Answered step by step

Verified Expert Solution

Question

1 Approved Answer

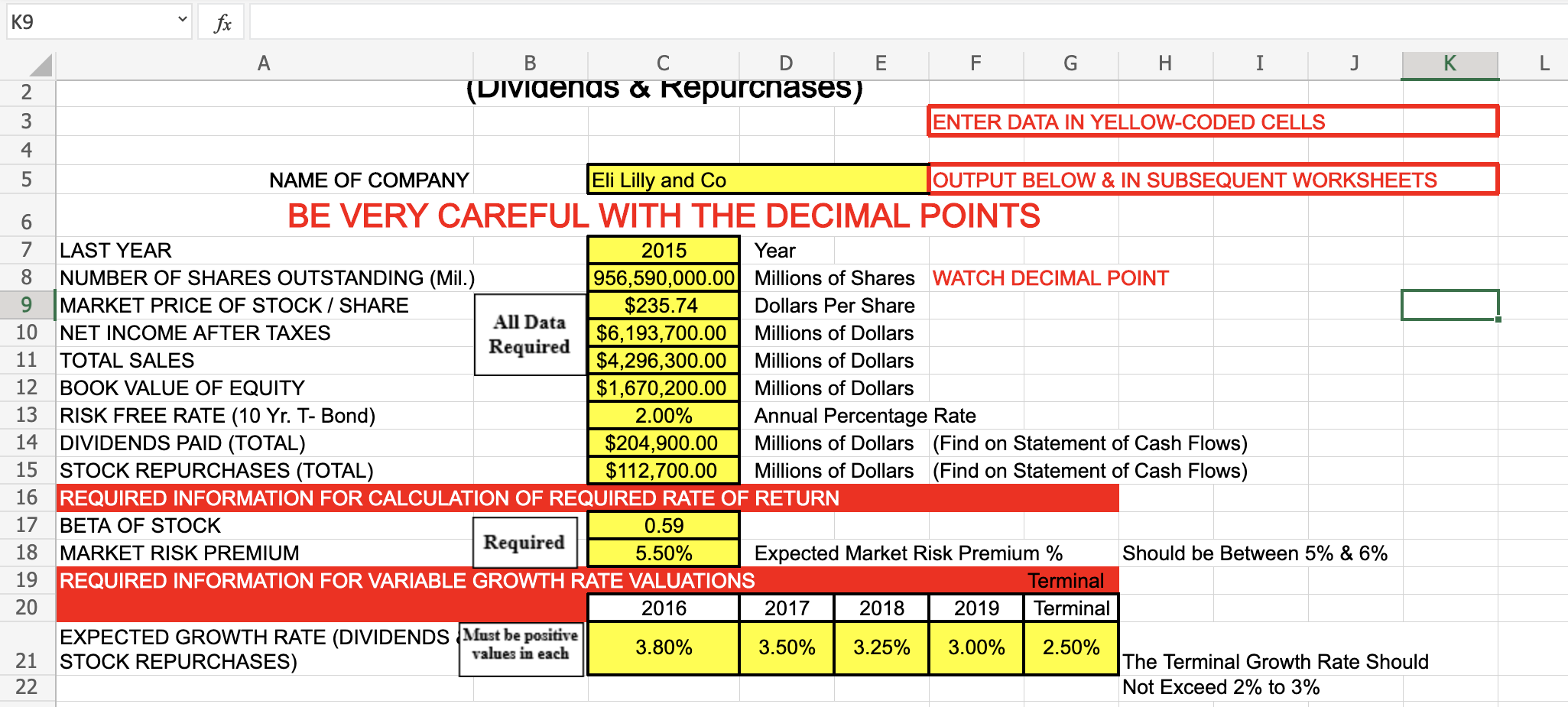

Could someone please help me with a walkthrough on answering the yellow blocks for Eli Lilly year 2020? K9 fx A B E F G

Could someone please help me with a walkthrough on answering the yellow blocks for Eli Lilly year 2020?

