Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could someone let me know if my graph looks correct with the conditions of the trust fund? please and thank you! Suppose that, after studying

could someone let me know if my graph looks correct with the conditions of the trust fund? please and thank you!

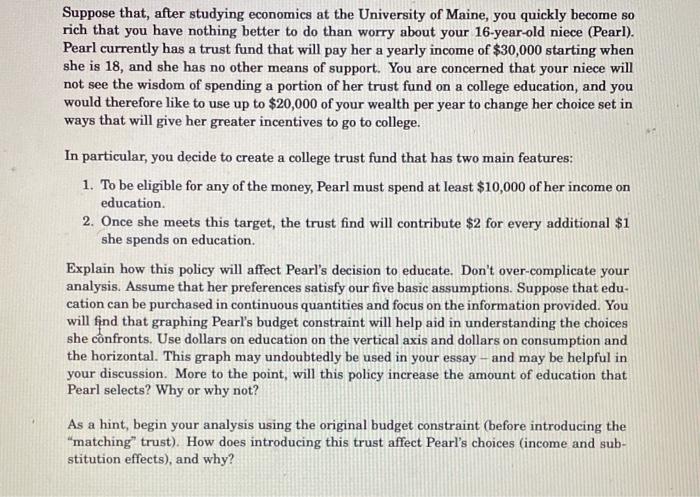

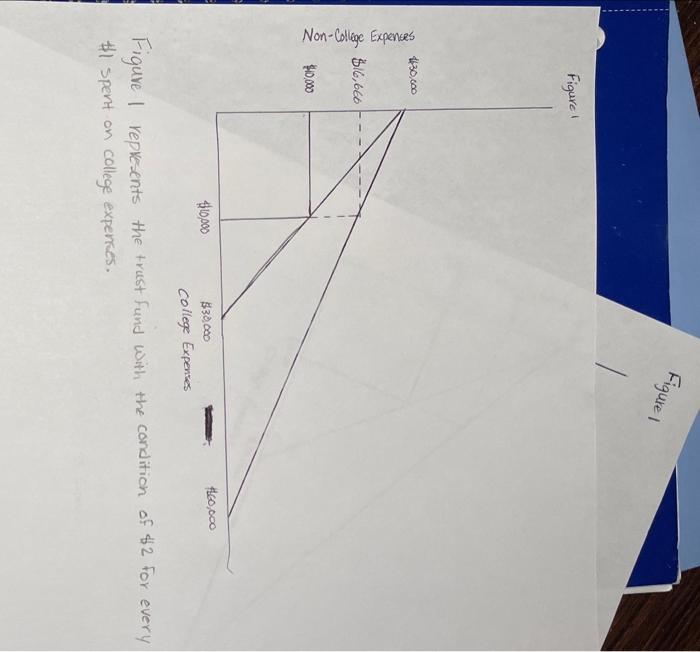

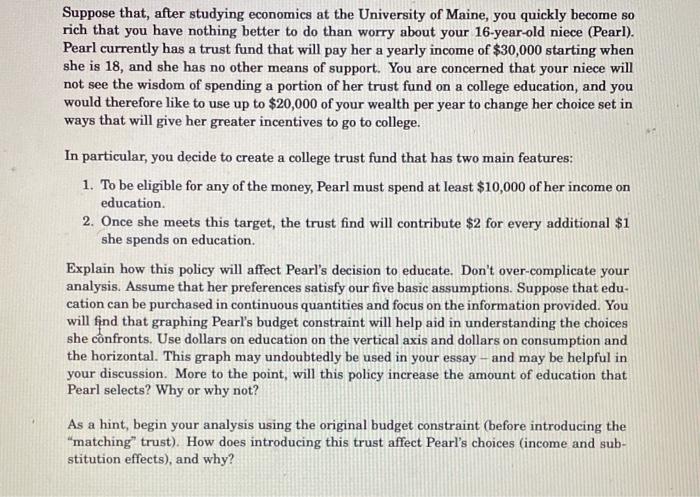

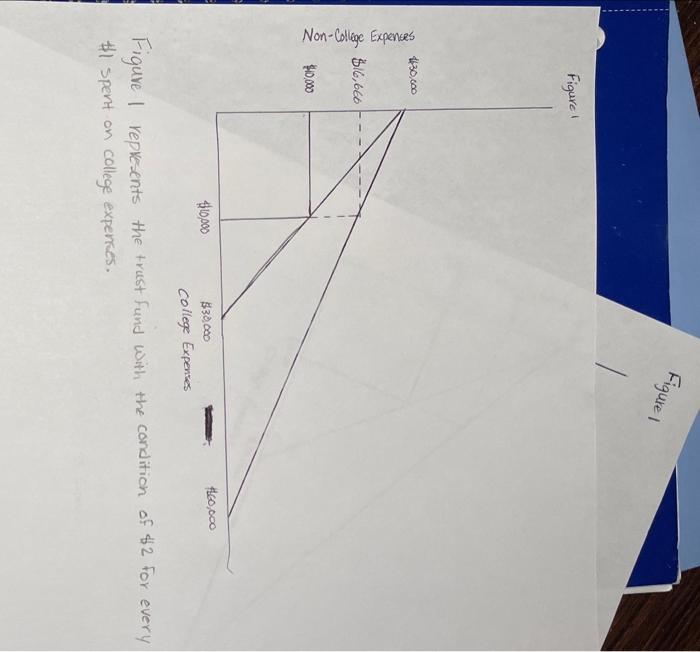

Suppose that, after studying economics at the University of Maine, you quickly become so rich that you have nothing better to do than worry about your 16-year-old niece (Pearl). Pearl currently has a trust fund that will pay her a yearly income of $30,000 starting when she is 18, and she has no other means of support. You are concerned that your niece will not see the wisdom of spending a portion of her trust fund on a college education, and you would therefore like to use up to $20,000 of your wealth per year to change her choice set in ways that will give her greater incentives to go to college. In particular, you decide to create a college trust fund that has two main features: 1. To be eligible for any of the money, Pearl must spend at least $10,000 of her income on education. 2. Once she meets this target, the trust find will contribute $2 for every additional $1 she spends on education. Explain how this policy will affect Pearl's decision to educate. Don't over-complicate your analysis. Assume that her preferences satisfy our five basic assumptions. Suppose that education can be purchased in continuous quantities and focus on the information provided. You will find that graphing Pearl's budget constraint will help aid in understanding the choices she confronts. Use dollars on education on the vertical axis and dollars on consumption and the horizontal. This graph may undoubtedly be used in your essay - and may be helpful in your discussion. More to the point, will this policy increase the amount of education that Pearl selects? Why or why not? As a hint, begin your analysis using the original budget constraint (before introducing the "matching" trust). How does introducing this trust affect Pearl's choices (income and substitution effects), and why? Figure I repkesents the trust fund with the condition of $2 for ever \$1 spent on college expences. Suppose that, after studying economics at the University of Maine, you quickly become so rich that you have nothing better to do than worry about your 16-year-old niece (Pearl). Pearl currently has a trust fund that will pay her a yearly income of $30,000 starting when she is 18, and she has no other means of support. You are concerned that your niece will not see the wisdom of spending a portion of her trust fund on a college education, and you would therefore like to use up to $20,000 of your wealth per year to change her choice set in ways that will give her greater incentives to go to college. In particular, you decide to create a college trust fund that has two main features: 1. To be eligible for any of the money, Pearl must spend at least $10,000 of her income on education. 2. Once she meets this target, the trust find will contribute $2 for every additional $1 she spends on education. Explain how this policy will affect Pearl's decision to educate. Don't over-complicate your analysis. Assume that her preferences satisfy our five basic assumptions. Suppose that education can be purchased in continuous quantities and focus on the information provided. You will find that graphing Pearl's budget constraint will help aid in understanding the choices she confronts. Use dollars on education on the vertical axis and dollars on consumption and the horizontal. This graph may undoubtedly be used in your essay - and may be helpful in your discussion. More to the point, will this policy increase the amount of education that Pearl selects? Why or why not? As a hint, begin your analysis using the original budget constraint (before introducing the "matching" trust). How does introducing this trust affect Pearl's choices (income and substitution effects), and why? Figure I repkesents the trust fund with the condition of $2 for ever \$1 spent on college expences

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started