hline 30 & Paid rent for store equipment for December, $1,300. \\ \hline 31 & Paid cash for a web page advertisement, $2,060. \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started