Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could someone please help me with this? I would like to check my work. Thank you. 37. On October 1, 2017, Sharp Company (based in

Could someone please help me with this? I would like to check my work. Thank you.

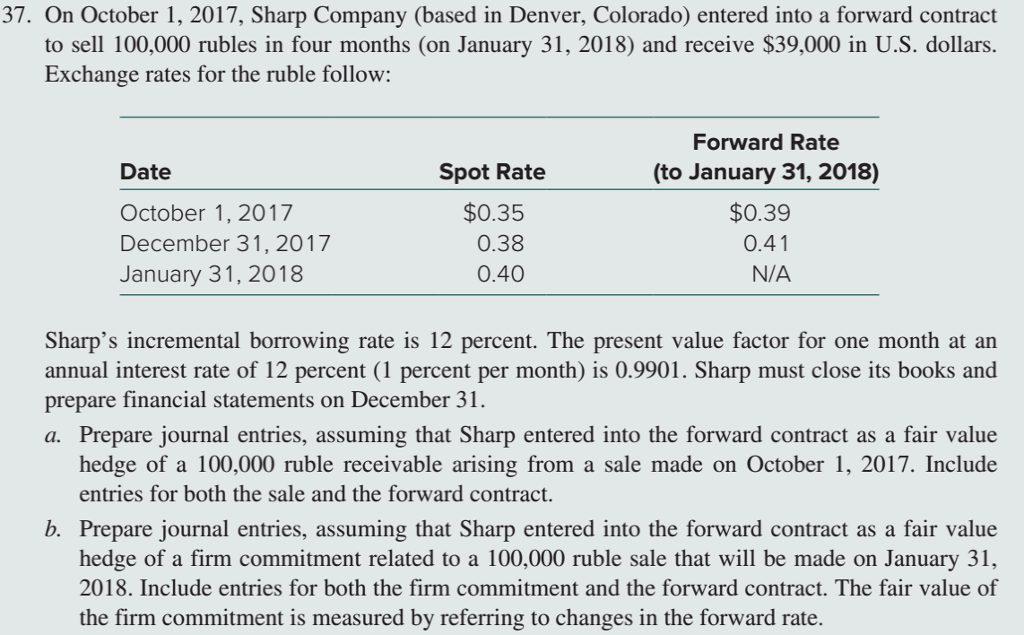

37. On October 1, 2017, Sharp Company (based in Denver, Colorado) entered into a forward contradt to sell 100,000 rubles in four months (on January 31, 2018) and receive $39,000 in U.S. dollars Exchange rates for the ruble follow: Date October 1, 2017 December 31, 2017 January 31, 2018 Spot Rate $0.35 0.38 0.40 Forward Rate (to January 31, 2018) $0.39 0.41 N/A Sharp's incremental borrowing rate is 12 percent. The present value factor for one month at an annual interest rate of 12 percent (1 percent per month) is 0.9901. Sharp must close its books and prepare financial statements on December 3 a. Prepare journal entries, assuming that Sharp entered into the forward contract as a fair value hedge of a 100,000 ruble receivable arising from a sale made on October 1, 2017. Include entries for both the sale and the forward contract. b. Prepare journal entries, assuming that Sharp entered into the forward contract as a fair value hedge of a firm commitment related to a 100,000 ruble sale that will be made on January 31, 2018. Include entries for both the firm commitment and the forward contract. The fair value of the firm commitment is measured by referring to changes in the forward rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started