K9 fx A B E F G H I J K L C D (Dividends & Repurchases) 2 3 ENTER DATA IN YELLOW-CODED CELLS 4 ON NAME OF COMPANY Eli Lilly and Co OUTPUT BELOW & IN SUBSEQUENT WORKSHEETS 6 BE VERY CAREFUL WITH THE DECIMAL POINTS 7 LAST YEAR 2015 Year 8 NUMBER OF SHARES OUTSTANDING (Mil.) 956,590,000.00 Millions of Shares WATCH DECIMAL POINT 9 MARKET PRICE OF STOCK / SHARE $235.74 Dollars Per Share All Data 10 NET INCOME AFTER TAXES $6,193,700.00 Millions of Dollars 11 Required TOTAL SALES $4,296,300.00 Millions of Dollars 12 BOOK VALUE OF EQUITY $1,670,200.00 Millions of Dollars 13 RISK FREE RATE (10 Yr. T- Bond) 2.00% Annual Percentage Rate 14 DIVIDENDS PAID (TOTAL) $204,900.00 Millions of Dollars (Find on Statement of Cash Flows) 15 STOCK REPURCHASES (TOTAL) $112,700.00 Millions of Dollars (Find on Statement of Cash Flows) 16 REQUIRED INFORMATION FOR CALCULATION OF REQUIRED RATE OF RETURN 17 BETA OF STOCK 0.59 18 MARKET RISK PREMIUM Required 5.50% Expected Market Risk Premium % Should be Between 5% & 6% 19 REQUIRED INFORMATION FOR VARIABLE GROWTH RATE VALUATIONS Terminal 20 2016 2017 2018 2019 Terminal EXPECTED GROWTH RATE (DIVIDENDS Must be positive 3.80% values in each 3.50% 3.25% 3.00% 21 2.50% STOCK REPURCHASES) The Terminal Growth Rate Should 22 Not Exceed 2% to 3% 2 K9 fx A B E F G H I J K L C D (Dividends & Repurchases) 2 3 ENTER DATA IN YELLOW-CODED CELLS 4 ON NAME OF COMPANY Eli Lilly and Co OUTPUT BELOW & IN SUBSEQUENT WORKSHEETS 6 BE VERY CAREFUL WITH THE DECIMAL POINTS 7 LAST YEAR 2015 Year 8 NUMBER OF SHARES OUTSTANDING (Mil.) 956,590,000.00 Millions of Shares WATCH DECIMAL POINT 9 MARKET PRICE OF STOCK / SHARE $235.74 Dollars Per Share All Data 10 NET INCOME AFTER TAXES $6,193,700.00 Millions of Dollars 11 Required TOTAL SALES $4,296,300.00 Millions of Dollars 12 BOOK VALUE OF EQUITY $1,670,200.00 Millions of Dollars 13 RISK FREE RATE (10 Yr. T- Bond) 2.00% Annual Percentage Rate 14 DIVIDENDS PAID (TOTAL) $204,900.00 Millions of Dollars (Find on Statement of Cash Flows) 15 STOCK REPURCHASES (TOTAL) $112,700.00 Millions of Dollars (Find on Statement of Cash Flows) 16 REQUIRED INFORMATION FOR CALCULATION OF REQUIRED RATE OF RETURN 17 BETA OF STOCK 0.59 18 MARKET RISK PREMIUM Required 5.50% Expected Market Risk Premium % Should be Between 5% & 6% 19 REQUIRED INFORMATION FOR VARIABLE GROWTH RATE VALUATIONS Terminal 20 2016 2017 2018 2019 Terminal EXPECTED GROWTH RATE (DIVIDENDS Must be positive 3.80% values in each 3.50% 3.25% 3.00% 21 2.50% STOCK REPURCHASES) The Terminal Growth Rate Should 22 Not Exceed 2% to 3% 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started